Answered step by step

Verified Expert Solution

Question

1 Approved Answer

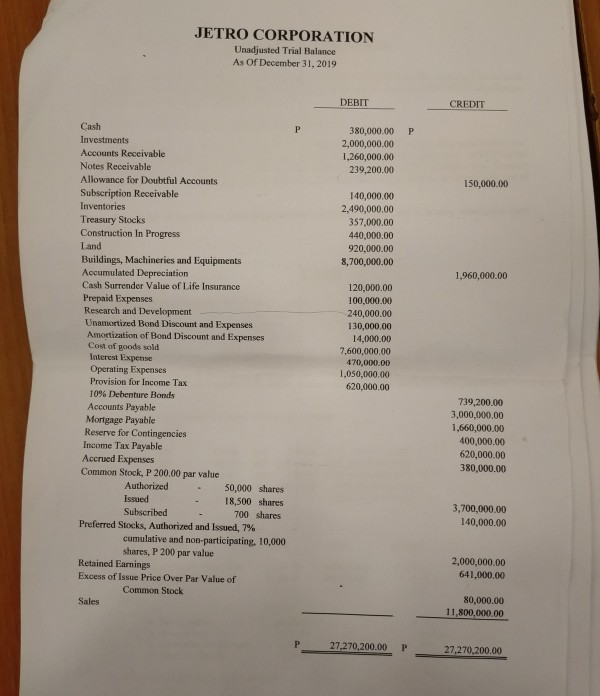

JETRO CORPORATION Unadjusted Trial Balance As Of December 31, 2019 DEBIT CREDIT P 380,000.00 2,000,000.00 1,260,000.00 239,200.00 150,000.00 140,000.00 2,490,000.00 357,000.00 440,000.00 920,000.00 8,700,000.00 1.960,000.00

