Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jimmy has fallen on hard times recently. Last year he borrowed $258,750 and added an additional $53,500 of his own funds to purchase $312,250

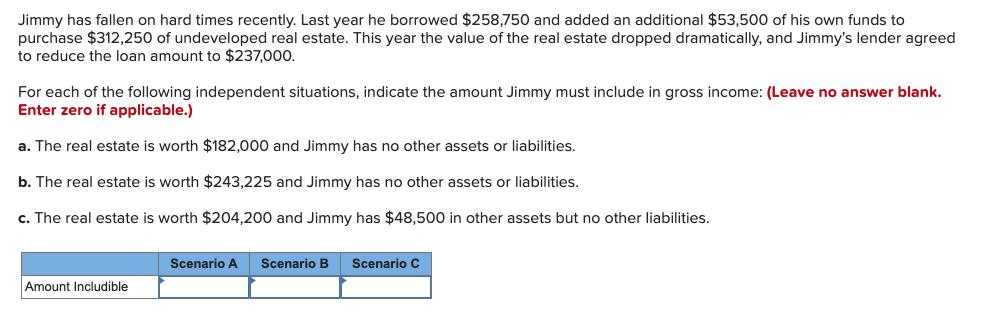

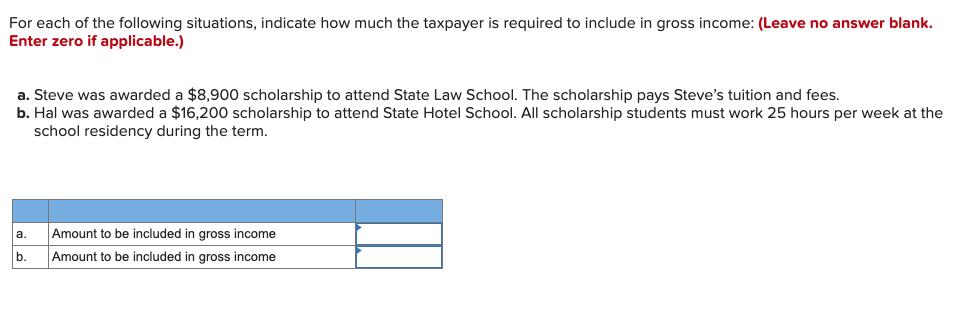

Jimmy has fallen on hard times recently. Last year he borrowed $258,750 and added an additional $53,500 of his own funds to purchase $312,250 of undeveloped real estate. This year the value of the real estate dropped dramatically, and Jimmy's lender agreed to reduce the loan amount to $237,000. For each of the following independent situations, indicate the amount Jimmy must include in gross income: (Leave no answer blank. Enter zero if applicable.) a. The real estate is worth $182,000 and Jimmy has no other assets or liabilities. b. The real estate is worth $243,225 and Jimmy has no other assets or liabilities. c. The real estate is worth $204,200 and Jimmy has $48,500 in other assets but no other liabilities. Scenario A Scenario B Scenario C Amount Includible For each of the following situations, indicate how much the taxpayer is required to include in gross income: (Leave no answer blank. Enter zero if applicable.) a. Steve was awarded a $8,900 scholarship to attend State Law School. The scholarship pays Steve's tuition and fees. b. Hal was awarded a $16,200 scholarship to attend State Hotel School. All scholarship students must work 25 hours per week at the school residency during the term. Amount to be included in gross income a. b. Amount to be included in gross income

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer Part 1 Solution Scenario a Scenario b Scenario c Amount includible 0 6225 15700 Calculatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started