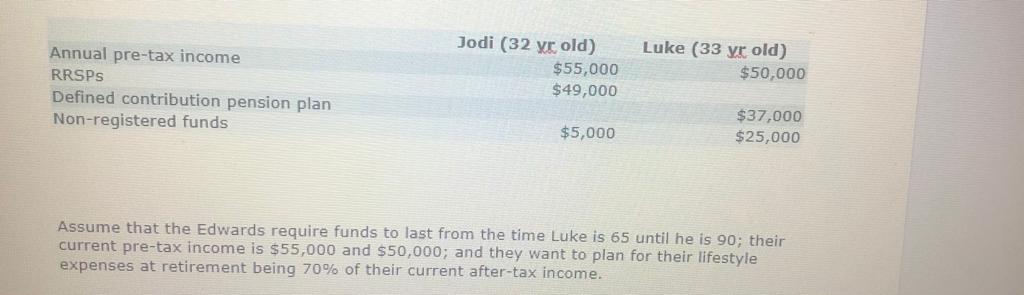

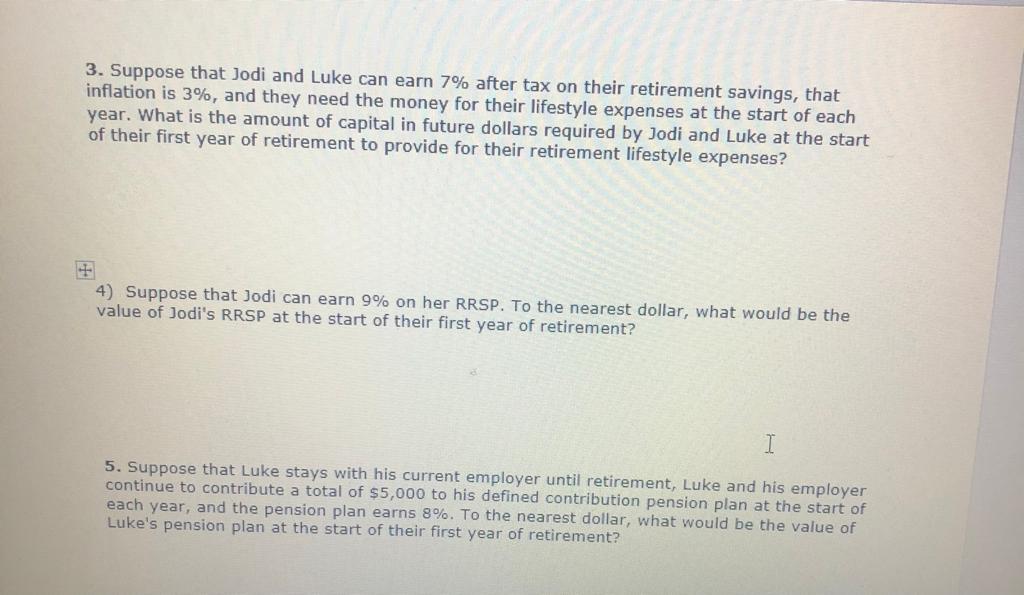

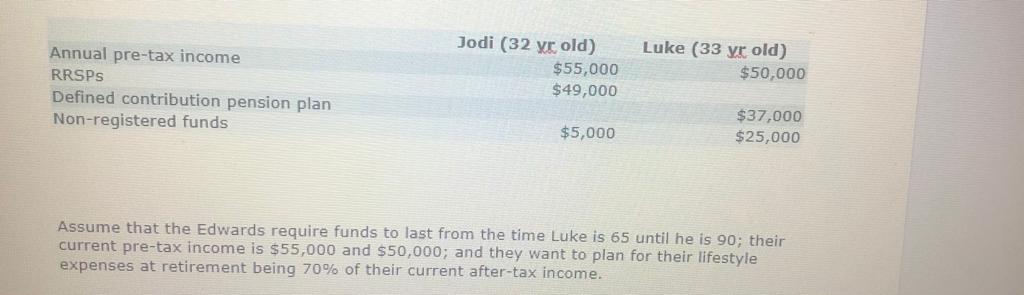

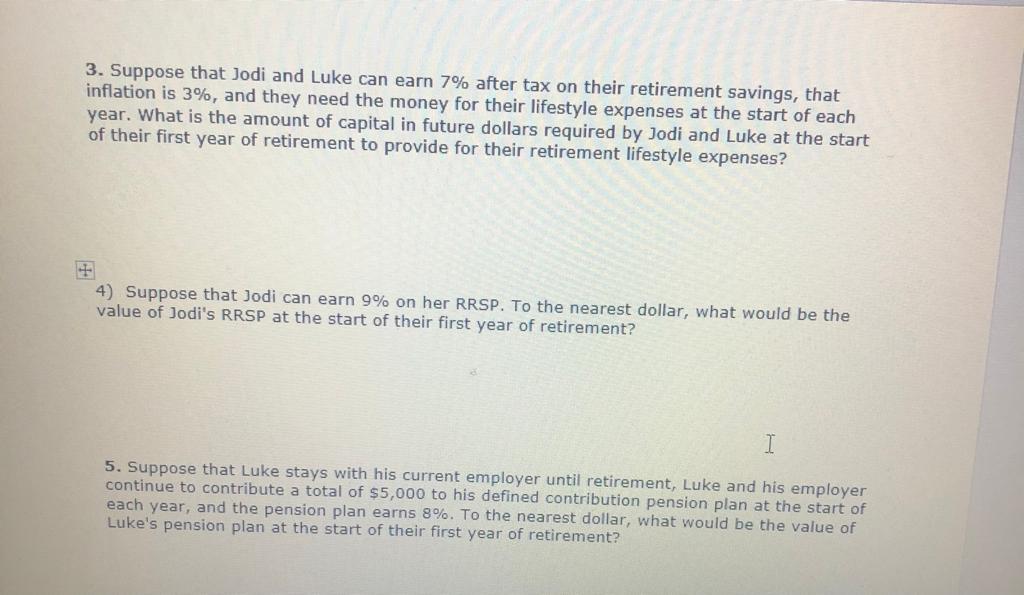

Jodi (32 yr old) $55,000 $49,000 Annual pre-tax income RRSPs Defined contribution pension plan Non-registered funds Luke (33 yr old) $50,000 $5,000 $37,000 $25,000 Assume that the Edwards require funds to last from the time Luke is 65 until he is 90; their current pre-tax income is $55,000 and $50,000; and they want to plan for their lifestyle expenses at retirement being 70% of their current after-tax income. 3. Suppose that Jodi and Luke can earn 7% after tax on their retirement savings, that inflation is 3%, and they need the money for their lifestyle expenses at the start of each year. What is the amount of capital in future dollars required by Jodi and Luke at the start of their first year of retirement to provide for their retirement lifestyle expenses? 4) Suppose that Jodi can earn 9% on her RRSP. To the nearest dollar, what would be the value of Jodi's RRSP at the start of their first year of retirement? I 5. Suppose that Luke stays with his current employer until retirement, Luke and his employer continue to contribute a total of $5,000 to his defined contribution pension plan at the start of each year, and the pension plan earns 8%. To the nearest dollar, what would be the value of Luke's pension plan at the start of their first year of retirement? Jodi (32 yr old) $55,000 $49,000 Annual pre-tax income RRSPs Defined contribution pension plan Non-registered funds Luke (33 yr old) $50,000 $5,000 $37,000 $25,000 Assume that the Edwards require funds to last from the time Luke is 65 until he is 90; their current pre-tax income is $55,000 and $50,000; and they want to plan for their lifestyle expenses at retirement being 70% of their current after-tax income. 3. Suppose that Jodi and Luke can earn 7% after tax on their retirement savings, that inflation is 3%, and they need the money for their lifestyle expenses at the start of each year. What is the amount of capital in future dollars required by Jodi and Luke at the start of their first year of retirement to provide for their retirement lifestyle expenses? 4) Suppose that Jodi can earn 9% on her RRSP. To the nearest dollar, what would be the value of Jodi's RRSP at the start of their first year of retirement? I 5. Suppose that Luke stays with his current employer until retirement, Luke and his employer continue to contribute a total of $5,000 to his defined contribution pension plan at the start of each year, and the pension plan earns 8%. To the nearest dollar, what would be the value of Luke's pension plan at the start of their first year of retirement