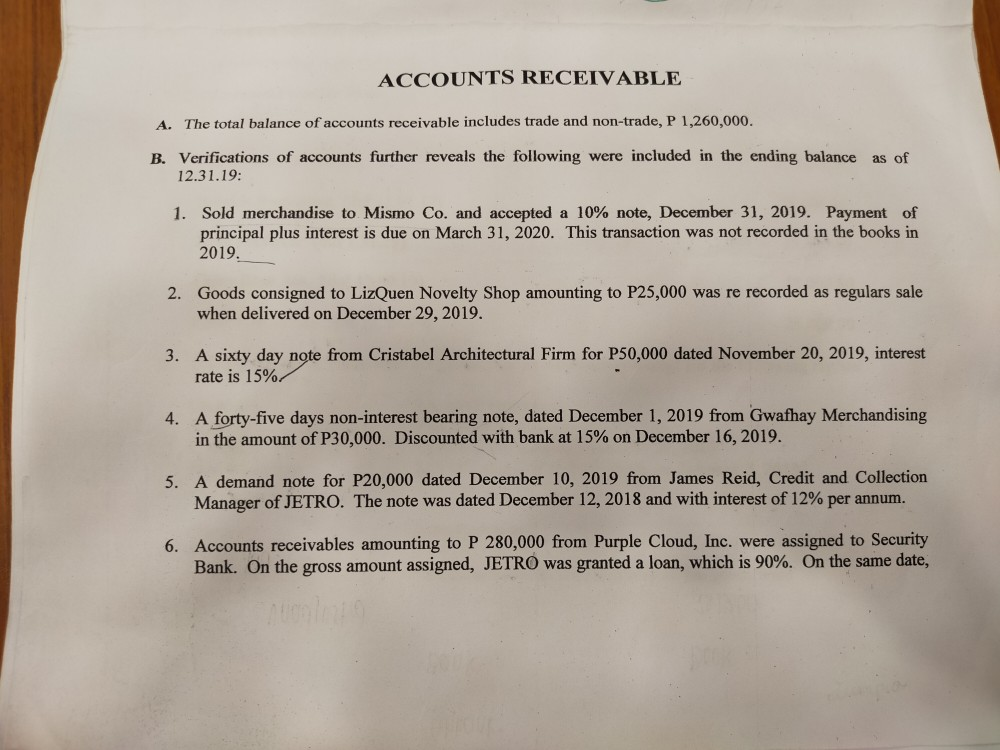

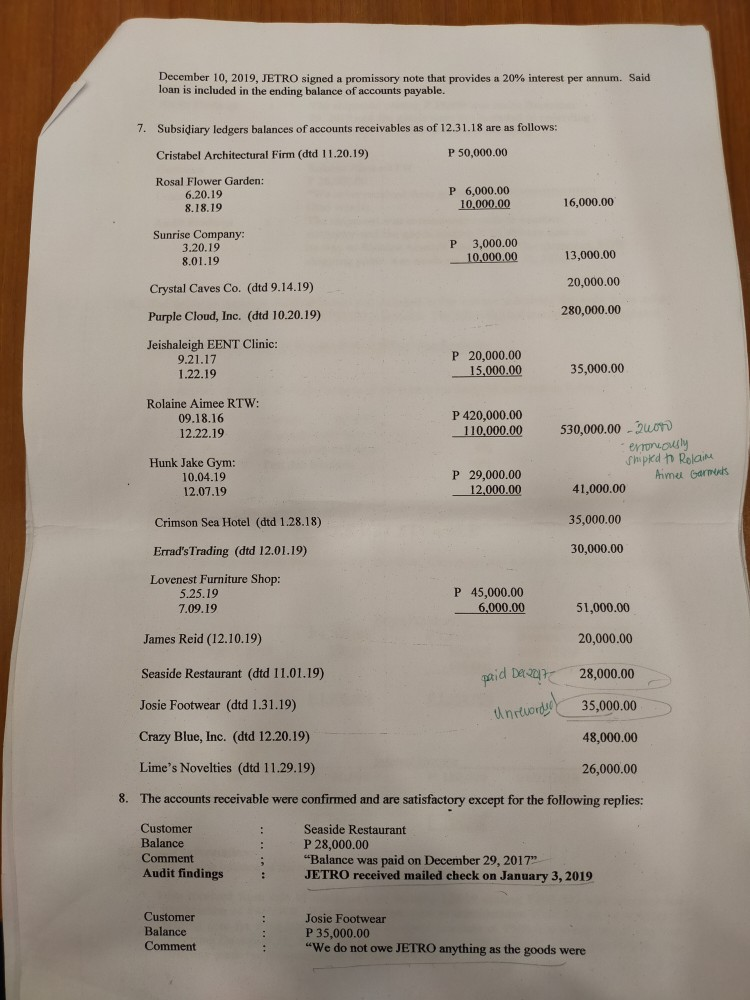

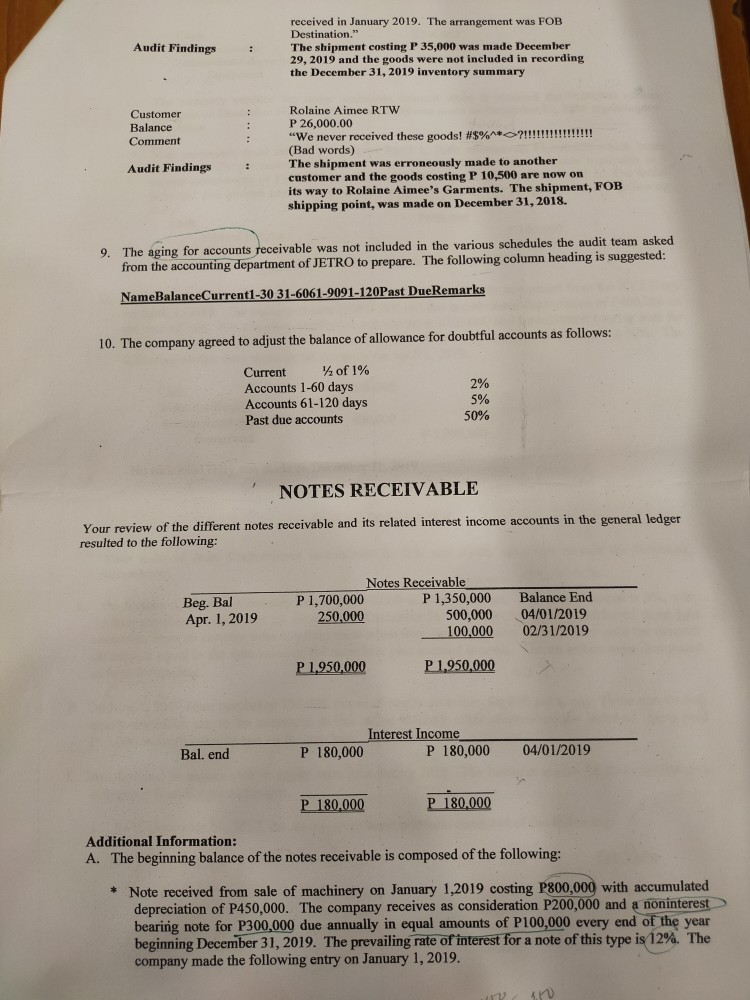

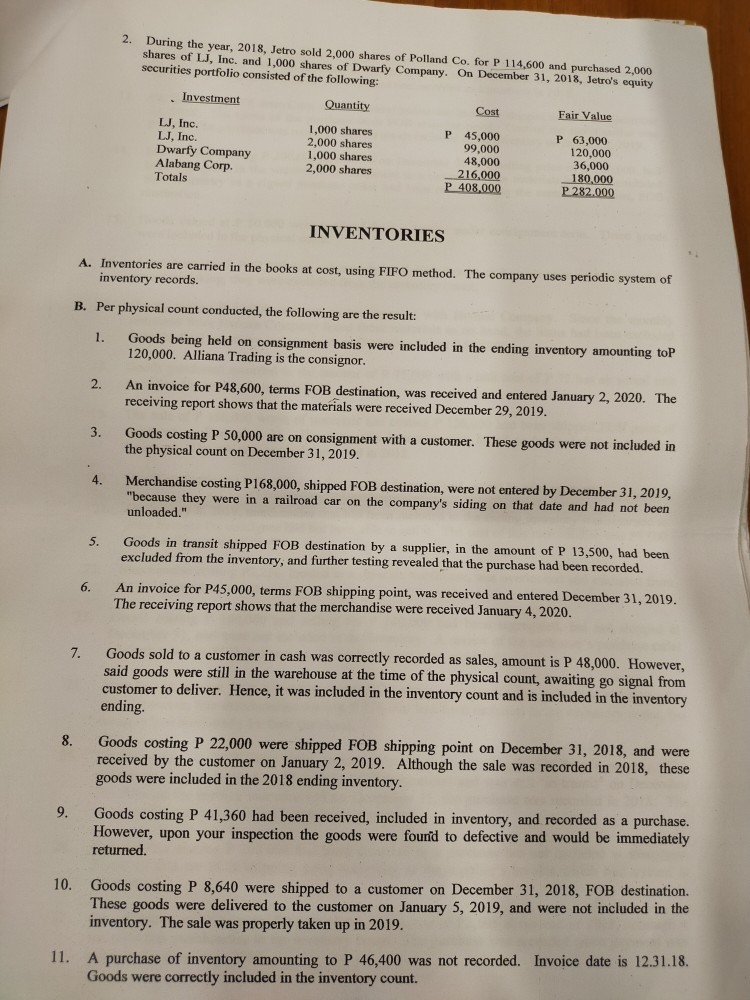

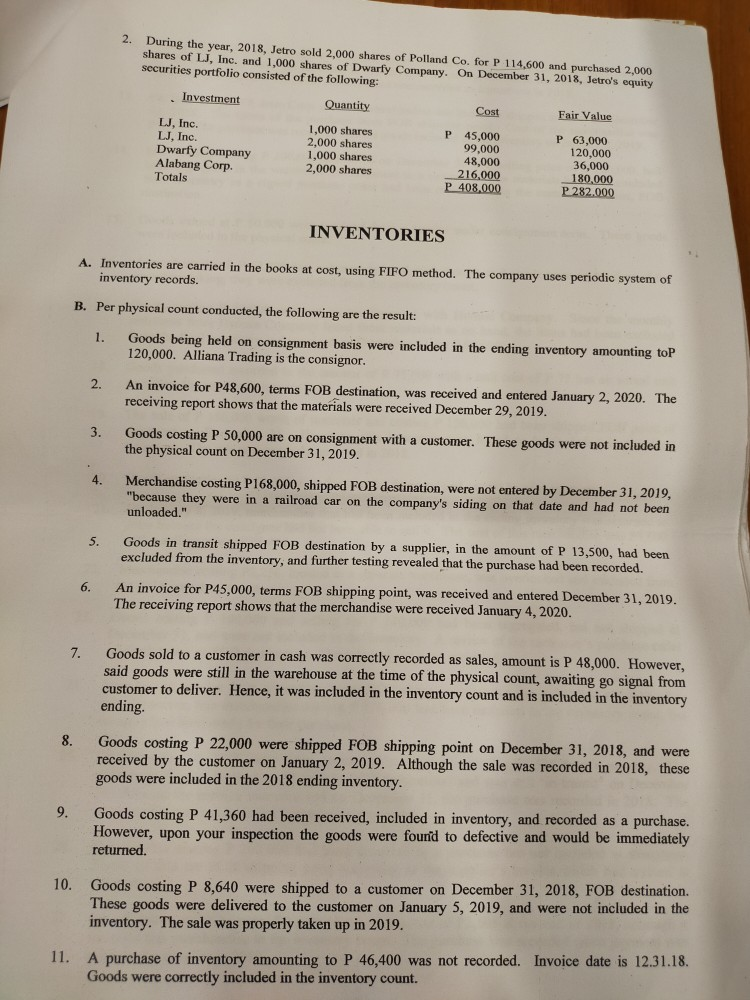

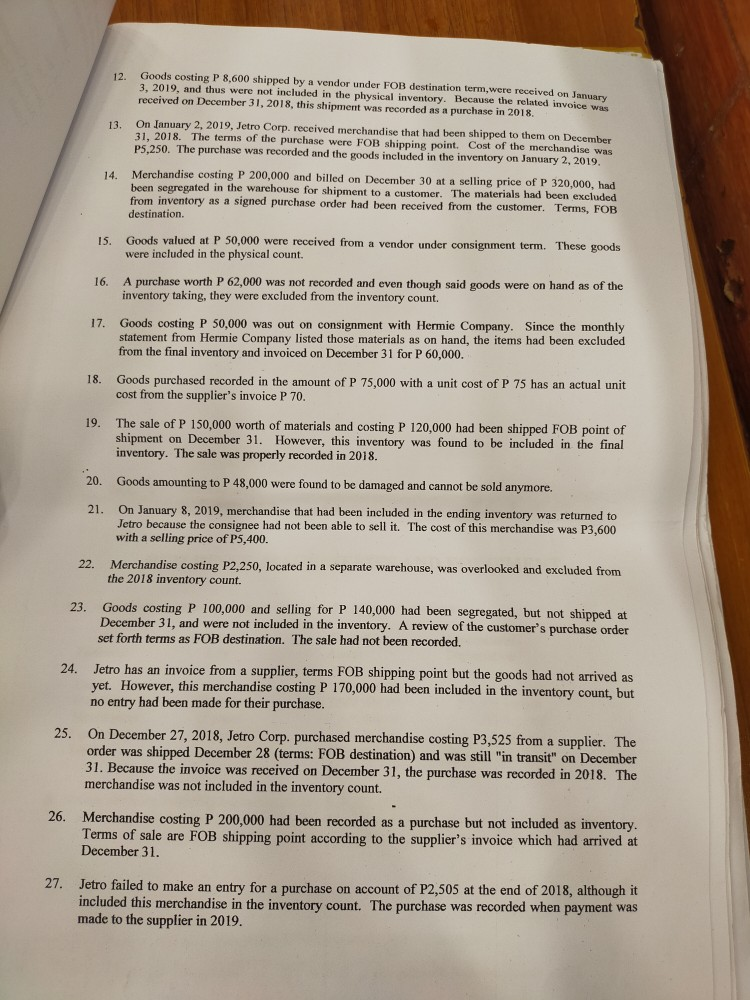

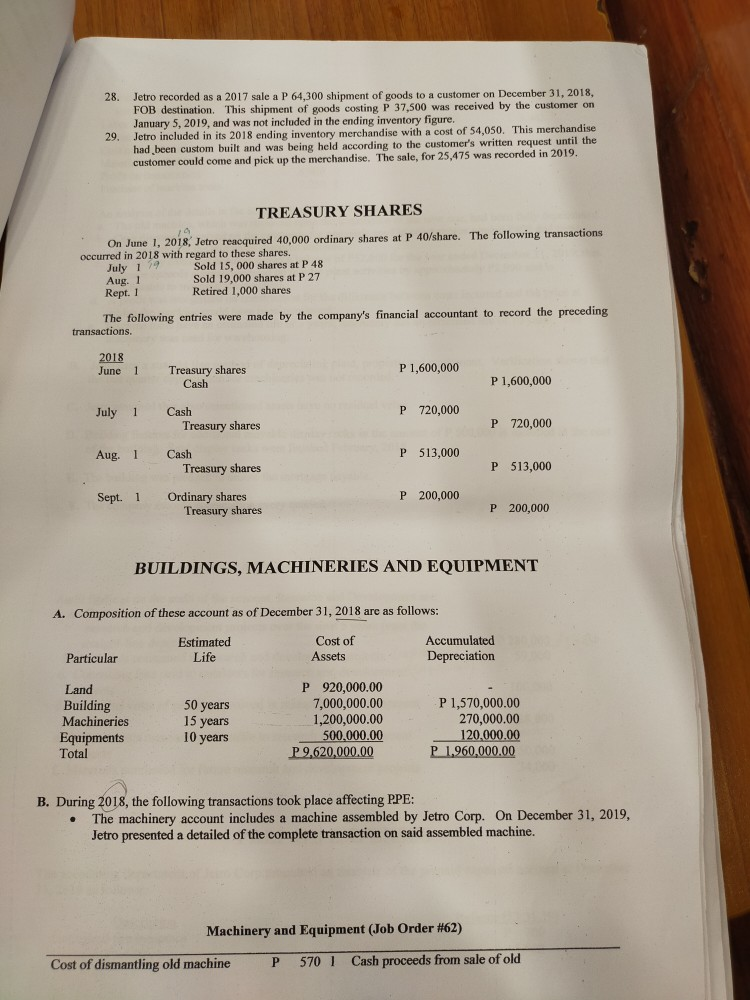

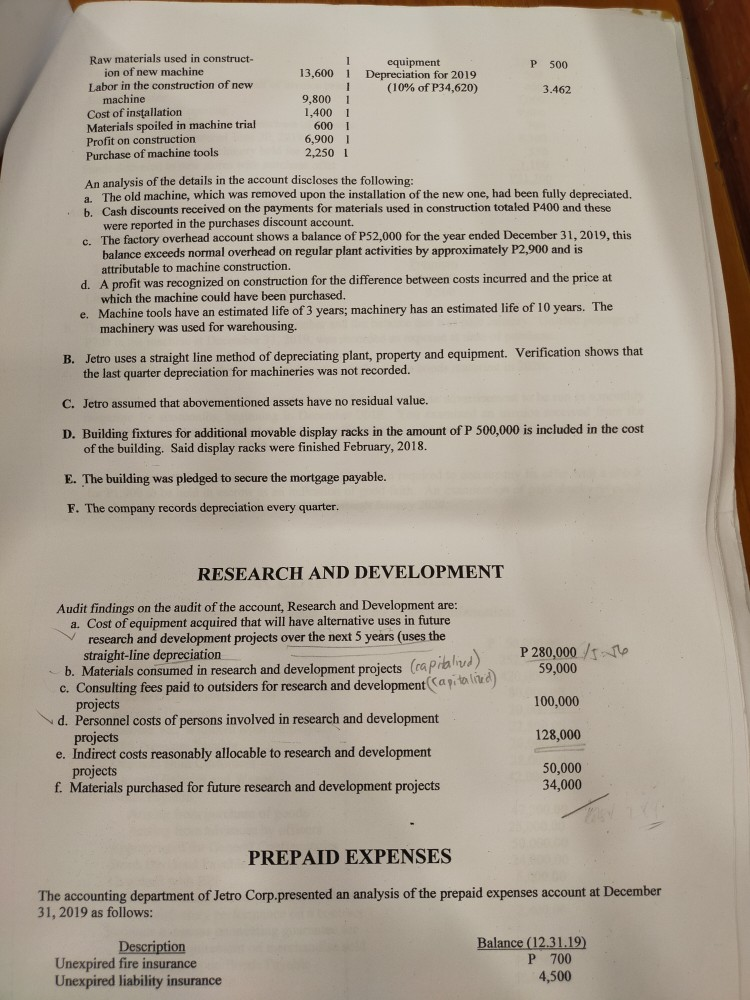

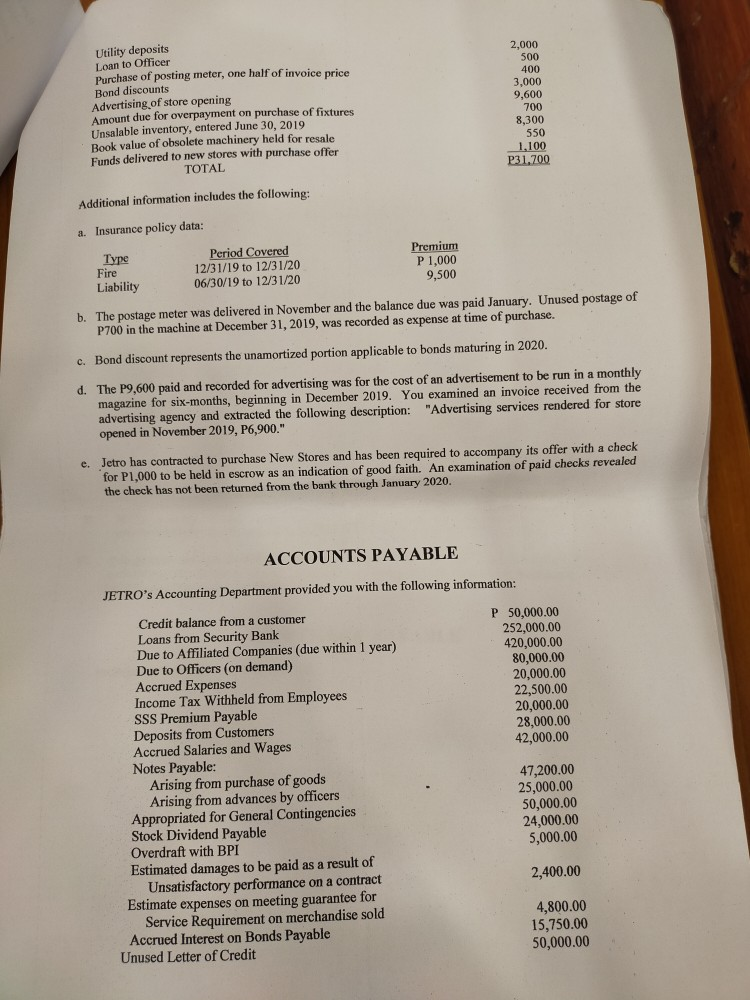

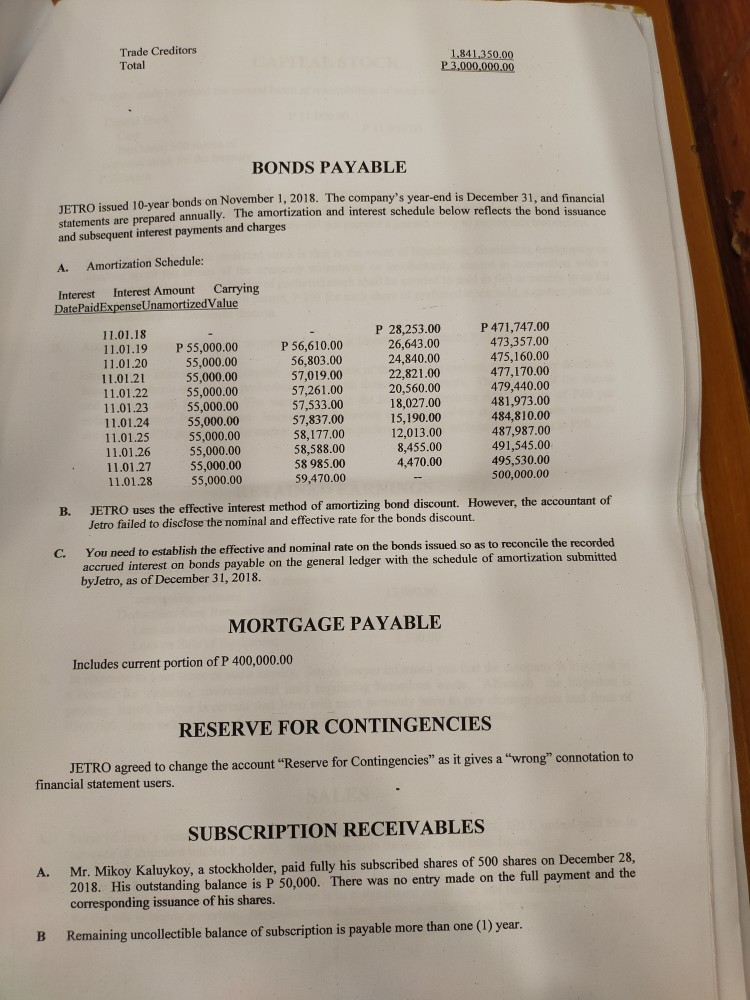

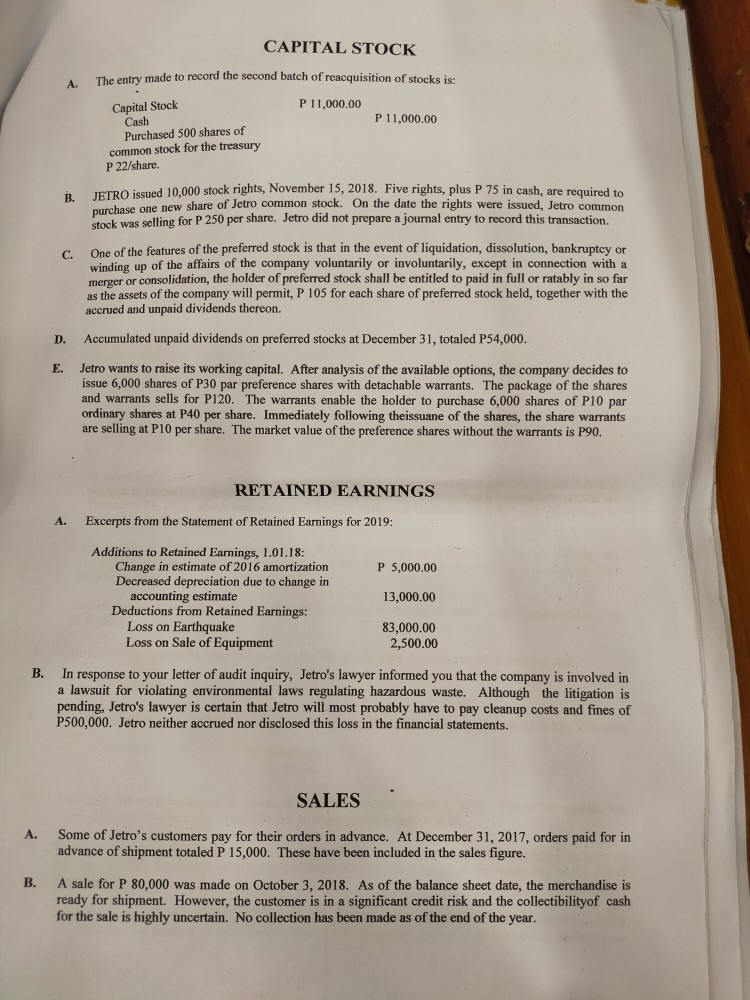

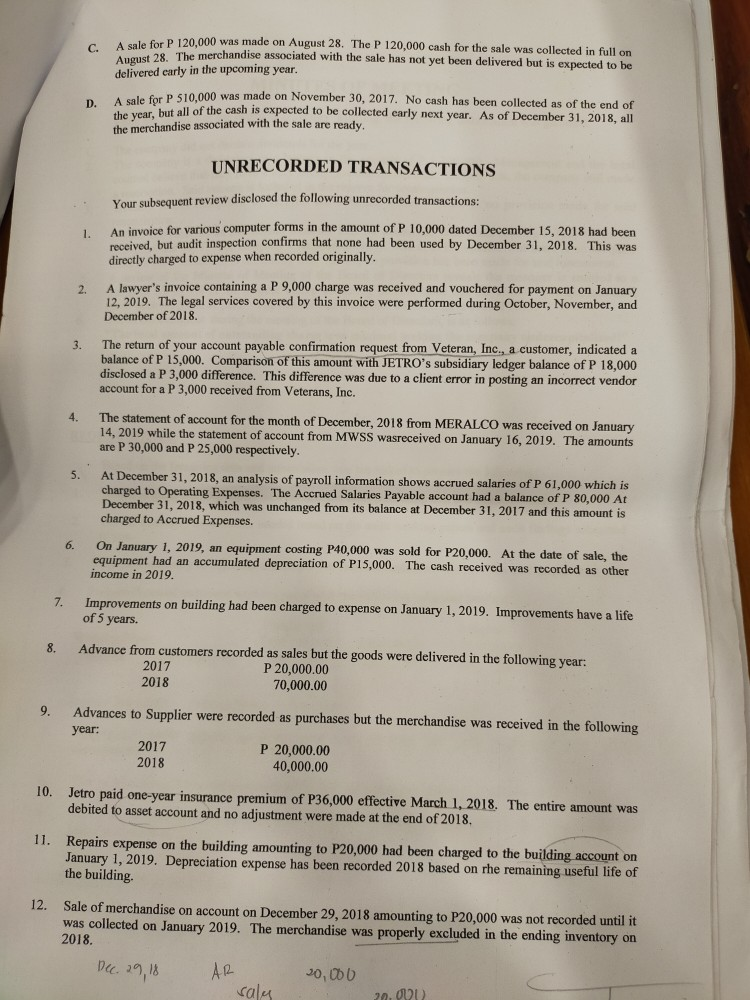

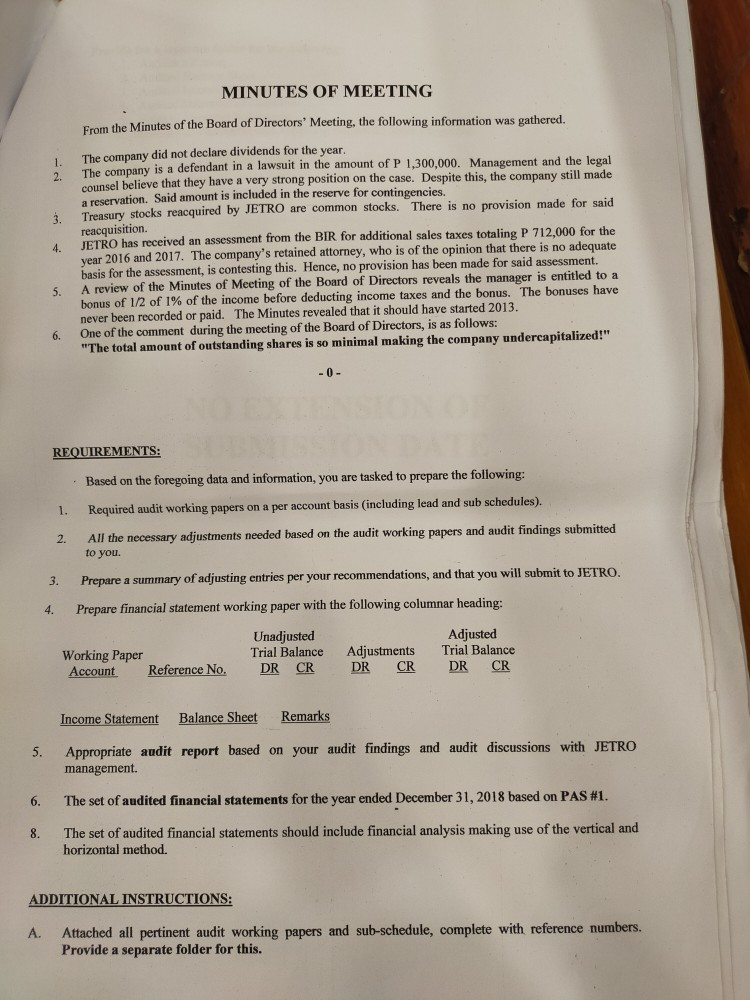

JETRO CORPORATION Unadjusted Trial Balance As Of December 31, 2019 DEBIT CREDIT P 380,000.00 2,000,000.00 1,260,000.00 239,200.00 150,000.00 140,000.00 2,490,000.00 357,000.00 440,000.00 920,000.00 8,700,000.00 1.960,000.00 Cash Investments Accounts Receivable Notes Receivable Allowance for Doubtful Accounts Subscription Receivable Inventories Treasury Stocks Construction In Progress I and Buildings, Machineries and Equipments Accumulated Depreciation Cash Surrender Value of Life Insurance Prepaid Expenses Research and Development Unamortized Bond Discount and Expenses Amortization of Bond Discount and Expenses Cost of goods sold Interest Expense Operating Expenses Provision for Income Tax 10% Debenture Bonds Accounts Payable Mortgage Payable Reserve for Contingencies Income Tax Payable Accrued Expenses Common Stock, P 200.00 par value Authorized - 50,000 shares Issued - 18,500 shares Subscribed - 700 shares Preferred Stocks, Authorized and Issued, 7% cumulative and non-participating. 10,000 shares, P 200 par value Retained Earnings Excess of Issue Price Over Par Value of Common Stock Sales 120,000.00 100,000.00 240,000.00 130,000.00 14,000.00 7,600,000.00 470,000.00 1,050,000.00 620,000.00 739,200.00 3,000,000.00 1,660,000.00 400,000.00 620,000.00 380,000.00 3,700,000.00 140,000.00 2,000,000.00 641,000.00 80,000.00 11,800,000.00 P 27,270,200.00 P 27,270,200.00 ACCOUNTS RECEIVABLE A. The total balance of accounts receivable includes trade and non-trade, P 1,260,000. B. Verifications of accounts further reveals the following were included in the ending balance as of 12.31.19: 1. Sold merchandise to Mismo Co. and accepted a 10% note, December 31, 2019. Payment of principal plus interest is due on March 31, 2020. This transaction was not recorded in the books in 2019 2. Goods consigned to LizQuen Novelty Shop amounting to P25,000 was re recorded as regulars sale when delivered on December 29, 2019. 3. A sixty day note from Cristabel Architectural Firm for P50,000 dated November 20, 2019, interest rate is 15% 4. A forty-five days non-interest bearing note, dated December 1, 2019 from Gwafhay Merchandising in the amount of P30,000. Discounted with bank at 15% on December 16, 2019. 5. A demand note for P20,000 dated December 10, 2019 from James Reid, Credit and Collection Manager of JETRO. The note was dated December 12, 2018 and with interest of 12% per annum. 6. Accounts receivables amounting to P 280,000 from Purple Cloud, Inc. were assigned to Security Bank. On the gross amount assigned, JETRO was granted a loan, which is 90%. On the same date, December 10, 2019, JETRO signed a promissory note that provides a 20% interest per annum. Said loan is included in the ending balance of accounts payable. 7. Subsidiary ledgers balances of accounts receivables as of 12.31.18 are as follows: Cristabel Architectural Firm (dtd 11.20.19) P 50,000.00 Rosal Flower Garden: 6.20.19 8.18.19 P 6,000.00 10,000.00 16,000.00 Sunrise Company: 3.20.19 8.01.19 P 3,000.00 10,000.00 13,000.00 20,000.00 Crystal Caves Co. (dtd 9.14.19) Purple Cloud, Inc. (dtd 10.20.19) 280,000.00 Jeishaleigh EENT Clinic: 9.21.17 1.22.19 P 20,000.00 15,000.00 35,000.00 Rolaine Aimee RTW: 09.18.16 12.22.19 P 420,000.00 110,000.00 Hunk Jake Gym: 10.04.19 12.07.19 530,000.00 - Quor erroneously Shipted to Rolain Ama Garmus 41,000.00 P 29,000.00 12,000.00 Crimson Sea Hotel (dtd 1.28.18) 35,000.00 Errad's Trading (dtd 12.01.19) 30,000.00 Lovenest Furniture Shop: 5.25.19 7.09.19 P 45,000.00 6,000.00 51,000.00 James Reid (12.10.19) 20,000.00 Seaside Restaurant (dtd 11.01.19) maid De 2017 - 28,000.00 Josie Footwear (dtd 1.31.19) Unrecorded 35,000.00 Crazy Blue, Inc. (dtd 12.20.19) 48,000.00 Lime's Novelties (dtd 11.29.19) 26,000.00 8. The accounts receivable were confirmed and are satisfactory except for the following replies: Customer Balance Comment Audit findings Seaside Restaurant P 28,000.00 "Balance was paid on December 29, 2017" JETRO received mailed check on January 3, 2019 Customer Balance Comment Josie Footwear P 35,000.00 "We do not owe JETRO anything as the goods were Audit Findings received in January 2019. The arrangement was FOB Destination." The shipment costing P 35,000 was made December 29, 2019 and the goods were not included in recording the December 31, 2019 inventory summary Customer Balance Comment Rolaine Aimee RTW P 26,000.00 "We never received these goods! #$%^#O?!!!!!!!!!!!!!!!! (Bad words) The shipment was erroneously made to another customer and the goods costing P 10,500 are now on its way to Rolaine Aimee's Garments. The shipment, FOB shipping point, was made on December 31, 2018. Audit Findings 9. The aging for accounts receivable was not included in the various schedules the audit team asked from the accounting department of JETRO to prepare. The following column heading is suggested: NameBalanceCurrent1-30 31-6061-9091-120Past DueRemarks 10. The company agreed to adjust the balance of allowance for doubtful accounts as follows: Current of 1% Accounts 1-60 days Accounts 61-120 days Past due accounts 2% 5% 50% NOTES RECEIVABLE Your review of the different notes receivable and its related interest income accounts in the general ledger resulted to the following: . Beg. Bal Apr. 1, 2019 Notes Receivable P1,700,000 P 1,350,000 250,000 500,000 100,000 Balance End 04/01/2019 02/31/2019 P 1,950,000 P1.950,000 Interest Income P 180,000 P 180,000 Bal. end 04/01/2019 P 180,000 P 180,000 Additional Information: A. The beginning balance of the notes receivable is composed of the following: Note received from sale of machinery on January 1,2019 costing P800,000 with accumulated depreciation of P450,000. The company receives as consideration P200,000 and a noninterest bearing note for P300,000 due annually in equal amounts of P100,000 every end of the year beginning December 31, 2019. The prevailing rate of interest for a note of this type is 12%. The company made the following entry on January 1, 2019. 50 2. During the year, 2018, Jetro sold 2,000 shares of Polland Co. for P 114,600 and purchased 2,000 shares of LJ, Inc. and 1,000 shares of Dwarfy Company. On December 31, 2018, Jetro's equity securities portfolio consisted of the following: Investment Quantity Cost Fair Value LJ, Inc. LJ, Inc. Dwarfy Company Alabang Corp Totals 1,000 shares 2,000 shares 1,000 shares 2,000 shares P 45.000 99,000 48,000 216.000 P 408.000 P 63,000 120,000 36,000 180,000 P282.000 INVENTORIES A. Inventories are carried in the books at cost, using FIFO method. The company uses periodic system of inventory records. B. Per physical count conducted, the following are the result: 1. Goods being held on consignment basis were included in the ending inventory amounting top 120,000. Alliana Trading is the consignor. 2. An invoice for P48,600, terms FOB destination, was received and entered January 2, 2020. The receiving report shows that the materials were received December 29, 2019. Goods costing P 50,000 are on consignment with a customer. These goods were not included in the physical count on December 31, 2019. Merchandise costing P168,000, shipped FOB destination, were not entered by December 31, 2019, "because they were in a railroad car on the company's siding on that date and had not been unloaded." 5. Goods in transit shipped FOB destination by a supplier, in the amount of P 13,500, had been excluded from the inventory, and further testing revealed that the purchase had been recorded. 6. An invoice for P45,000, terms FOB shipping point, was received and entered December 31, 2019. The receiving report shows that the merchandise were received January 4, 2020. Goods sold to a customer in cash was correctly recorded as sales, amount is P 48,000. However, said goods were still in the warehouse at the time of the physical count, awaiting go signal from customer to deliver. Hence, it was included in the inventory count and is included in the inventory ending Goods costing P 22,000 were shipped FOB shipping point on December 31, 2018, and were received by the customer on January 2, 2019. Although the sale was recorded in 2018, these goods were included in the 2018 ending inventory. Goods costing P 41,360 had been received, included in inventory, and recorded as a purchase. However, upon your inspection the goods were found to defective and would be immediately returned. 