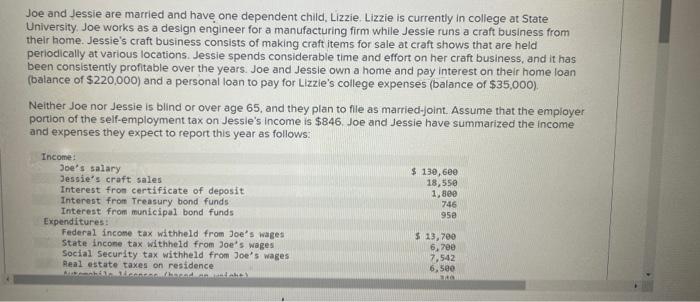

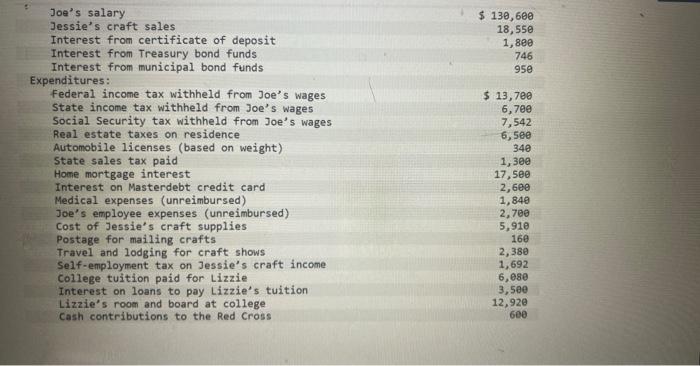

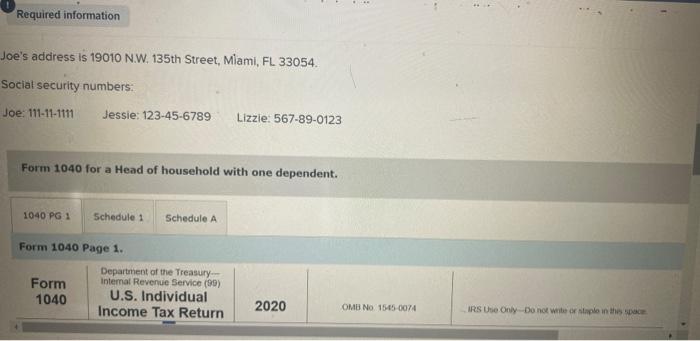

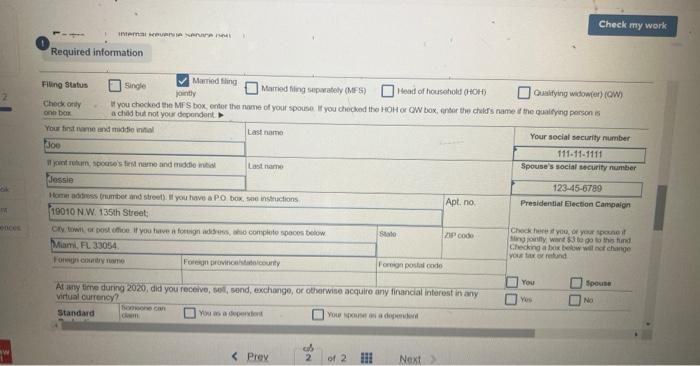

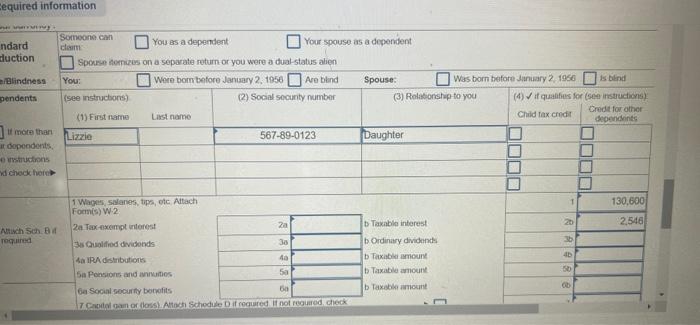

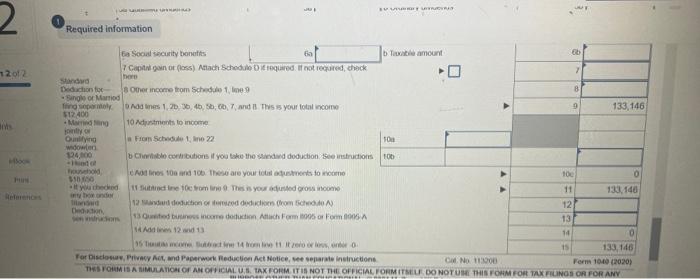

Joe and Jessie are married and have one dependent child, Lizzie, Lizzie is currently in college at State University. Joe works as a design engineer for a manufacturing firm while Jessie runs a craft business from their home. Jessie's craft business consists of making craft items for sale at craft shows that are held periodically at various locations. Jessie spends considerable time and effort on her craft business, and it has been consistently profitable over the years. Joe and Jessle own a home and pay interest on their home loan (balance of $220,000 ) and a personal loan to pay for Lizzie's college expenses (balance of $35,000 ). Neither Joe nor Jessie is blind or over age 65 , and they plan to file as married-joint. Assume that the employer portion of the self-employment tax on Jessle's income is $846. Joe and Jessie have summarized the income and expenses they expect to report this year as follows: Joe's salary Jessie's craft sales Interest from certificate of deposit Interest from Treasury bond funds Interest from municipal bond funds Expenditures: Federal income tax withheld from Joe's wages State income tax withheld from Joe's wages Social Security tax withheld from Joe's wages Real estate taxes on residence Automobile licenses (based on weight) State sales tax paid Home mortgage interest Interest on Masterdebt credit card Medical expenses (unreimbursed) Joe's employee expenses (unreimbursed) Cost of Jessie's craft supplies Postage for mailing crafts Travel and lodging for craft shows Self-employment tax on Jessie's craft income college tuition paid for Lizzie Interest on loans to pay Lizzie's tuition Lizzie's room and board at college Cash contributions to the Red Cross Joe's addiress is 19010 N.W. 135th Street, Miami, FL 33054. Social security numbers: Joe: 111-11-1111 Jessie: 123-45-6789 Form 1040 for a Head of household with one dependent. Fling status Chock orty one ber Married thing a child but not vour dociondant. equired information Your spouse as a dependent Spowken Acrices on a separate return or you were a dual-status alien It more than It dopenderits. 