Answered step by step

Verified Expert Solution

Question

1 Approved Answer

JOB ORDER COSTING SHEET FOR #3: PLEASE ANSWER 3-7 AND USE THE ABOVE CALCULATIONS AND JOB ORDER COST SHEET product cost under activity-based costing for

JOB ORDER COSTING SHEET FOR #3:

PLEASE ANSWER 3-7 AND USE THE ABOVE CALCULATIONS AND JOB ORDER COST SHEET

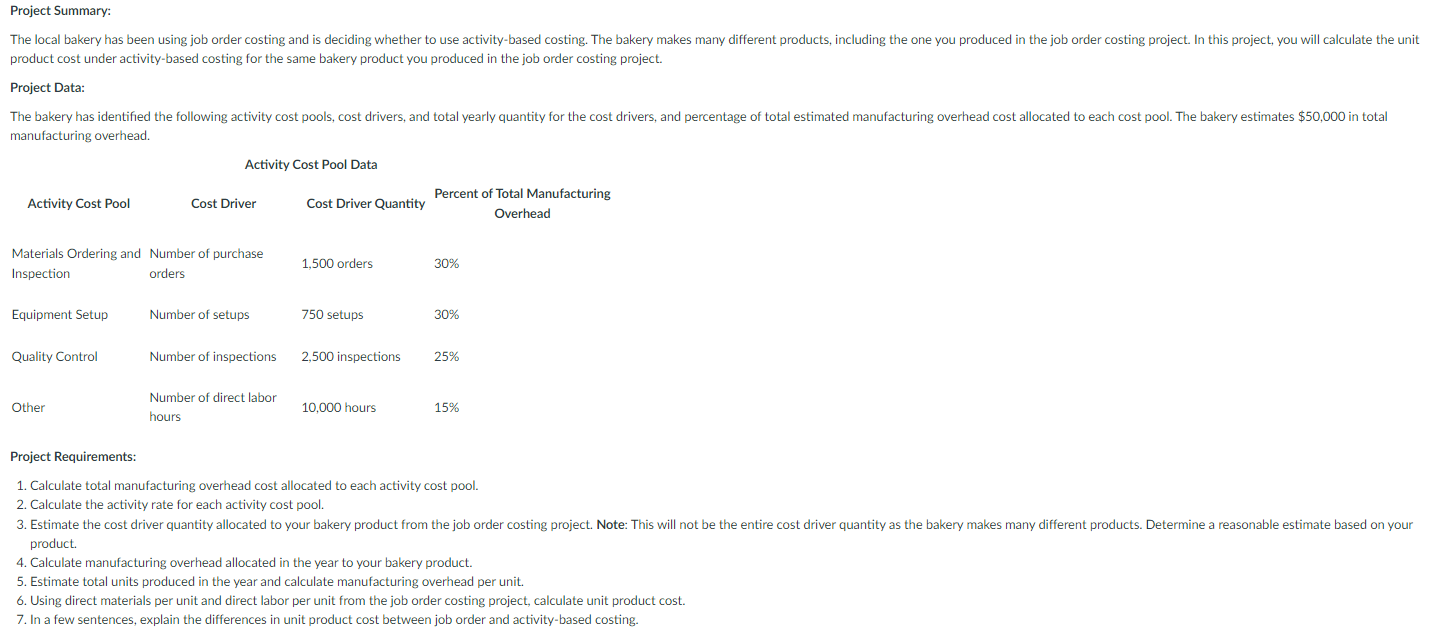

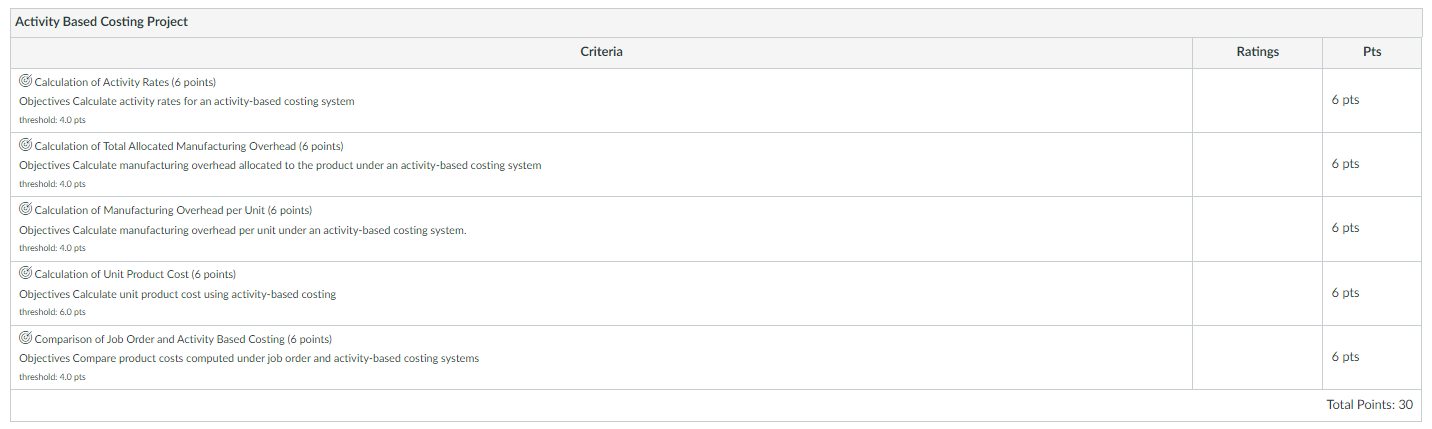

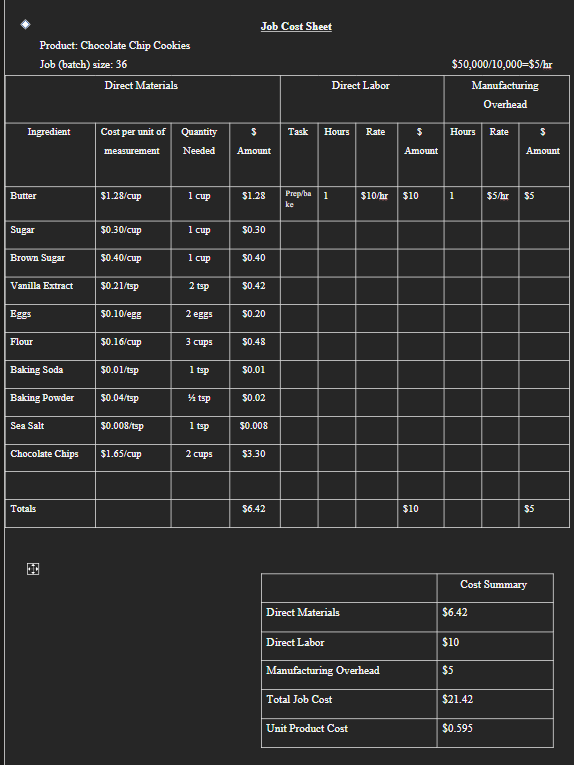

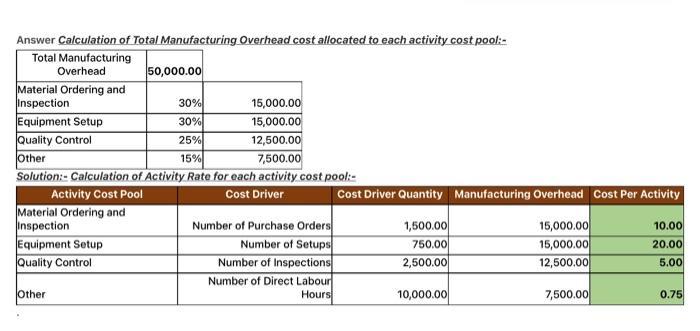

product cost under activity-based costing for the same bakery product you produced in the job order costing project. Project Data: manufacturing overhead. Project Requirements: 1. Calculate total manufacturing overhead cost allocated to each activity cost pool. 2. Calculate the activity rate for each activity cost pool. product. 4. Calculate manufacturing overhead allocated in the year to your bakery product. 5. Estimate total units produced in the year and calculate manufacturing overhead per unit. 6. Using direct materials per unit and direct labor per unit from the job order costing project, calculate unit product cost. 7. In a few sentences, explain the differences in unit product cost between job order and activity-based costing. Activity Based Costing Project (4) Calculation of Activity Rates (6 points) Objectives Calculate activity rates for an activity-based costing system threshold: 4.0 pts ((5) Calculation of Total Allocated Manufacturing Overhead ( 6 points) Objectives Calculate manufacturing overhead allocated to the product under an activity-based costing system threshold: 4.0pts ((4) Calculation of Manufacturing Overhead per Unit (6 points) Objectives Calculate manufacturing overhead per unit under an activity-based costing system. threshold: 4.0pts () Calculation of Unit Product Cost (6 points) Objectives Calculate unit product cost using activity-based costing threshold: 6.0pts ((5) Comparison of Job Order and Activity Based Costing (6 points) Objectives Compare product costs computed under job order and activity-based costing systems threshold: 4.0pts Criteria \begin{tabular}{|l|l|} \hline Ratings & \multicolumn{1}{|c|}{ Pts } \\ \hline & 6pts \\ \hline & 6pts \\ \hline & 6pts \\ \hline & 6pts \\ \hline & 6pts \\ \hline Total Points 30 \\ \hline \end{tabular} Job Cost Sheet Product: Chocolate Chip Cookies Answer Calculation of Total Manufacturing Overhead cost allocated to each activity cost pool:- Solution:- Calculation of Activity Rate for each activity cost poolStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started