10. Goods costing P 8,640 were shipped to a customer on December 31, 2018, FOB destination. These goods were delivered to the customer on January 5, 2019, and were not included in the inventory. The sale was properly taken up in 2019. A purchase of inventory amounting to P 46,400 was not recorded. Invoice date is 12.31.18. Goods were correctly included in the inventory count. 12Goods costing P 8,600 shipped by a vendor under FOB destination term, were received on January 3, 2019, and thus were not included in the physical inventory. Because the related invoice was received on December 31, 2018, this shipment was recorded as a purchase in 2018. 11 On January 2, 2019, Jetro Corp. received merchandise that had been shipped to them on December 31, 2018. The terms of the purchase were FOB shipping point. Cost of the merchandise was P5.250. The purchase was recorded and the goods included in the inventory on January 2, 2019. 14. Merchandise costing P 200,000 and billed on December 30 at a selling price of P 320,000, had been segregated in the warehouse for shipment to a customer. The materials had been excluded from inventory as a signed purchase order had been received from the customer. Terms, FOB destination. 15. Goods valued at P 50,000 were received from a vendor under consignment term. These goods were included in the physical count. 16. A purchase worth P 62,000 was not recorded and even though said goods were on hand as of the inventory taking, they were excluded from the inventory count. 17. Goods costing P 50,000 was out on consignment with Hermie Company. Since the monthly statement from Hermie Company listed those materials as on hand, the items had been excluded from the final inventory and invoiced on December 31 for P 60,000. 18. Goods purchased recorded in the amount of P 75,000 with a unit cost of P 75 has an actual unit cost from the supplier's invoice P 70. 19. The sale of P 150,000 worth of materials and costing P 120,000 had been shipped FOB point of shipment on December 31. However, this inventory was found to be included in the final inventory. The sale was properly recorded in 2018. 20. Goods amounting to P 48,000 were found to be damaged and cannot be sold anymore. 21. On January 8, 2019, merchandise that had been included in the ending inventory was returned to Jetro because the consignee had not been able to sell it. The cost of this merchandise was P3,600 with a selling price of P5,400. 22. Merchandise costing P2,250, located in a separate warehouse, was overlooked and excluded from the 2018 inventory count. 23. Goods costing P 100,000 and selling for P 140,000 had been segregated, but not shipped at December 31, and were not included in the inventory. A review of the customer's purchase order set forth terms as FOB destination. The sale had not been recorded. 24. Jetro has an invoice from a supplier, terms FOB shipping point but the goods had not arrived as yet. However, this merchandise costing P 170,000 had been included in the inventory count, but no entry had been made for their purchase. 25. On December 27, 2018, Jetro Corp. purchased merchandise costing P3,525 from a supplier. The order was shipped December 28 (terms: FOB destination) and was still "in transit" on December 31. Because the invoice was received on December 31, the purchase was recorded in 2018. The merchandise was not included in the inventory count. 26. Merchandise costing P 200,000 had been recorded as a purchase but not included as inventory. Terms of sale are FOB shipping point according to the supplier's invoice which had arrived at December 31. Jetro failed to make an entry for a purchase on account of P2,505 at the end of 2018, although it included this merchandise in the inventory count. The purchase was recorded when payment was made to the supplier in 2019. 28. 29. Jetro recorded as a 2017 sale a P 64,300 shipment of goods to a customer on December 31, 2018, FOB destination. This shipment of goods costing P 37,500 was received by the customer on January 5, 2019, and was not included in the ending inventory figure. Jetro included in its 2018 ending inventory merchandise with a cost of 54,050. This merchandise had been custom built and was being held according to the customer's written request until the customer could come and pick up the merchandise. The sale, for 25,475 was recorded in 2019. TREASURY SHARES On June 1, 2018, Jetro reacquired 40,000 ordinary shares at P 40/share. The following transactions occurred in 2018 with regard to these shares. July 179 Sold 15, 000 shares at P 48 Aug. 1 Sold 19,000 shares at P 27 Rept. 1 Retired 1,000 shares The following entries were made by the company's financial accountant to record the preceding transactions. 2018 June 1 Treasury shares Cash P 1,600,000 P 1,600,000 July 1 Cash Treasury shares P 720,000 P 720,000 Aug. 1 Cash Treasury shares P 513,000 P 513,000 Sept. 1 Ordinary shares Treasury shares P 200,000 P 200,000 BUILDINGS, MACHINERIES AND EQUIPMENT A. Composition of these account as of December 31, 2018 are as follows: Particular Estimated Life Cost of Assets Accumulated Depreciation Land Building Machineries Equipments Total 50 years 15 years 10 years P920,000.00 7,000,000.00 1,200,000.00 500,000.00 P 9.620,000.00 P 1,570,000.00 270,000.00 120,000.00 P 1.960,000.00 B. During 2018, the following transactions took place affecting P.PE: The machinery account includes a machine assembled by Jetro Corp. On December 31, 2019, Jetro presented a detailed of the complete transaction on said assembled machine. Machinery and Equipment (Job Order #62) Cost of dismantling old machine P 570 I Cash proceeds from sale of old P 500 equipment Depreciation for 2019 (10% of P34,620) 3.462 Raw materials used in construct ion of new machine Labor in the construction of new machine Cost of installation Materials spoiled in machine trial Profit on construction Purchase of machine tools 13,600 1 9.800 1 1.400 1 600 1 6,900 2,250 1 An analysis of the details in the account discloses the following: The old machine, which was removed upon the installation of the new one, had been fully depreciated. b. Cash discounts received on the payments for materials used in construction totaled P400 and these were reported in the purchases discount account. c. The factory overhead account shows a balance of P52,000 for the year ended December 31, 2019, this teeds normal overhead on regular plant activities by approximately P2,900 and is attributable to machine construction. d. A profit was recognized on construction for the difference between costs incurred and the price at which the machine could have been purchased. e. Machine tools have an estimated life of 3 years; machinery has an estimated life of 10 years. The machinery was used for warehousing. B. Jetro uses a straight line method of depreciating plant, property and equipment. Verification shows that the last quarter depreciation for machineries was not recorded. C. Jetro assumed that abovementioned assets have no residual value. D. Building fixtures for additional movable display racks in the amount of P 500,000 is included in the cost of the building. Said display racks were finished February, 2018 E. The building was pledged to secure the mortgage payable. F. The company records depreciation every quarter. RESEARCH AND DEVELOPMENT P 280,000/ 59,000 16 ojects (capitalized) Audit findings on the audit of the account, Research and Development are: a. Cost of equipment acquired that will have alternative uses in future research and development projects over the next 5 years (uses the straight-line depreciation b. Materials consumed in research and development projects (rapro e. Consulting fees paid to outsiders for research and development Capital projects d. Personnel costs of persons involved in research and development projects e. Indirect costs reasonably allocable to research and development projects f. Materials purchased for future research and development projects 100,000 128,000 50,000 34,000 PREPAID EXPENSES The accounting department of Jetro Corp.presented an analysis of the prepaid expenses account at December 31, 2019 as follows: Description Unexpired fire insurance Unexpired liability insurance Balance (12.31.19) P 700 4,500 2,000 500 Utility deposits