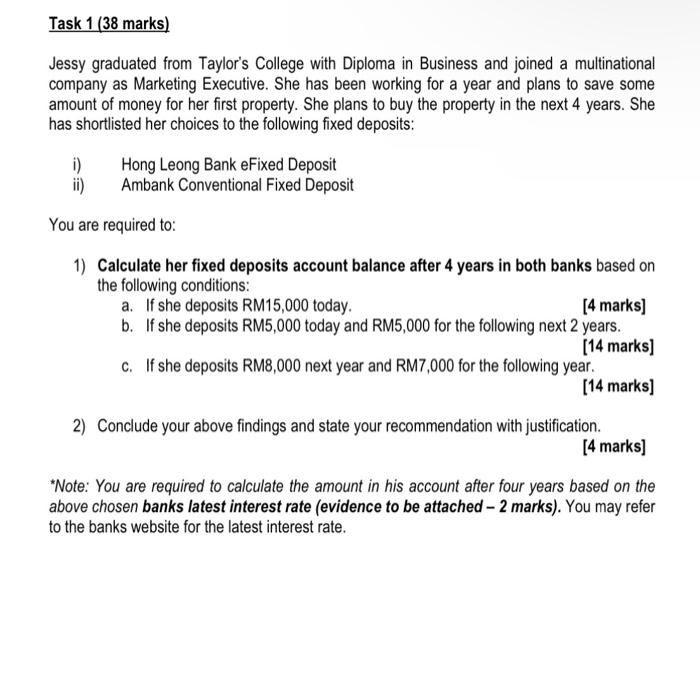

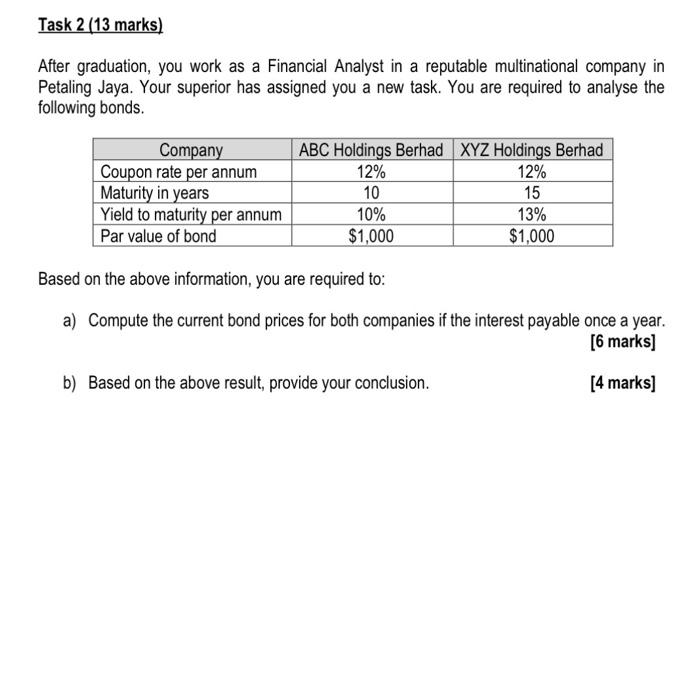

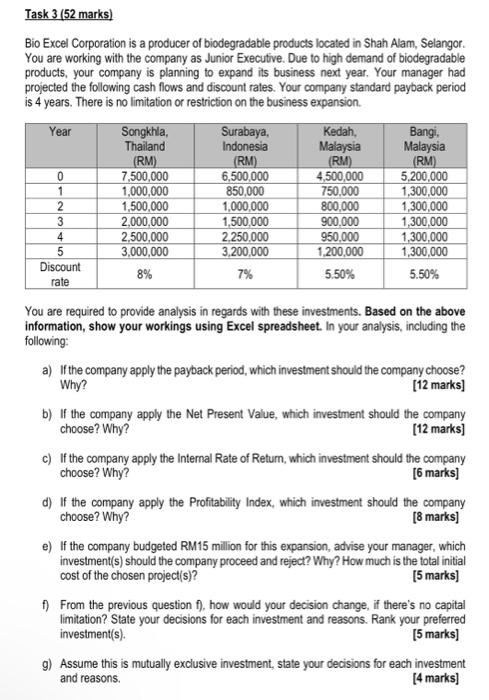

Jessy graduated from Taylor's College with Diploma in Business and joined a multinational company as Marketing Executive. She has been working for a year and plans to save some amount of money for her first property. She plans to buy the property in the next 4 years. She has shortlisted her choices to the following fixed deposits: i) Hong Leong Bank eFixed Deposit ii) Ambank Conventional Fixed Deposit You are required to: 1) Calculate her fixed deposits account balance after 4 years in both banks based on the following conditions: a. If she deposits RM15,000 today. [4 marks] b. If she deposits RM5,000 today and RM5,000 for the following next 2 years. [14 marks] c. If she deposits RM8,000 next year and RM7,000 for the following year. [14 marks] 2) Conclude your above findings and state your recommendation with justification. [4 marks] "Note: You are required to calculate the amount in his account after four years based on the above chosen banks latest interest rate (evidence to be attached - 2 marks). You may refer to the banks website for the latest interest rate. After graduation, you work as a Financial Analyst in a reputable multinational company in Petaling Jaya. Your superior has assigned you a new task. You are required to analyse the following bonds. Based on the above information, you are required to: a) Compute the current bond prices for both companies if the interest payable once a year. [6 marks] b) Based on the above result, provide your conclusion. [4 marks] Task 3 (52 marks) Bio Excel Corporation is a producer of biodegradable products located in Shah Alam, Selangor. You are working with the company as Junior Executive. Due to high demand of biodegradable products, your company is planning to expand its business next year. Your manager had projected the following cash flows and discount rates. Your company standard payback period is 4 years. There is no limitation or restriction on the business expansion. You are required to provide analysis in regards with these investments. Based on the above information, show your workings using Excel spreadsheet. In your analysis, including the following: a) If the company apply the payback period, which investment should the company choose? Why? [12 marks] b) If the company apply the Net Present Value, which investment should the company choose? Why? [12 marks] c) If the company apply the Internal Rate of Return, which investment should the company choose? Why? [6 marks] d) If the company apply the Profitability Index, which investment should the company choose? Why? [8 marks] e) If the company budgeted RM15 million for this expansion, advise your manager, which investment(s) should the company proceed and reject? Why? How much is the total initial cost of the chosen project(s)? [5 marks] f) From the previous question f). how would your decision change, if there's no capital limitation? State your decisions for each investment and reasons. Rank your preferred investment(s). [5 marks] g) Assume this is mutually exclusive investment, state