Answered step by step

Verified Expert Solution

Question

1 Approved Answer

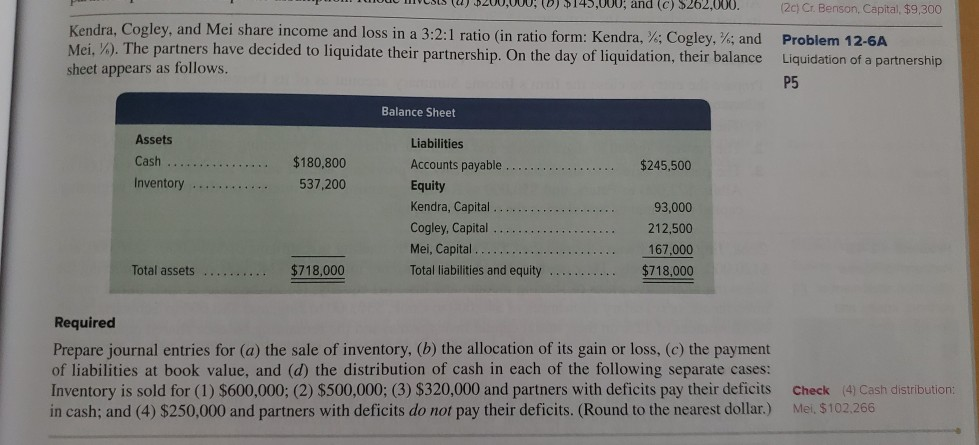

JIS (U) $200,000 $145,000, and (c) $262,000. (2c) Cr. Benson, Capital, $9,300 Kendra, Cogley, and Mei share income and loss in a 3:2:1 ratio (in

JIS (U) $200,000 $145,000, and (c) $262,000. (2c) Cr. Benson, Capital, $9,300 Kendra, Cogley, and Mei share income and loss in a 3:2:1 ratio (in ratio form: Kendra, %: Cogley, and Mei..). The partners have decided to liquidate their partnership. On the day of liquidation, their balance sheet appears as follows. Problem 12-6A Liquidation of a partnership P5 Balance Sheet Assets Cash ... $180,800 537,200 $245,500 Inventory ............ Liabilities Accounts payable Equity Kendra, Capital .......... Cogley, Capital .......... Mei, Capital............ Total liabilities and equity ........... 93,000 212,500 167.000 $718,000 Total assets .......... $718,000 Required Prepare journal entries for (a) the sale of inventory, (b) the allocation of its gain or loss, (c) the payment of liabilities at book value, and (d) the distribution of cash in each of the following separate cases: Inventory is sold for (1) $600,000; (2) $500,000; (3) $320,000 and partners with deficits pay their deficits in cash: and (4) $250,000 and partners with deficits do not pay their deficits. (Round to the nearest dollar. Check (4) Cash distribution: Mel $102.266

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started