Loan to Officer Purchase of posting meter, one half of invoice price Bond discounts Advertising of store opening Amount due for overpayment on purchase of fixtures Unsalable inventory, entered June 30, 2019 Book value of obsolete machinery held for resale Funds delivered to new stores with purchase offer TOTAL 400 3,000 9,600 700 8,300 550 1.100 P31,700 Additional information includes the following: a. Insurance policy data: Type Fire Liability Period Covered 12/31/19 to 12/31/20 06/30/19 to 12/31/20 Premium P 1,000 9,500 b. The postage meter was delivered in November and the balance due was paid January. Unused postage of P700 in the machine at December 31, 2019, was recorded as expense at time of purchase. c. Bond discount represents the unamortized portion applicable to bonds maturing in 2020. d. The P9,600 paid and recorded for advertising was for the cost of an advertisement to be run in a monthly magazine for six-months, beginning in December 2019. You examined an invoice received from the advertising agency and extracted the following description: "Advertising services rendered for store opened in November 2019, P6,900." e. Jetro has contracted to purchase New Stores and has been required to accompany its offer with a check for P1,000 to be held in escrow as an indication of good faith. An examination of paid checks revealed the check has not been returned from the bank through January 2020. ACCOUNTS PAYABLE JETRO's Accounting Department provided you with the following information: P 50,000.00 252,000.00 420,000.00 80,000.00 20,000.00 22,500.00 20,000.00 28,000.00 42,000.00 Credit balance from a customer Loans from Security Bank Due to Affiliated Companies (due within 1 year) Due to Officers (on demand) Accrued Expenses Income Tax Withheld from Employees SSS Premium Payable Deposits from Customers Accrued Salaries and Wages Notes Payable: Arising from purchase of goods Arising from advances by officers Appropriated for General Contingencies Stock Dividend Payable Overdraft with BPI Estimated damages to be paid as a result of Unsatisfactory performance on a contract Estimate expenses on meeting guarantee for Service Requirement on merchandise sold Accrued Interest on Bonds Payable Unused Letter of Credit 47,200.00 25,000.00 50,000.00 24,000.00 5,000.00 2,400.00 4,800.00 15,750.00 50,000.00 Trade Creditors Total 1.841.350.00 P 3.000.000.00 BONDS PAYABLE 10 year bonds on November 1, 2018. The company's year-end is December 31, and financial statements are prepared annually. The amortization and interest schedule below reflects the bond issuance and subsequent interest payments and charges A. Amortization Schedule: Interest Interest Amount Carrying DatePaidExpense Unamortized Value 11.01.18 11.01.19P 11.01.20 11.01.21 11.01.22 11.01.23 11.01.24 11.01.25 11.01.26 11.01.27 11.01.28 55,000.00 55,000.00 55,000.00 55,000.00 55,000.00 55,000.00 55,000.00 55,000.00 55,000.00 55,000.00 P 56,610.00 56,803.00 57,019.00 57,261.00 57,533.00 57,837.00 58,177.00 58,588.00 58 985.00 59,470.00 P 28,253.00 26,643.00 24,840.00 22,821.00 20,560.00 18,027.00 15,190.00 12,013.00 8,455.00 4,470.00 P 471,747.00 473,357.00 475,160.00 477,170.00 479,440.00 481,973.00 484,810.00 487,987.00 491,545.00 495,530.00 500,000.00 B. JETRO uses the effective interest method of amortizing bond discount. However, the accountant of Jetro failed to disclose the nominal and effective rate for the bonds discount. C. You need to establish the effective and nominal rate on the bonds issued so as to reconcile the recorded accrued interest on bonds payable on the general ledger with the schedule of amortization submitted byJetro, as of December 31, 2018. MORTGAGE PAYABLE Includes current portion of P 400,000.00 RESERVE FOR CONTINGENCIES JETRO agreed to change the account "Reserve for Contingencies" as it gives a "wrong" connotation to financial statement users. SUBSCRIPTION RECEIVABLES A. Mr. Mikoy Kaluykoy, a stockholder, paid fully his subscribed shares of 500 shares on December 28, 2018. His outstanding balance is P 50,000. There was no entry made on the full payment and the corresponding issuance of his shares. B Remaining uncollectible balance of subscription is payable more than one (1) year. CAPITAL STOCK The entry made to record the second batch of reacquisition of stocks is: P 11,000.00 P 11,000.00 Capital Stock Cash Purchased 500 shares of common stock for the treasury P 22/share. B. cud 10.000 stock rights, November 15, 2018. Five rights, plus P 75 in cash, are required to JETRO issued 10,000 stock rights, November 15, 2013 ne new share of Jetro common stock. On the date the rights were issued, Jetro common ook was selling for P250 per share. Jetro did not prepare a journal entry to record this transaction. One of the features of the preferred stock is that in the event of liquidation, dissolution, bankruptcy or winding up of the affairs of the company voluntarily or involuntarily, except in connection with a merger or consolidation, the holder of preferred stock shall be entitled to paid in full or ratably in so far as the assets of the company will permit, P 105 for each share of preferred stock held, together with the accrued and unpaid dividends thereon. D. Accumulated unpaid dividends on preferred stocks at December 31, totaled P54,000. E. Jetro wants to raise its working capital. After analysis of the available options, the company decides to issue 6,000 shares of P30 par preference shares with detachable warrants. The package of the shares and warrants sells for P120. The warrants enable the holder to purchase 6,000 shares of P10 par ordinary shares at P40 per share. Immediately following theissuane of the shares, the share warrants are selling at P10 per share. The market value of the preference shares without the warrants is P90. RETAINED EARNINGS A. Excerpts from the Statement of Retained Earnings for 2019: P 5,000.00 Additions to Retained Earnings, 1.01.18: Change in estimate of 2016 amortization Decreased depreciation due to change in accounting estimate Deductions from Retained Earnings: Loss on Earthquake Loss on Sale of Equipment 13,000.00 83,000.00 2,500.00 B. In response to your letter of audit inquiry, Jetro's lawyer informed you that the company is involved in a lawsuit for violating environmental laws regulating hazardous waste. Although the litigation is pending, Jetro's lawyer is certain that Jetro will most probably have to pay cleanup costs and fines of P500,000. Jetro neither accrued nor disclosed this loss in the financial statements. SALES A. Some of Jetro's customers pay for their orders in advance. At December 31, 2017, orders paid for in advance of shipment totaled P 15,000. These have been included in the sales figure. B. A sale for P 80,000 was made on October 3, 2018. As of the balance sheet date, the merchandise is ready for shipment. However, the customer is in a significant credit risk and the collectibilityof cash for the sale is highly uncertain. No collection has been made as of the end of the year. for P 120,000 was made on August 28. The P 120,000 cash for the sale was collected in full on The merchandise associated with the sale has not yet been delivered but is expected to be August 28. The merchandise associated delivered early in the upcoming year. D. A sale for P 510,000 was made on No for p 510,000 was made on November 30, 2017. No cash has been collected as of the end of but all of the cash is expected to be collected early next year. As of December 31, 2018, all the merchandise associated with the sale are ready. UNRECORDED TRANSACTIONS Your subsequent review disclosed the following unrecorded transactions: An invoice for various computer forms in the amount of P 10,000 dated December 15, 2018 had been received, but audit inspection confirms that none had been used by December 31, 2018. This was directly charged to expense when recorded originally. A lawyer's invoice containing a P 9,000 charge was received and vouchered for payment on January 12, 2019. The legal services covered by this invoice were performed during October, November, and December of 2018 3. The return of your account payable confirmation request from Veteran, Inc., a customer, indicated a balance of P 15,000. Comparison of this amount with JETRO's subsidiary ledger balance of P 18,000 disclosed a P 3,000 difference. This difference was due to a client error in posting an incorrect vendor account for a P 3,000 received from Veterans, Inc. 4. The statement of account for the month of December, 2018 from MERALCO was received on January 14, 2019 while the statement of account from MWSS wasreceived on January 16, 2019. The amounts are P 30,000 and P 25,000 respectively. 