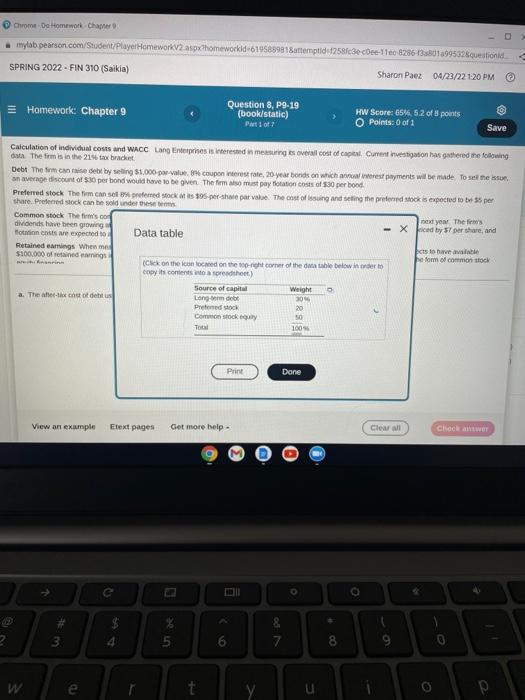

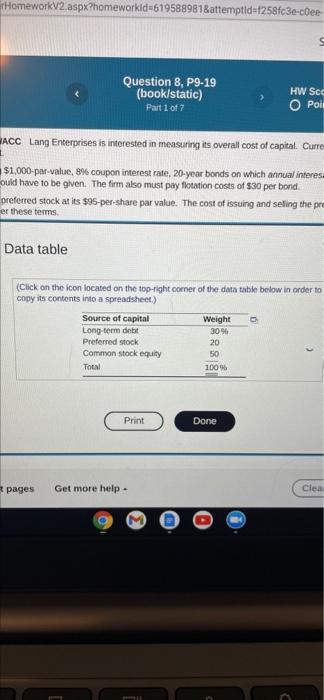

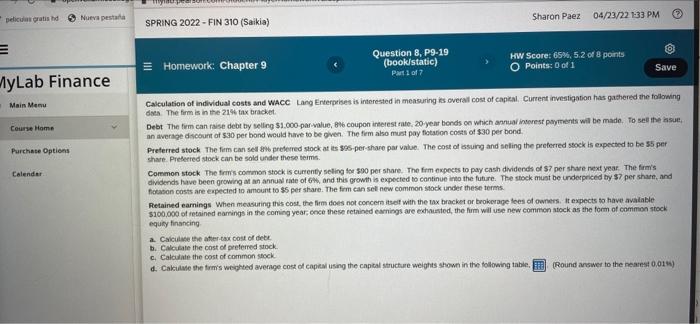

JM Chombo Homework.ch ecollege mylab pearson.com/Student/Player Homework 2.0 homeworkc619529981temp2ccee-11608286-130095326questionid SPRING 2022 - FIN 310 (Saikia) Sharon Paez 04/23/22 1:20 PM Homework: Chapter 9 Question 8, P9-19 (book/static) Patio HW Score: 65%, 5.2 of points O Points: 0 of 1 2 Save Calculation of individual costs and WACC Lang Ereprises is terested in mang tseveral cost of capital. Current version has gathered the following data The form is in the 2146 x bracket Det them canais det by sing 51.000 open stre, 20 year bonds on which westments who made to so the out an average discount of 50 per bond would love to be given the imao must pay flotation of 50 per bond Preferred stock The con el prefened sockets 30 peshe par value. The cost of song and selling the preferred socks expected to be per share. Preferred stack can be sold underste Common lockThe common is currently seling for 90 perse. The formexpects pay cash dividends of per stare rest your Them divdes have been growing an and this growth is expected to come into the future. The stock must be copied by 57 per head Botion to expected to out to $5 per shume. The focal new common stock under these term Retained earnings When this cout, the moes not concern the bracket or tragtes of we expects to have avale 5200.000 etanering in the coming year, once the retained came house, the form witne new.common stock as the form of common stock Quy failg Calculate the cost of debit b. Che cost of pretendo e. Calcu the common ock Catetewige verge of capital in the capital structure weighs shown in the following table under the nearesto The hero the proximation for the map View an example Etext pages Get more help Clear all Check > c an 0 R 2 5 4 3 5 6 7 8 o 9 Chrome Do Homework Chamer mylab pearson.com/Student/Player Homeworkv2 aspx homeworld6195899818attemptid1258fc3ecee-11e0-8286-13801995326question SPRING 2022 - FIN 310 (Saikia) Sharon Paez 04/23/22 1:20 PM = Homework: Chapter 9 Question 8, P9-19 (book/static) Pof? HW Score: 65%, 5.2 of 3 points O Points: 0 of 1 Save Calculation of individual costs and WACC Lang Enterprines is ined in measures overall cost of Cape Current investigation has gathered the following data. The firm is in the 219 tax bradunt Debt The firman debt by selling $1,000 per valute coupon nele, 20 years on which werest payments will be made To set the sun an average discount of 530 per bond would have to be given the firms must pay ation costs of 330 per boot. Preferred stock The man se preferred stock is per-shot par value. The cost of issuing and selling the preferred took is expected to be per share. Preferred stock can be sold under the Common stock The's con next year. There's dividends have been growing - Xed by 57 per share, and Hotion costs are expected to Data table Retained earnings When me to be able $100,000 of retained he form of common stock (Click on the colored on the right corner of the datable below into copy its content Worthot) Source of capital Weight a. The fact that Long terme 304 Preferred Stock 20 Comon stock 50 Total 100 Print Done View an example Etext pages Get more help Clear all nues Check 5 6 7 8 e o p patid Nura esta SPRING 2022 - FIN 310 (Saikia) Sharon Paez 04/23/22 1:32 PM = Homework: Chapter 9 Question 8, P9-19 (book/static) Part 17 HW Score: 65%.5.2 of 8 points O Points: 0 of 1 Save MyLab Finance Main Menu Course Home Purchase Option Center Calculation of individual costs and WACC Lang Enterprises is interested in measuring is overall cost of capital. Current investigation has gathered the following data. The firm is in the 21x bracket Debt The tem can raise debt by selling $1,000-par-vahe, coupon interest rate, 20-ytur bonds on which annual interest payments will be made. To set the issue. an average discount of $30 per bond would