Question

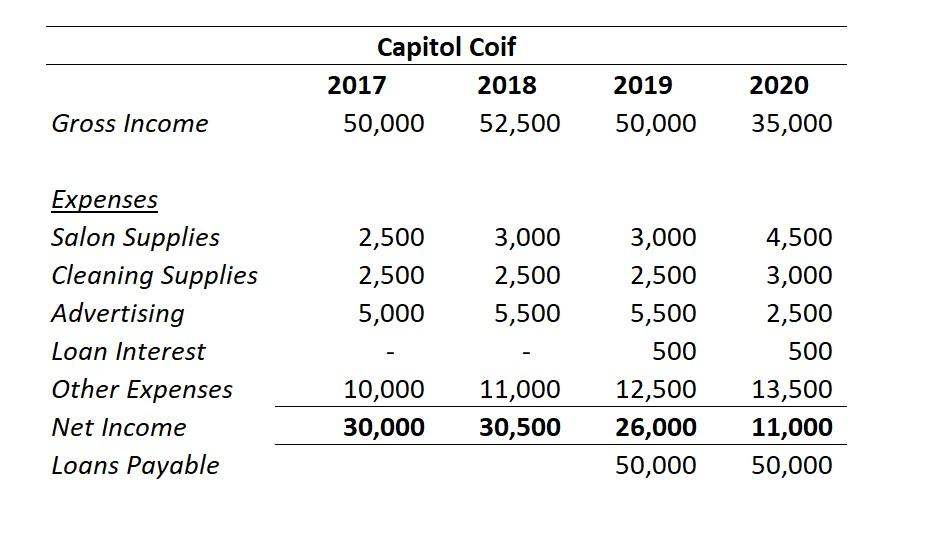

Jim and Naomi own a Capitol Coif hair salon located in a Washington DC with tremendous local competition. As a result, Jim normally devotes at

Jim and Naomi own a Capitol Coif hair salon located in a Washington DC with tremendous local competition. As a result, Jim normally devotes at least 10 percent of his budget to advertising and marketing. His marketing efforts are concentrated in two general areas: He advertises through social media and, in addition, he mails out coupons (good for 10 percent off highlights) to every household within a one-mile radius of his business.

In 2020, following the pandemic quarantine, Jim sues his wife for divorce.

You, a forensic accountant, are hired to review the company's books, and gains access to them in early 2021.

- Assume any potential business decline in 2020 is explained by Jim as due to local restrictions on salons to prevent the spread of COVID-19.

- The main supplier of salon supplies and cleaning supplies changed in early 2020. These invoices show an increase in the quantity of chemicals ordered by Jim and, in addition, an increase in price from what he had been paying previously.

- Other expenses contains a mix of laundry services, answering service costs, website maintenance and chemical expenses for a new hair treatment the salon will be offering in February 2021.

- The loan was used by Jim as a down payment on a beach house in the Hamptons. This house is in Jim's name alone and other than the down payment, he has no equity in this property.

- Jim works solely for the hair salon. Naomi is a high school teacher.

- Review the following detailed records and discuss 3 red flags.

- How would you go about analyzing the legitimacy of the claim that resulted in a business decline?

- How would you demonstrate that the figure for supplies may be incorrect?

- How would you treat the loan in valuing the company?

- How might the couple's tax returns come into play?

Gross Income Expenses Salon Supplies Cleaning Supplies Advertising Loan Interest Other Expenses Net Income Loans Payable Capitol Coif 2017 50,000 2,500 2,500 5,000 2018 52,500 3,000 2,500 5,500 10,000 11,000 30,000 30,500 2019 50,000 3,000 2,500 5,500 500 2020 35,000 4,500 3,000 2,500 500 12,500 13,500 26,000 11,000 50,000 50,000

Step by Step Solution

3.37 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

1 discuss 3 red flags a Significant Drop in Gross Income in 2020 The substantial decrease in gross income from 50000 in 2019 to 35000 in 2020 raises a red flag While Jim attributes it to COVID19 restr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started