5. At December 31, 2018, an analysis of payroll information shows accrued salaries of P 61,000 which is charged to Operating Expenses. The Accrued Salaries Payable account had a balance of P 80,000 At December 31, 2018, which was unchanged from its balance at December 31, 2017 and this amount is charged to Accrued Expenses. On January 1, 2019, an equipment costing P40,000 was sold for P20,000. At the date of sale, the equipment had an accumulated depreciation of P15,000. The cash received was recorded as other income in 2019. Improvements on building had been charged to expense on January 1, 2019. Improvements have a life of 5 years. 8. Advance from customers recorded as sales but the goods were delivered in the following year: 2017 P 20,000.00 2018 70,000.00 9. Advances to Supplier were recorded as purchases but the merchandise was received in the following year: 2017 P 20,000.00 2018 40,000.00 10. Jetro paid one-year insurance premium of P36,000 effective March 1, 2018. The entire amount was debited to asset account and no adjustment were made at the end of 2018. 11. Repairs expense on the building amounting to P20,000 had been charged to the building account on January 1, 2019. Depreciation expense has been recorded 2018 based on the remaining useful life of the building. 12. Sale of merchandise on account on December 29, 2018 amounting to P20,000 was not recorded until it was collected on January 2019. The merchandise was properly excluded in the ending inventory on 2018. Dec. 29, 18 20,000 sals 20.00 MINUTES OF MEETING From the Minutes of the Board of Directors' Meeting, the following information was gathered. 2. The company did not declare dividends for the year. The company is a defendant in a lawsuit in the amount of P 1,300,000. Management and the legal counsel believe that they have a very strong position on the case. Despite this, the company still made a reservation. Said amount is included in the reserve for contingencies. Treasury stocks reacquired by JETRO are common stocks. There is no provision made for said reacquisition. JETRO has received an assessment from the BIR for additional sales taxes totaling P 712,000 for the year 2016 and 2017. The company's retained attorney, who is of the opinion that there is no adequate basis for the assessment, is contesting this. Hence, no provision has been made for said assessment. A review of the Minutes of Meeting of the Board of Directors reveals the manager is entitled to a bonus of 112 of 1% of the income before deducting income taxes and the bonus. The bonuses have never been recorded or paid. The Minutes revealed that it should have started 2013. One of the comment during the meeting of the Board of Directors, is as follows: "The total amount of outstanding shares is so minimal making the company undercapitalized!" -0- REQUIREMENTS: . Based on the foregoing data and information, you are tasked to prepare the following: 1. Required audit working papers on a per account basis (including lead and sub schedules). 2. All the necessary adjustments needed based on the audit working papers and audit findings submitted to you. 3. Prepare a summary of adjusting entries per your recommendations, and that you will submit to JETRO. 4. Prepare financial statement working paper with the following columnar heading: Working Paper Account Reference No. Unadjusted Trial Balance DR CR Adjustments D R CR Adjusted Trial Balance DR CR 5. Income Statement Balance Sheet Remarks Appropriate audit report based on your audit findings and audit discussions with JETRO management. 6. The set of audited financial statements for the year ended December 31, 2018 based on PAS #1. 8. The set of audited financial statements should include financial analysis making use of the vertical and horizontal method. ADDITIONAL INSTRUCTIONS: A. Attached all pertinent audit working papers and sub-schedule, complete with reference numbers. Provide a separate folder for this. B. Provide for a separate folder for the following: 1. Auditor's Report 2. Audited Balance Sheet 3. Audited Income Statement 4.. Audited Statement of Cashflow 5. Notes to Financial Statements 6. Summary of Recommended Adjusting Entries for Jetro's approval. C. Submit the practice set e rker than the scheduled final exam. This is because the client, JETRO CORPORATION, needs to review the various audit findings as they have a new set of Board of Directors. JETRO CORPORATION Unadjusted Trial Balance As Of December 31, 2019 DEBIT CREDIT P 380,000.00 2,000,000.00 1,260,000.00 239,200.00 150,000.00 140,000.00 2,490,000.00 357,000.00 440,000.00 920,000.00 8,700,000.00 1.960,000.00 Cash Investments Accounts Receivable Notes Receivable Allowance for Doubtful Accounts Subscription Receivable Inventories Treasury Stocks Construction In Progress I and Buildings, Machineries and Equipments Accumulated Depreciation Cash Surrender Value of Life Insurance Prepaid Expenses Research and Development Unamortized Bond Discount and Expenses Amortization of Bond Discount and Expenses Cost of goods sold Interest Expense Operating Expenses Provision for Income Tax 10% Debenture Bonds Accounts Payable Mortgage Payable Reserve for Contingencies Income Tax Payable Accrued Expenses Common Stock, P 200.00 par value Authorized - 50,000 shares Issued - 18,500 shares Subscribed - 700 shares Preferred Stocks, Authorized and Issued, 7% cumulative and non-participating. 10,000 shares, P 200 par value Retained Earnings Excess of Issue Price Over Par Value of Common Stock Sales 120,000.00 100,000.00 240,000.00 130,000.00 14,000.00 7,600,000.00 470,000.00 1,050,000.00 620,000.00 739,200.00 3,000,000.00 1,660,000.00 400,000.00 620,000.00 380,000.00 3,700,000.00 140,000.00 2,000,000.00 641,000.00 80,000.00 11,800,000.00 P 27,270,200.00 P 27,270,200.00 ACCOUNTS RECEIVABLE A. The total balance of accounts receivable includes trade and non-trade, P 1,260,000. B. Verifications of accounts further reveals the following were included in the ending balance as of 12.31.19: 1. Sold merchandise to Mismo Co. and accepted a 10% note, December 31, 2019. Payment of principal plus interest is due on March 31, 2020. This transaction was not recorded in the books in 2019 2. Goods consigned to LizQuen Novelty Shop amounting to P25,000 was re recorded as regulars sale when delivered on December 29, 2019. 3. A sixty day note from Cristabel Architectural Firm for P50,000 dated November 20, 2019, interest rate is 15% 4. A forty-five days non-interest bearing note, dated December 1, 2019 from Gwafhay Merchandising in the amount of P30,000. Discounted with bank at 15% on December 16, 2019. 5. A demand note for P20,000 dated December 10, 2019 from James Reid, Credit and Collection Manager of JETRO. The note was dated December 12, 2018 and with interest of 12% per annum. 6. Accounts receivables amounting to P 280,000 from Purple Cloud, Inc. were assigned to Security Bank. On the gross amount assigned, JETRO was granted a loan, which is 90%. On the same date, December 10, 2019, JETRO signed a promissory note that provides a 20% interest per annum. Said loan is included in the ending balance of accounts payable. 7. Subsidiary ledgers balances of accounts receivables as of 12.31.18 are as follows: Cristabel Architectural Firm (dtd 11.20.19) P 50,000.00 Rosal Flower Garden: 6.20.19 8.18.19 P 6,000.00 10,000.00 16,000.00 Sunrise Company: 3.20.19 8.01.19 P 3,000.00 10,000.00 13,000.00 20,000.00 Crystal Caves Co. (dtd 9.14.19) Purple Cloud, Inc. (dtd 10.20.19) 280,000.00 Jeishaleigh EENT Clinic: 9.21.17 1.22.19 P 20,000.00 15,000.00 35,000.00 Rolaine Aimee RTW: 09.18.16 12.22.19 P 420,000.00 110,000.00 Hunk Jake Gym: 10.04.19 12.07.19 530,000.00 - Quor erroneously Shipted to Rolain Ama Garmus 41,000.00 P 29,000.00 12,000.00 Crimson Sea Hotel (dtd 1.28.18) 35,000.00 Errad's Trading (dtd 12.01.19) 30,000.00 Lovenest Furniture Shop: 5.25.19 7.09.19 P 45,000.00 6,000.00 51,000.00 James Reid (12.10.19) 20,000.00 Seaside Restaurant (dtd 11.01.19) maid De 2017 - 28,000.00 Josie Footwear (dtd 1.31.19) Unrecorded 35,000.00 Crazy Blue, Inc. (dtd 12.20.19) 48,000.00 Lime's Novelties (dtd 11.29.19) 26,000.00 8. The accounts receivable were confirmed and are satisfactory except for the following replies: Customer Balance Comment Audit findings Seaside Restaurant P 28,000.00 "Balance was paid on December 29, 2017" JETRO received mailed check on January 3, 2019 Customer Balance Comment Josie Footwear P 35,000.00 "We do