Answered step by step

Verified Expert Solution

Question

1 Approved Answer

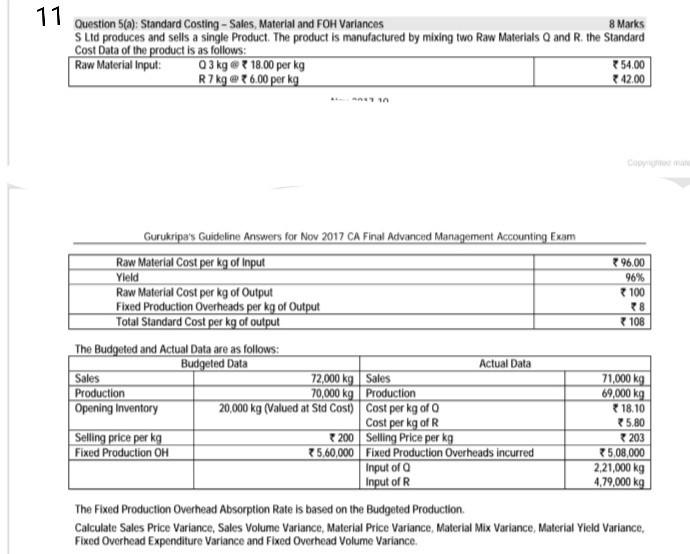

jiy 11 Question 5(a): Standard Costing - Sales, Material and FOH Variances 8 Marks S Lid produces and sells a single Product. The product is

jiy

11 Question 5(a): Standard Costing - Sales, Material and FOH Variances 8 Marks S Lid produces and sells a single Product. The product is manufactured by mixing two Raw Materials and R. the Standard Cost Data of the product is as follows: Raw Material Input: Q3 kg 18.00 per kg 254.00 R7 kg 86.00 per kg *42.00 MA Gurukripa's Guideline Answers for Nov 2017 CA Final Advanced Management Accounting Exam Raw Material Cost per kg of Input 96.00 Yleld 96% Raw Material Cost per kg of Output 100 Fixed Production Overheads per kg of Output 8 Total Standard Cost per kg of output 108 The Budgeted and Actual Data are as follows: Budgeted Data Actual Data Sales 72,000 kg Sales 71,000 kg Production 70,000 kg Production 69,000 kg Opening Inventory 20,000 kg (Valued at Std Cost) Cost per kg of O 18.10 Cost per kg of R 5.80 Selling price per kg 200 Selling Price per kg 203 Fixed Production OH 25,60,000 Fixed Production Overheads incurred 5,08,000 Input of a 221,000 kg Input of R 4.79,000 kg The Fixed Production Overhead Absorption Rate is based on the Budgeted Production Calculate Sales Price Variance, Sales Volume Variance, Material Price Variance, Material Mix Variance, Material Yield Variance. Fixed Overhead Expenditure Variance and Fixed Overhead Volume VarianceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started