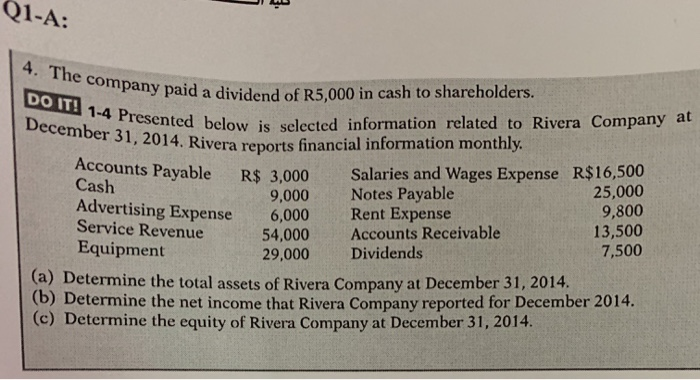

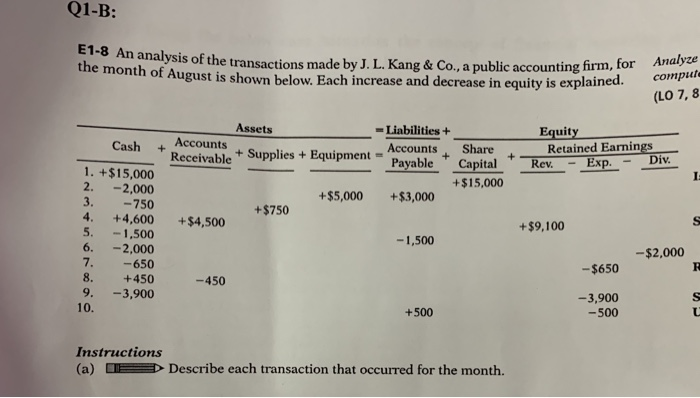

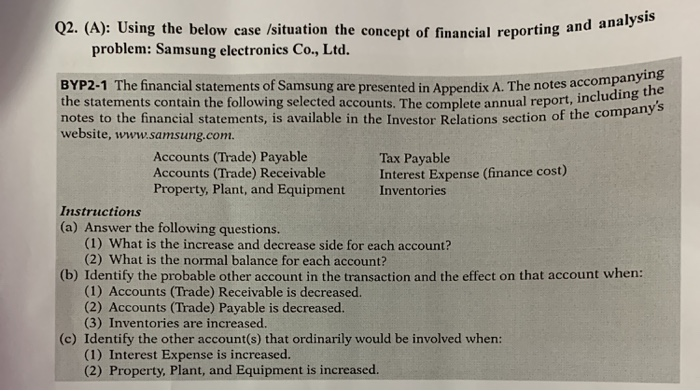

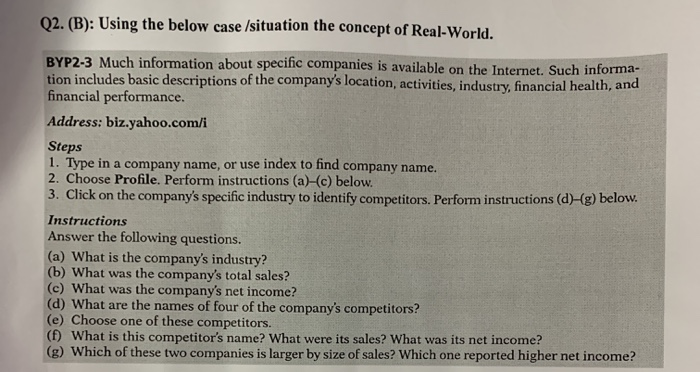

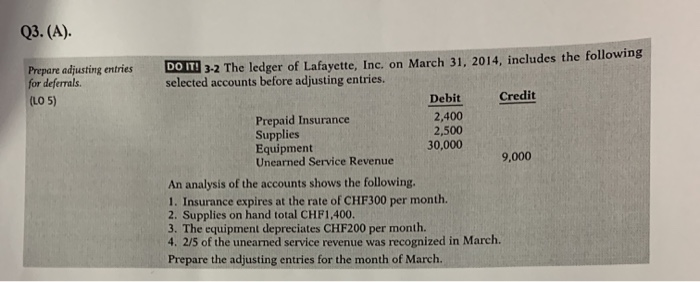

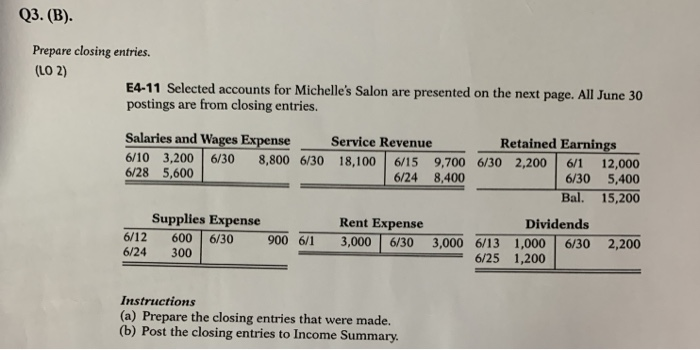

JI Q1-A: 4. The company paid a div DO IT! 1-4 Presented belo December 31, 2014. Rivera rep Cash ny paid a dividend of R5,000 in cash to shareholders. sented below is selected information related to Rivera Company at 1, 2014. Rivera reports financial information monthly. Accounts Payable R$ 3.000 Salaries and Wages Expense R$ 16,500 9,000 Notes Payable 25,000 Advertising Expense 6,000 Rent Expense 9,800 Service Revenue 54,000 Accounts Receivable 13,500 Equipment 29,000 Dividends 7,500 (a) Determine the total assets of Rivera Company at December 31, 2014. (b) Determine the net income that Rivera Company reported for December 2014. (c) Determine the equity of Rivera Company at December 31, 2014. Q1-B: E1-8 An analysis of the transactions ma ysis of the transactions made by J. L. Kang & Co., a public accounting firm, for August is shown below. Each increase and decrease in equity is explained. (LO 7,8 Assets -Liabilities + Equity Cash + Accounts Accounts Share Retained Earnings Receivable + Supplies + Equipment = Payable * Capital * Rev. - Exp. - Div. 1. +$15,000 2. +$15,000 -2,000 3. +$5,000 +$3,000 - 750 +$750 4. +4,600 +$4,500 +$9,100 5. - 1,500 - 1,500 6. -2,000 7. -650 - $650 +450 -450 -3,900 -3,900 10. +500 -500 --$2,000 Instructions (a) F Describe each transaction that occurred for the month. Q2. (A): Using the below case /situation the concept of financial reporting and problem: Samsung electronics Co., Ltd. reporting and analysis . The notes accompanying e annual report, including the BYP2-1 The financial statements of Samsung are presented in Appendix A. The notes acc the statements contain the following selected accounts. The complete annual report, Inc notes to the financial statements, is available in the Investor Relations section of the website, www.samsung.com. Accounts (Trade) Payable Tax Payable Accounts (Trade) Receivable Interest Expense (finance cost) Property, Plant, and Equipment Inventories Instructions (a) Answer the following questions. (1) What is the increase and decrease side for each account? (2) What is the normal balance for each account? (b) Identify the probable other account in the transaction and the effect on