not owe JETRO anything as the goods were Audit Findings received in January 2019. The arrangement was FOB Destination." The shipment costing P 35,000 was made December 29, 2019 and the goods were not included in recording the December 31, 2019 inventory summary Customer Balance Comment Rolaine Aimee RTW P 26,000.00 "We never received these goods! #$%^#O?!!!!!!!!!!!!!!!! (Bad words) The shipment was erroneously made to another customer and the goods costing P 10,500 are now on its way to Rolaine Aimee's Garments. The shipment, FOB shipping point, was made on December 31, 2018. Audit Findings 9. The aging for accounts receivable was not included in the various schedules the audit team asked from the accounting department of JETRO to prepare. The following column heading is suggested: NameBalanceCurrent1-30 31-6061-9091-120Past DueRemarks 10. The company agreed to adjust the balance of allowance for doubtful accounts as follows: Current of 1% Accounts 1-60 days Accounts 61-120 days Past due accounts 2% 5% 50% NOTES RECEIVABLE Your review of the different notes receivable and its related interest income accounts in the general ledger resulted to the following: . Beg. Bal Apr. 1, 2019 Notes Receivable P1,700,000 P 1,350,000 250,000 500,000 100,000 Balance End 04/01/2019 02/31/2019 P 1,950,000 P1.950,000 Interest Income P 180,000 P 180,000 Bal. end 04/01/2019 P 180,000 P 180,000 Additional Information: A. The beginning balance of the notes receivable is composed of the following: Note received from sale of machinery on January 1,2019 costing P800,000 with accumulated depreciation of P450,000. The company receives as consideration P200,000 and a noninterest bearing note for P300,000 due annually in equal amounts of P100,000 every end of the year beginning December 31, 2019. The prevailing rate of interest for a note of this type is 12%. The company made the following entry on January 1, 2019. 50 2. During the year, 2018, Jetro sold 2,000 shares of Polland Co. for P 114,600 and purchased 2,000 shares of LJ, Inc. and 1,000 shares of Dwarfy Company. On December 31, 2018, Jetro's equity securities portfolio consisted of the following: Investment Quantity Cost Fair Value LJ, Inc. LJ, Inc. Dwarfy Company Alabang Corp Totals 1,000 shares 2,000 shares 1,000 shares 2,000 shares P 45.000 99,000 48,000 216.000 P 408.000 P 63,000 120,000 36,000 180,000 P282.000 INVENTORIES A. Inventories are carried in the books at cost, using FIFO method. The company uses periodic system of inventory records. B. Per physical count conducted, the following are the result: 1. Goods being held on consignment basis were included in the ending inventory amounting top 120,000. Alliana Trading is the consignor. 2. An invoice for P48,600, terms FOB destination, was received and entered January 2, 2020. The receiving report shows that the materials were received December 29, 2019. Goods costing P 50,000 are on consignment with a customer. These goods were not included in the physical count on December 31, 2019. Merchandise costing P168,000, shipped FOB destination, were not entered by December 31, 2019, "because they were in a railroad car on the company's siding on that date and had not been unloaded." 5. Goods in transit shipped FOB destination by a supplier, in the amount of P 13,500, had been excluded from the inventory, and further testing revealed that the purchase had been recorded. 6. An invoice for P45,000, terms FOB shipping point, was received and entered December 31, 2019. The receiving report shows that the merchandise were received January 4, 2020. Goods sold to a customer in cash was correctly recorded as sales, amount is P 48,000. However, said goods were still in the warehouse at the time of the physical count, awaiting go signal from customer to deliver. Hence, it was included in the inventory count and is included in the inventory ending Goods costing P 22,000 were shipped FOB shipping point on December 31, 2018, and were received by the customer on January 2, 2019. Although the sale was recorded in 2018, these goods were included in the 2018 ending inventory. Goods costing P 41,360 had been received, included in inventory, and recorded as a purchase. However, upon your inspection the goods were found to defective and would be immediately returned. 10. Goods costing P 8,640 were shipped to a customer on December 31, 2018, FOB destination. These goods were delivered to the customer on January 5, 2019, and were not included in the inventory. The sale was properly taken up in 2019. A purchase of inventory amounting to P 46,400 was not recorded. Invoice date is 12.31.18. Goods were correctly included in the inventory count. 12Goods costing P 8,600 shipped by a vendor under FOB destination term, were received on January 3, 2019, and thus were not included in the physical inventory. Because the related invoice was received on December 31, 2018, this shipment was recorded as a purchase in 2018. 11 On January 2, 2019, Jetro Corp. received merchandise that had been shipped to them on December 31, 2018. The terms of the purchase were FOB shipping point. Cost of the merchandise was P5.250. The purchase was recorded and the goods included in the inventory on January 2, 2019. 14. Merchandise costing P 200,000 and billed on December 30 at a selling price of P 320,000, had been segregated in the warehouse for shipment to a customer. The materials had been excluded from inventory as a signed purchase order had been received from the customer. Terms, FOB destination. 15. Goods valued at P 50,000 were received from a vendor under consignment term. These goods were included in the physical count. 16. A purchase worth P 62,000 was not recorded and even though said goods were on hand as of the inventory taking, they were excluded from the inventory count. 17. Goods costing P 50,000 was out on consignment with Hermie Company. Since the monthly statement from Hermie Company listed those materials as on hand, the items had been excluded from the final inventory and invoiced on December 31 for P 60,000. 18. Goods purchased recorded in the amount of P 75,000 with a unit cost of P 75 has an actual unit cost from the supplier's invoice P 70. 19. The sale of P 150,000 worth of materials and costing P 120,000 had been shipped FOB point of shipment on December 31. However, this inventory was found to be included in the final inventory. The sale was properly recorded in 2018. 20. Goods amounting to P 48,000 were found to be damaged and cannot be sold anymore. 21. On January 8, 2019, merchandise that had been included in the ending inventory was returned to Jetro because the consignee had not been able to sell it. The cost of this merchandise was P3,600 with a selling price of P5,400. 22. Merchandise costing P2,250, located in a separate warehouse, was overlooked and excluded from the 2018 inventory count. 23. Goods costing P 100,000 and selling for P 140,000 had been segregated, but not shipped at December 31, and were not included in the inventory. A review of the customer's purchase order set forth terms as FOB destination. The sale had not been recorded. 24. Jetro has an invoice from a supplier, terms FOB shipping point but the goods had not arrived as yet. However, this merchandise costing P 170,000 had been included in the inventory count, but no entry had been made for their purchase. 25. On December 27, 2018, Jetro Corp. purchased merchandise costing P3,525 from a supplier. The order was shipped December 28 (terms: FOB destination) and was still "in transit" on December 31. Because the invoice was received on December 31, the purchase was recorded in 2018. The merchandise was not included in the inventory count. 26. Merchandise costing P 200,000 had been recorded as a purchase but not included as inventory. Terms of sale are FOB shipping point according to the supplier's invoice which had arrived at December 31. Jetro failed to make an entry for a purchase on account of P2,505 at the end of 2018, although it included this merchandise in the inventory count. The purchase was recorded when payment was made to the supplier in 2019. 28. 29. Jetro recorded as a 2017 sale a P 64,300 shipment of goods to a customer on December 31, 2018, FOB destination. This shipment of goods costing P 37,500 was received by the customer on January 5, 2019, and was not included in the ending inventory figure. Jetro included in its 2018 ending inventory merchandise with a cost of 54,050. This merchandise had been custom built and was being held according to the customer's written request until the customer could come and pick up the merchandise. The sale, for 25,475 was recorded in 2019. TREASURY SHARES On June 1, 2018, Jetro reacquired 40,000 ordinary shares at P 40/share. The following transactions occurred in 2018 with regard to these shares. July 179 Sold 15, 000 shares at P 48 Aug. 1 Sold 19,000 shares at P 27 Rept. 1 Retired 1,000 shares The following entries were made by the company's financial accountant to record the preceding transactions. 