have to be given. The firm also must pay flotation costs of 30 per bond. Preferred stock The case preferred stock at $95-per-shore par value. The cost of issuing and selling the preferred stock is expected to be 55 per share. Preferred stock can be sold under these Common stock The firm's common stock is currently seling for so per share. The firm expects to pay cash dividends of S7 per she next year. The firm's dividends have been glowing at an alte of 6% and this growth is expected to continue into the future. The stock must be underpriced by 7 per share, and fotation costs are expected to amount to 5 per share. The firm can sel new common stock under these terms Retained earnings when measuring this cost, the form does not concern itself with the tax bracket or brokerage fees of owners. It expects to have available $100,000 of retained coming in the coming year, once so retained emings are exhausted, the firm will use new common stock as the form of common stock equity financing a. Calcule the wax cost of debt. b. Calculate the cost of preferred sock e Calculate the cost of common stock d. Caciulate the weighted average cost of using the capital structure weighs shown in the following table m (Round answer to the nearest 0014 Homework 2.aspx?homeworkid=619588981&attemptid=1258fc3e-c0ee- Question 8, P9-19 (book/static) Part 1 of 7 HW Sce O Poi ACC Lang Enterprises is interested in mensuring its overall cost of capital. Curre 1 $1,000-par-value, 8% coupon interest rate, 20-year bonds on which annual interes ould have to be given. The firm also must pay flotation costs of 30 per bond. preferred stock at its $95-per-share par value. The cost of issuing and selling the pre er these terms Data table (Click on the icon located on the top right corner of the data table below in order to copy its contents into a spreadsheet.) Source of capital Weight Long-term debit 3096 Preferred stock 20 Common stock equity 50 Total 100 Print Done pages Get more help Clea peliculas gratis hd Nueva pesta Sharon Paez 04/23/22 1:33 PM SPRING 2022 - FIN 310 (Saikia) Homework: Chapter 9 Question 8, P9-19 (book/static) Part of HW Score: 65%, 5.2 of 8 points O Points: 0 of 1 Save VyLab Finance Main Menu Course Home Purchase Options Calendar Calculation of individual costs and WACC Lang Enterprises is interested in measuring its overall cost of capital. Current investigation has gathered the following data. The firm is in the 21% tax bracket Debt The tem can raise debt by selling $1.000 par value, 16 coupon interest rate 20 year bonds on which annual interest payments will be made. To set the sun an average discount of 530 per bond would have to be oven. The firm also must pay flotation costs of $30 per bond Preferred stock The firm can selle preferred stock at its sper share par value. The cost of issuing and selling the preferred stock is expected to be 55 per share. Preferred stock can be sold under these terms Common stock The firm's common stock is currently seling for $90 per share. The firm expects to pay cash dividends of S7 per she next year. The firm's dividends have been growing an annual rate of 6, and this growth is expected to continue into the future. The stock must be underpriced by 37 per share, and fotion costs are expected to amount to $5 per share. The firm can sel new common stock under these terms. Retained earnings When measuring this cost the firm does not concern itself with the tax bracket or brokerage fees of owners. It expects to have aviable $100,000 of retained earings in the coming year, once these retained earnings are exhausted, the firm will use new common stock as the form of common stock equity financing a. Calculate the after-tax cost of debt b. Calculate the cost of preferred stock c. Calculate the cost of common stock d. Cake the tow's weighted average cost of capital using the capital structure weights shown in the following table, (Round answer to the nearest 0,015)