that account when: (1) Accounts (Trade) Receivable is decreased. (2) Accounts (Trade) Payable is decreased. (3) Inventories are increased. (c) Identify the other account(s) that ordinarily would be involved when: (1) Interest Expense is increased. (2) Property, Plant, and Equipment is increased. Q2. (B): Using the below case /situation the concept of Real-World. BYP2.3 Much information about specific companies is available on the Internet. Such informa- tion includes basic descriptions of the company's location, activities, industry, financial health, and financial performance. Address: biz.yahoo.com/ Steps 1. Type in a company name, or use index to find company name. 2. Choose Profile. Perform instructions (a)-(c) below. 3. Click on the company's specific industry to identify competitors. Perform instructions (d)-(g) below. Instructions Answer the following questions. (a) What is the company's industry? (b) What was the company's total sales? (c) What was the company's net income? (d) What are the names of four of the company's competitors? (e) Choose one of these competitors. (f) What is this competitor's name? What were its sales? What was its net income? (g) Which of these two companies is larger by size of sales? Which one reported higher net income? Q3.(A). Prepare adjusting entries for deferrals. (LO 5) DO IT! 3-2 The ledger of Lafayette, Inc. on March 31, 2014, includes the following selected accounts before adjusting entries. Debit Credit Prepaid Insurance 2,400 Supplies 2,500 Equipment 30,000 Unearned Service Revenue 9,000 An analysis of the accounts shows the following. 1. Insurance expires at the rate of CHF300 per month. 2. Supplies on hand total CHF1,400. 3. The equipment depreciates CHF200 per month. 4. 2/5 of the unearned service revenue was recognized in March. Prepare the adjusting entries for the month of March. Q3. (B). Prepare closing entries. (LO2) E4-11 Selected accounts for Michelle's Salon are presented on the next page. All June 30 postings are from closing entries. Bata Salaries and Wages Expense 6/10 3,2006/30 8,800 6/30 6/28 5,600 Service Revenue Retained Earnings 18,1006/15 9,700 6/30 2,2006/ 1 12,000 6/24 8,400 6/30 5,400 Bal. 15,200 Supplies Expense 6/12 600 6/30 6/24 300 900 6/1 Rent Expense 3,000 6/30 Dividends 3,000 6/13 1,000 6/30 6/25 1,200 2,200 Instructions (a) Prepare the closing entries that were made. (b) Post the closing entries to Income Summary