Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jim Smith, a client of yours, has asked you to prepare the tax return for the current year for BJS , LLC , of which

Jim Smith, a client of yours, has asked you to prepare the tax return for the current year for BJS LLC of which he is a member. This is the first year of operations for BJS LLC

Jim has contributed cash in the amount of $

In addition, Betsy Smith, Jims daughter, has contributed cash in the amount of $

Sandco Industries, Inc., a Ccorporation, decided to become a member of BJS LLC by contributing its land in Texas, which has a basis of $ and a fairmarket value of $

The Johnson Neuman Trust contributed cash to BJS LLC in the amount of $

A CCorporation named Tiger, Inc. contributed $ cash.

The Articles of Incorporation for BJS LLC states that profit and loss will be in proportion to the capital contribution.

Financial data for BJS LLC for the current tax year is as follows:

Gross Income from operations:

$

Payroll expenses:

$

Rent expense:

$

BJS LLC also purchased a company vehicle for $ using cash on XX most recent year end

Address and other relevant information:

BJS LLC

Anywhere Street,

Midtown, TX

EIN:

Date Business started: XX years ago

Tasks:

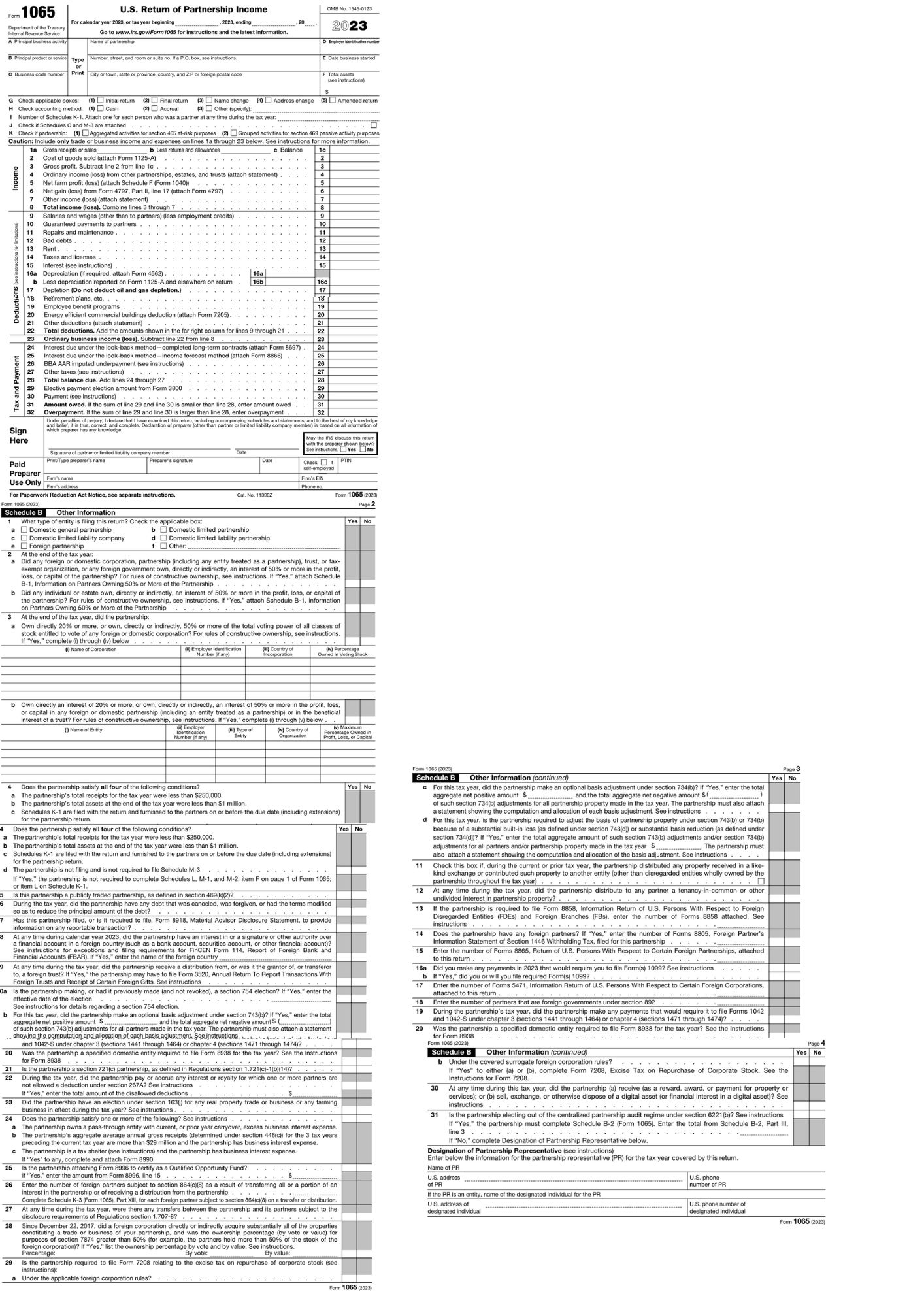

Download a current Form from the IRS Website. You can review the instructions to these forms at wwwirs.gov. Applicable Internal Revenue code sections and treasury regulations can be researched at wwwtaxalmanac.com.

You are required to complete Form for the current tax year pages for BJS LLC

PLease list and label answers from pages shown of form pages Label letters and numbers with answers and any possible calculations with work shown. Thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started