Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jill needs to determine a beta for a private company for its valuation. She found a public comparable with a beta of 1.2. As of

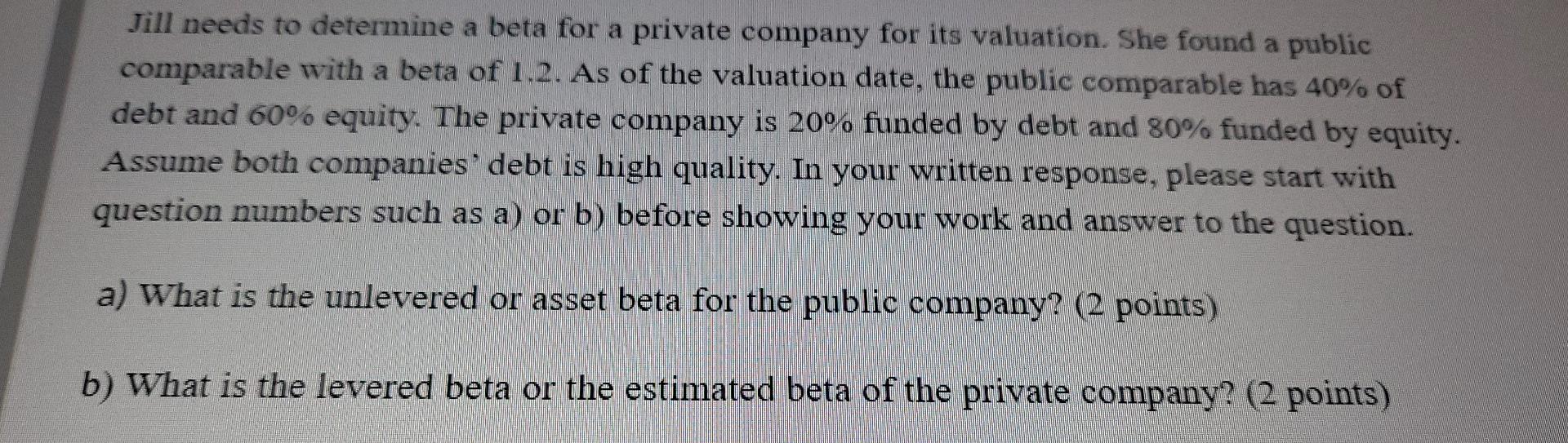

Jill needs to determine a beta for a private company for its valuation. She found a public comparable with a beta of 1.2. As of the valuation date, the public comparable has 40% of debt and 60% equity. The private company is 20% funded by debt and 80% funded by equity. Assume both companies' debt is high quality. In your written response, please start with question numbers such as a) or b) before showing your work and answer to the question. a) What is the unlevered or asset beta for the public company? (2 points) b) What is the levered beta or the estimated beta of the private company? (2 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started