2018 June 1 Treasury shares Cash P 1,600,000 P 1,600,000 July 1 Cash Treasury shares P 720,000 P 720,000 Aug. 1 Cash Treasury shares P 513,000 P 513,000 Sept. 1 Ordinary shares Treasury shares P 200,000 P 200,000 BUILDINGS, MACHINERIES AND EQUIPMENT A. Composition of these account as of December 31, 2018 are as follows: Particular Estimated Life Cost of Assets Accumulated Depreciation Land Building Machineries Equipments Total 50 years 15 years 10 years P920,000.00 7,000,000.00 1,200,000.00 500,000.00 P 9.620,000.00 P 1,570,000.00 270,000.00 120,000.00 P 1.960,000.00 B. During 2018, the following transactions took place affecting P.PE: The machinery account includes a machine assembled by Jetro Corp. On December 31, 2019, Jetro presented a detailed of the complete transaction on said assembled machine. Machinery and Equipment (Job Order #62) Cost of dismantling old machine P 570 I Cash proceeds from sale of old P 500 equipment Depreciation for 2019 (10% of P34,620) 3.462 Raw materials used in construct ion of new machine Labor in the construction of new machine Cost of installation Materials spoiled in machine trial Profit on construction Purchase of machine tools 13,600 1 9.800 1 1.400 1 600 1 6,900 2,250 1 An analysis of the details in the account discloses the following: The old machine, which was removed upon the installation of the new one, had been fully depreciated. b. Cash discounts received on the payments for materials used in construction totaled P400 and these were reported in the purchases discount account. c. The factory overhead account shows a balance of P52,000 for the year ended December 31, 2019, this teeds normal overhead on regular plant activities by approximately P2,900 and is attributable to machine construction. d. A profit was recognized on construction for the difference between costs incurred and the price at which the machine could have been purchased. e. Machine tools have an estimated life of 3 years; machinery has an estimated life of 10 years. The machinery was used for warehousing. B. Jetro uses a straight line method of depreciating plant, property and equipment. Verification shows that the last quarter depreciation for machineries was not recorded. C. Jetro assumed that abovementioned assets have no residual value. D. Building fixtures for additional movable display racks in the amount of P 500,000 is included in the cost of the building. Said display racks were finished February, 2018 E. The building was pledged to secure the mortgage payable. F. The company records depreciation every quarter. RESEARCH AND DEVELOPMENT P 280,000/ 59,000 16 ojects (capitalized) Audit findings on the audit of the account, Research and Development are: a. Cost of equipment acquired that will have alternative uses in future research and development projects over the next 5 years (uses the straight-line depreciation b. Materials consumed in research and development projects (rapro e. Consulting fees paid to outsiders for research and development Capital projects d. Personnel costs of persons involved in research and development projects e. Indirect costs reasonably allocable to research and development projects f. Materials purchased for future research and development projects 100,000 128,000 50,000 34,000 PREPAID EXPENSES The accounting department of Jetro Corp.presented an analysis of the prepaid expenses account at December 31, 2019 as follows: Description Unexpired fire insurance Unexpired liability insurance Balance (12.31.19) P 700 4,500 2,000 500 Utility deposits Loan to Officer Purchase of posting meter, one half of invoice price Bond discounts Advertising of store opening Amount due for overpayment on purchase of fixtures Unsalable inventory, entered June 30, 2019 Book value of obsolete machinery held for resale Funds delivered to new stores with purchase offer TOTAL 400 3,000 9,600 700 8,300 550 1.100 P31,700 Additional information includes the following: a. Insurance policy data: Type Fire Liability Period Covered 12/31/19 to 12/31/20 06/30/19 to 12/31/20 Premium P 1,000 9,500 b. The postage meter was delivered in November and the balance due was paid January. Unused postage of P700 in the machine at December 31, 2019, was recorded as expense at time of purchase. c. Bond discount represents the unamortized portion applicable to bonds maturing in 2020. d. The P9,600 paid and recorded for advertising was for the cost of an advertisement to be run in a monthly magazine for six-months, beginning in December 2019. You examined an invoice received from the advertising agency and extracted the following description: "Advertising services rendered for store opened in November 2019, P6,900." e. Jetro has contracted to purchase New Stores and has been required to accompany its offer with a check for P1,000 to be held in escrow as an indication of good faith. An examination of paid checks revealed the check has not been returned from the bank through January 2020. ACCOUNTS PAYABLE JETRO's Accounting Department provided you with the following information: P 50,000.00 252,000.00 420,000.00 80,000.00 20,000.00 22,500.00 20,000.00 28,000.00 42,000.00 Credit balance from a customer Loans from Security Bank Due to Affiliated Companies (due within 1 year) Due to Officers (on demand) Accrued Expenses Income Tax Withheld from Employees SSS Premium Payable Deposits from Customers Accrued Salaries and Wages Notes Payable: Arising from purchase of goods Arising from advances by officers Appropriated for General Contingencies Stock Dividend Payable Overdraft with BPI Estimated damages to be paid as a result of Unsatisfactory performance on a contract Estimate expenses on meeting guarantee for Service Requirement on merchandise sold Accrued Interest on Bonds Payable Unused Letter of Credit 47,200.00 25,000.00 50,000.00 24,000.00 5,000.00 2,400.00 4,800.00 15,750.00 50,000.00 Trade Creditors Total 1.841.350.00 P 3.000.000.00 BONDS PAYABLE 10 year bonds on November 1, 2018. The company's year-end is December 31, and financial statements are prepared annually. The amortization and interest schedule below reflects the bond issuance and subsequent interest payments and charges A. Amortization Schedule: Interest Interest Amount Carrying DatePaidExpense Unamortized Value 11.01.18 11.01.19P 11.01.20 11.01.21 11.01.22 11.01.23 11.01.24 11.01.25 11.01.26 11.01.27 11.01.28 55,000.00 55,000.00 55,000.00 55,000.00 55,000.00 55,000.00 55,000.00 55,000.00 55,000.00 55,000.00 P 56,610.00 56,803.00 57,019.00 57,261.00 57,533.00 57,837.00 58,177.00 58,588.00 58 985.00 59,470.00 P 28,253.00 26,643.00 24,840.00 22,821.00 20,560.00 18,027.00 15,190.00 12,013.00 8,455.00 4,470.00 P 471,747.00 473,357.00 475,160.00 477,170.00 479,440.00 481,973.00 484,810.00 487,987.00 491,545.00 495,530.00 500,000.00 B. JETRO uses the effective interest method of amortizing bond discount. However, the accountant of Jetro failed to disclose the nominal and effective rate for the bonds discount. C. You need to establish the effective and nominal rate on the bonds issued so as to reconcile the recorded accrued interest on bonds payable on the general ledger with the schedule of amortization submitted byJetro, as of December 31, 2018. MORTGAGE PAYABLE Includes current portion of P 400,000.00 RESERVE FOR CONTINGENCIES JETRO agreed to change the account "Reserve for Contingencies" as it gives a "wrong" connotation to financial statement users. SUBSCRIPTION RECEIVABLES A. Mr. Mikoy Kaluykoy, a stockholder, paid fully his subscribed shares of 500 shares on December 28, 2018. His outstanding balance is P 50,000. There was no entry made on the full payment and the corresponding issuance of his shares. B Remaining uncollectible balance of subscription is payable more than one (1) year. CAPITAL STOCK The entry made to record the second batch of reacquisition of stocks is: P 11,000.00 P 11,000.00 Capital Stock Cash Purchased 500 shares of common stock for the treasury P 22/share. B. cud 10.000 stock rights, November 15, 2018. Five rights, plus P 75 in cash, are required to JETRO issued 10,000 stock rights, November 15, 2013 ne new share of Jetro