Answered step by step

Verified Expert Solution

Question

1 Approved Answer

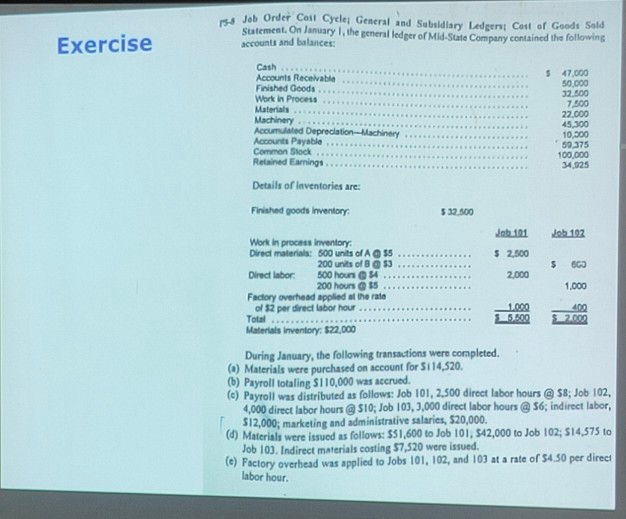

Job Order Coil Cycle General and Subsidiary Ledgerat Cost of Goods Sold Statement. On January 1, the general ledger of Mid-State Company contained the following

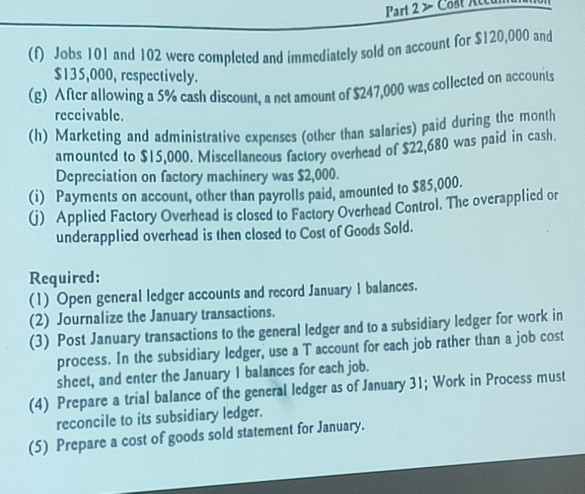

Job Order Coil Cycle General and Subsidiary Ledgerat Cost of Goods Sold Statement. On January 1, the general ledger of Mid-State Company contained the following accounts and balances: Exercise Cash Accounts Receivable Finished Goods ....... Work in Process... Materials. Machinery. ... Accumulated Depreciation-Machin Accounts Payable Common Stock ....... Retained Earnings... 47.000 50.000 32.500 7000 22.000 10.000 59.375 100,000 34.925 Details of Inventories are: Finished goods Inventory $32.500 Job 102 Job 101 $ 2,500 2.000 Work in process inventory Dired materials: 500 units of A 55 200 units of $3 Direct labor 500 hour 54. 200 hours 55 Factory overhead applied at the rate of 52 per direct labor hour...... Total Materials inventory: 122,000 1.000 32.5 600 During January, the following transactions were completed, (a) Materials were purchased on account for 5114,520. (b) Payroll totaling $110,000 was accrued. (c) Payroll was distributed as follows: Job 101, 2,500 direct labor hours @ 58; Job 102, 4,000 direct labor hours $10; Job 103,3,000 direct labor hours @ 56; indirect labor, $12,000; marketing and administrative salaries, $20,000. (1) Materials were issued as follows: 551,600 to Job 101, 542,000 to Job 102, 514,575 to Job 100. Indirect materials costing $7,520 were issued. () Factory overhead was applied to Jobs 101, 102, and 103 at a rate of $4.50 per direct labor hour. Part 2 > Cost Allu mpleted and immediately sold on account for $120,000 and cash discount, a nct amount of $247,000 was collected on accounts (0) Jobs 101 and 102 were completed and immediately so $135,000, respectively. (c) After allowing a 5% cash discount, a nct amount of $24 receivable. (h) Marketing and administrative expenses (other than salarics) amounted to $15,000. Miscellancous factory overhead of 324 Depreciation on factory machinery was $2,000. (1) Payments on account, other than payrolls paid, amounted to 585,00 (1) Applied Factory Overhead is closed to Factory Overhead Control underapplied overhead is then closed to Cost of Goods Sold. rative expenses (other than salaries) paid during the month incous factory overhead of $22,680 was paid in cash. is closed to Factory Overhead Control. The overapplied or Required: (1) Open general ledger accounts and record January 1 balances. (2) Journalize the January transactions. (3) Post January transactions to the general ledger and to a subsidiary ledger for work in process. In the subsidiary ledger, use a T account for each job rather than a job cost shect, and enter the January 1 balances for each job. (4) Prepare a trial balance of the general ledger as of January 31; Work in Process must reconcile to its subsidiary ledger. (5) Prepare a cost of goods sold statement for January

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started