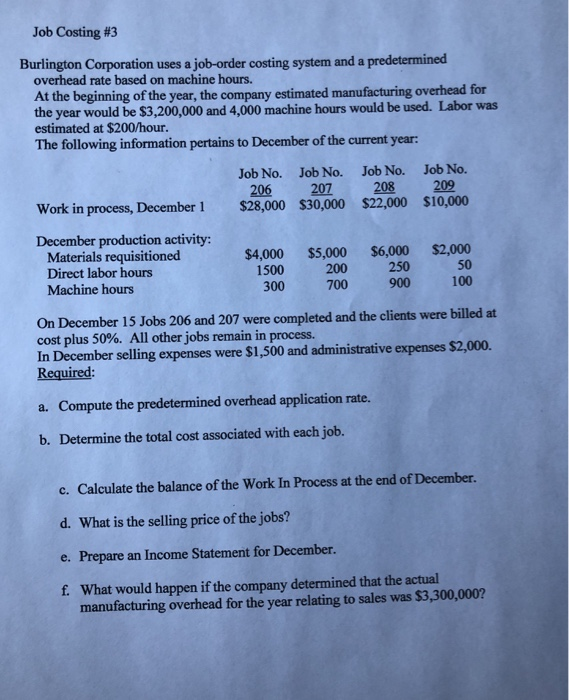

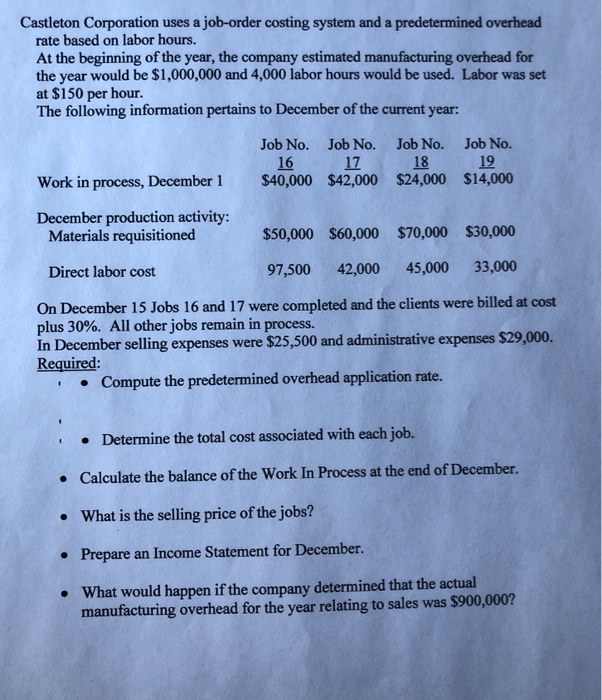

Job Costing #3 Burlington Corporation uses a job-order costing system and a predetermined overhead rate based on machine hours. At the beginning of the year, the company estimated manufacturing overhead for the year would be $3,200,000 and 4,000 machine hours would be used. Labor was estimated at $200/hour. The following information pertains to December of the current year: Job No. Job No. Job No. Job No. 206 207 208 209 Work in process, December 1 $28,000 $30,000 $22,000 $10,000 December production activity: Materials requisitioned $4,000 $5,000 $6,000 $2,000 50 900 100 Direct labor hours 1500 300 250 200 700 Machine hours On December 15 Jobs 206 and 207 were completed and the clients were billed at cost plus 50%. All other jobs remain in process. In December selling expenses were $1,500 and administrative expenses $2,000. Required: Compute the predetermined overhead application rate. Determine the total cost associated with each job. c. Calculate the balance of the Work In Process at the end of December. d. What is the selling price of the jobs? e. Prepare an Income Statement for December. f. What would happen if the company determined that the actual a. b. manufacturing overhead for the year relating to sales was $3,300,000? Castleton Corporation uses a job-order costing system and a predetermined overhead rate based on labor hours. At the beginning of the year, the company estimated manufacturing overhead for the year would be $1,000,000 and 4,000 labor hours would be used. Labor was set at $150 per hour. The following information pertains to December of the current year: Job No. Job No. Job No. Job No. Work in process, December 1 $40,000 $42,000 $24,000 $14,000 $50,000 $60,000 $70,000 $30,000 97,500 42,000 45,000 33,000 16 17 18 19 December production activity: Materials requisitioned Direct labor cost On December 15 Jobs 16 and 17 were completed and the clients were billed at cost plus 30%. All other jobs remain in process. In December selling expenses were $25,500 and administrative expenses $29,000. Required Compute the predetermined overhead application rate. Determine the total cost associated with each job. Calculate the balance of the Work In Process at the end of December. What is the selling price of the jobs? Prepare an Income Statement for December. What would happen if the company determined that the actual . . manufacturing overhead for the year relating to sales was $900,000? Job Costing #3 Burlington Corporation uses a job-order costing system and a predetermined overhead rate based on machine hours. At the beginning of the year, the company estimated manufacturing overhead for the year would be $3,200,000 and 4,000 machine hours would be used. Labor was estimated at $200/hour. The following information pertains to December of the current year: Job No. Job No. Job No. Job No. 206 207 208 209 Work in process, December 1 $28,000 $30,000 $22,000 $10,000 December production activity: Materials requisitioned $4,000 $5,000 $6,000 $2,000 50 900 100 Direct labor hours 1500 300 250 200 700 Machine hours On December 15 Jobs 206 and 207 were completed and the clients were billed at cost plus 50%. All other jobs remain in process. In December selling expenses were $1,500 and administrative expenses $2,000. Required: Compute the predetermined overhead application rate. Determine the total cost associated with each job. c. Calculate the balance of the Work In Process at the end of December. d. What is the selling price of the jobs? e. Prepare an Income Statement for December. f. What would happen if the company determined that the actual a. b. manufacturing overhead for the year relating to sales was $3,300,000? Castleton Corporation uses a job-order costing system and a predetermined overhead rate based on labor hours. At the beginning of the year, the company estimated manufacturing overhead for the year would be $1,000,000 and 4,000 labor hours would be used. Labor was set at $150 per hour. The following information pertains to December of the current year: Job No. Job No. Job No. Job No. Work in process, December 1 $40,000 $42,000 $24,000 $14,000 $50,000 $60,000 $70,000 $30,000 97,500 42,000 45,000 33,000 16 17 18 19 December production activity: Materials requisitioned Direct labor cost On December 15 Jobs 16 and 17 were completed and the clients were billed at cost plus 30%. All other jobs remain in process. In December selling expenses were $25,500 and administrative expenses $29,000. Required Compute the predetermined overhead application rate. Determine the total cost associated with each job. Calculate the balance of the Work In Process at the end of December. What is the selling price of the jobs? Prepare an Income Statement for December. What would happen if the company determined that the actual . . manufacturing overhead for the year relating to sales was $900,000