your decisions for each investment and reasons. [4 marks] Jessy graduated from Taylor's College with Diploma in Business and joined a multinational company as Marketing Executive. She has been working for a year and plans to save some amount of money for her first property. She plans to buy the property in the next 4 years. She has shortlisted her choices to the following fixed deposits: i) Hong Leong Bank eFixed Deposit ii) Ambank Conventional Fixed Deposit You are required to: 1) Calculate her fixed deposits account balance after 4 years in both banks based on the following conditions: a. If she deposits RM15,000 today. [4 marks] b. If she deposits RM5,000 today and RM5,000 for the following next 2 years. [14 marks] c. If she deposits RM8,000 next year and RM7,000 for the following year. [14 marks] 2) Conclude your above findings and state your recommendation with justification. [4 marks] "Note: You are required to calculate the amount in his account after four years based on the above chosen banks latest interest rate (evidence to be attached - 2 marks). You may refer to the banks website for the latest interest rate. After graduation, you work as a Financial Analyst in a reputable multinational company in Petaling Jaya. Your superior has assigned you a new task. You are required to analyse the following bonds. Based on the above information, you are required to: a) Compute the current bond prices for both companies if the interest payable once a year. [6 marks] b) Based on the above result, provide your conclusion. [4 marks] Task 3 (52 marks) Bio Excel Corporation is a producer of biodegradable products located in Shah Alam, Selangor. You are working with the company as Junior Executive. Due to high demand of biodegradable products, your company is planning to expand its business next year. Your manager had projected the following cash flows and discount rates. Your company standard payback period is 4 years. There is no limitation or restriction on the business expansion. You are required to provide analysis in regards with these investments. Based on the above information, show your workings using Excel spreadsheet. In your analysis, including the following: a) If the company apply the payback period, which investment should the company choose? Why? [12 marks] b) If the company apply the Net Present Value, which investment should the company choose? Why? [12 marks] c) If the company apply the Internal Rate of Return, which investment should the company choose? Why? [6 marks] d) If the company apply the Profitability Index, which investment should the company choose? Why? [8 marks] e) If the company budgeted RM15 million for this expansion, advise your manager, which investment(s) should the company proceed and reject? Why? How much is the total initial cost of the chosen project(s)? [5 marks] f) From the previous question f). how would your decision change, if there's no capital limitation? State your decisions for each investment and reasons. Rank your preferred investment(s). [5 marks] g) Assume this is mutually exclusive investment, state your decisions for each investment and reasons. [4 marks]