common stock. On the date the rights were issued, Jetro common ook was selling for P250 per share. Jetro did not prepare a journal entry to record this transaction. One of the features of the preferred stock is that in the event of liquidation, dissolution, bankruptcy or winding up of the affairs of the company voluntarily or involuntarily, except in connection with a merger or consolidation, the holder of preferred stock shall be entitled to paid in full or ratably in so far as the assets of the company will permit, P 105 for each share of preferred stock held, together with the accrued and unpaid dividends thereon. D. Accumulated unpaid dividends on preferred stocks at December 31, totaled P54,000. E. Jetro wants to raise its working capital. After analysis of the available options, the company decides to issue 6,000 shares of P30 par preference shares with detachable warrants. The package of the shares and warrants sells for P120. The warrants enable the holder to purchase 6,000 shares of P10 par ordinary shares at P40 per share. Immediately following theissuane of the shares, the share warrants are selling at P10 per share. The market value of the preference shares without the warrants is P90. RETAINED EARNINGS A. Excerpts from the Statement of Retained Earnings for 2019: P 5,000.00 Additions to Retained Earnings, 1.01.18: Change in estimate of 2016 amortization Decreased depreciation due to change in accounting estimate Deductions from Retained Earnings: Loss on Earthquake Loss on Sale of Equipment 13,000.00 83,000.00 2,500.00 B. In response to your letter of audit inquiry, Jetro's lawyer informed you that the company is involved in a lawsuit for violating environmental laws regulating hazardous waste. Although the litigation is pending, Jetro's lawyer is certain that Jetro will most probably have to pay cleanup costs and fines of P500,000. Jetro neither accrued nor disclosed this loss in the financial statements. SALES A. Some of Jetro's customers pay for their orders in advance. At December 31, 2017, orders paid for in advance of shipment totaled P 15,000. These have been included in the sales figure. B. A sale for P 80,000 was made on October 3, 2018. As of the balance sheet date, the merchandise is ready for shipment. However, the customer is in a significant credit risk and the collectibilityof cash for the sale is highly uncertain. No collection has been made as of the end of the year. for P 120,000 was made on August 28. The P 120,000 cash for the sale was collected in full on The merchandise associated with the sale has not yet been delivered but is expected to be August 28. The merchandise associated delivered early in the upcoming year. D. A sale for P 510,000 was made on No for p 510,000 was made on November 30, 2017. No cash has been collected as of the end of but all of the cash is expected to be collected early next year. As of December 31, 2018, all the merchandise associated with the sale are ready. UNRECORDED TRANSACTIONS Your subsequent review disclosed the following unrecorded transactions: An invoice for various computer forms in the amount of P 10,000 dated December 15, 2018 had been received, but audit inspection confirms that none had been used by December 31, 2018. This was directly charged to expense when recorded originally. A lawyer's invoice containing a P 9,000 charge was received and vouchered for payment on January 12, 2019. The legal services covered by this invoice were performed during October, November, and December of 2018 3. The return of your account payable confirmation request from Veteran, Inc., a customer, indicated a balance of P 15,000. Comparison of this amount with JETRO's subsidiary ledger balance of P 18,000 disclosed a P 3,000 difference. This difference was due to a client error in posting an incorrect vendor account for a P 3,000 received from Veterans, Inc. 4. The statement of account for the month of December, 2018 from MERALCO was received on January 14, 2019 while the statement of account from MWSS wasreceived on January 16, 2019. The amounts are P 30,000 and P 25,000 respectively. 5. At December 31, 2018, an analysis of payroll information shows accrued salaries of P 61,000 which is charged to Operating Expenses. The Accrued Salaries Payable account had a balance of P 80,000 At December 31, 2018, which was unchanged from its balance at December 31, 2017 and this amount is charged to Accrued Expenses. On January 1, 2019, an equipment costing P40,000 was sold for P20,000. At the date of sale, the equipment had an accumulated depreciation of P15,000. The cash received was recorded as other income in 2019. Improvements on building had been charged to expense on January 1, 2019. Improvements have a life of 5 years. 8. Advance from customers recorded as sales but the goods were delivered in the following year: 2017 P 20,000.00 2018 70,000.00 9. Advances to Supplier were recorded as purchases but the merchandise was received in the following year: 2017 P 20,000.00 2018 40,000.00 10. Jetro paid one-year insurance premium of P36,000 effective March 1, 2018. The entire amount was debited to asset account and no adjustment were made at the end of 2018. 11. Repairs expense on the building amounting to P20,000 had been charged to the building account on January 1, 2019. Depreciation expense has been recorded 2018 based on the remaining useful life of the building. 12. Sale of merchandise on account on December 29, 2018 amounting to P20,000 was not recorded until it was collected on January 2019. The merchandise was properly excluded in the ending inventory on 2018. Dec. 29, 18 20,000 sals 20.00 MINUTES OF MEETING From the Minutes of the Board of Directors' Meeting, the following information was gathered. 2. The company did not declare dividends for the year. The company is a defendant in a lawsuit in the amount of P 1,300,000. Management and the legal counsel believe that they have a very strong position on the case. Despite this, the company still made a reservation. Said amount is included in the reserve for contingencies. Treasury stocks reacquired by JETRO are common stocks. There is no provision made for said reacquisition. JETRO has received an assessment from the BIR for additional sales taxes totaling P 712,000 for the year 2016 and 2017. The company's retained attorney, who is of the opinion that there is no adequate basis for the assessment, is contesting this. Hence, no provision has been made for said assessment. A review of the Minutes of Meeting of the Board of Directors reveals the manager is entitled to a bonus of 112 of 1% of the income before deducting income taxes and the bonus. The bonuses have never been recorded or paid. The Minutes revealed that it should have started 2013. One of the comment during the meeting of the Board of Directors, is as follows: "The total amount of outstanding shares is so minimal making the company undercapitalized!" -0- REQUIREMENTS: . Based on the foregoing data and information, you are tasked to prepare the following: 1. Required audit working papers on a per account basis (including lead and sub schedules). 2. All the necessary adjustments needed based on the audit working papers and audit findings submitted to you. 3. Prepare a summary of adjusting entries per your recommendations, and that you will submit to JETRO. 4. Prepare financial statement working paper with the following columnar heading: Working Paper Account Reference No. Unadjusted Trial Balance DR CR Adjustments D R CR Adjusted Trial Balance DR CR 5. Income Statement Balance Sheet Remarks Appropriate audit report based on your audit findings and audit discussions with JETRO management. 6. The set of audited financial statements for the year ended December 31, 2018 based on PAS #1. 8. The set of audited financial statements should include financial analysis making use of the vertical and horizontal method. ADDITIONAL INSTRUCTIONS: A. Attached all pertinent audit working papers and sub-schedule, complete with reference numbers. Provide a separate folder for this. B. Provide for a separate folder for the following: 1. Auditor's Report 2. Audited Balance Sheet 3. Audited Income Statement 4.. Audited Statement of Cashflow 5. Notes to Financial Statements 6. Summary of Recommended Adjusting Entries for Jetro's approval. C. Submit the practice set e rker than the scheduled final exam. This is because the client, JETRO CORPORATION, needs to review the various audit findings as they have a new set of Board of Directors

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started