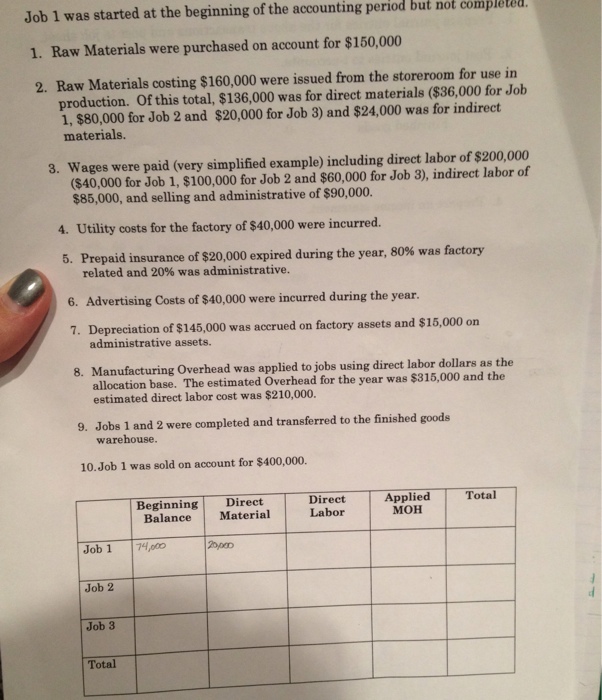

Job 1 was started at the beginning of the accounting period but not completes. Raw Materials were purchased on account for $160,000. Raw Materials costing $160,000 were issued from the storeroom for use in production. Of this total, $136,000 was for direct materials ($36,000 for Job 1, $80,000 for Job 2 and $20,000 for Job 3) and $24,000 was for indirect materials. Wages were paid (very simplified example) including direct labor of $200,000 ($40,000 for Job 1, $100,000 for Job 2 and $60,000 for Job 3), indirect labor of $85,000, and selling and administrative of $90,000.Utility costs for the factory of $40,000 were incurred. Prepaid insurance of $20,000 expired during the year, 80% was factory related and 20% was administrative. Advertising Costs of $40,000 were incurred during the year. Depreciation of $145,000 was accrued on factory assets and $15,000 on administrative assets. Manufacturing Overhead was applied to jobs using direct labor dollars as the allocation base. The estimated Overhead for the year was $315,000 and the estimated direct labor cost was $210,000.Jobs 1 and 2 were completed and transferred to the finished goods warehouse. Job 1 was sold on account for $400,000. Job 1 was started at the beginning of the accounting period but not completes. Raw Materials were purchased on account for $160,000. Raw Materials costing $160,000 were issued from the storeroom for use in production. Of this total, $136,000 was for direct materials ($36,000 for Job 1, $80,000 for Job 2 and $20,000 for Job 3) and $24,000 was for indirect materials. Wages were paid (very simplified example) including direct labor of $200,000 ($40,000 for Job 1, $100,000 for Job 2 and $60,000 for Job 3), indirect labor of $85,000, and selling and administrative of $90,000.Utility costs for the factory of $40,000 were incurred. Prepaid insurance of $20,000 expired during the year, 80% was factory related and 20% was administrative. Advertising Costs of $40,000 were incurred during the year. Depreciation of $145,000 was accrued on factory assets and $15,000 on administrative assets. Manufacturing Overhead was applied to jobs using direct labor dollars as the allocation base. The estimated Overhead for the year was $315,000 and the estimated direct labor cost was $210,000.Jobs 1 and 2 were completed and transferred to the finished goods warehouse. Job 1 was sold on account for $400,000