6 urituctinns wi check heint 1 Wages, sidanes, tips, ofc Altach Focm(s) W.2 2 a Tax-nxempt unterest 3is Criolfinod divitonds Sa IPA distributions 5a Ponsions and annutios 6a Social securty benofits b Taxabio interest 7Crotidoamor(loss)AtastischeduleDifrequeredifnotregined,chec b Ordinary dvidands b Taxiabie imouns b Taxabile amount b Taxabila amount. 1) Required information Joe and Jessie are married and have one dependent child, Lizzie, Lizzie is currently in college at State University. Joe works as a design engineer for a manufacturing firm while Jessie runs a craft business from their home. Jessie's craft business consists of making craft items for sale at craft shows that are held periodically at various locations. Jessie spends considerable time and effort on her craft business, and it has been consistently profitable over the years. Joe and Jessle own a home and pay interest on their home loan (balance of $220,000 ) and a personal loan to pay for Lizzie's college expenses (balance of $35,000 ). Neither Joe nor Jessie is blind or over age 65 , and they plan to file as married-joint. Assume that the employer portion of the self-employment tax on Jessle's income is $846. Joe and Jessie have summarized the income and expenses they expect to report this year as follows: Joe's salary Jessie's craft sales Interest from certificate of deposit Interest from Treasury bond funds Interest from municipal bond funds Expenditures: Federal income tax withheld from Joe's wages State income tax withheld from Joe's wages Social Security tax withheld from Joe's wages Real estate taxes on residence Automobile licenses (based on weight) State sales tax paid Home mortgage interest Interest on Masterdebt credit card Medical expenses (unreimbursed) Joe's employee expenses (unreimbursed) Cost of Jessie's craft supplies Postage for mailing crafts Travel and lodging for craft shows Self-employment tax on Jessie's craft income college tuition paid for Lizzie Interest on loans to pay Lizzie's tuition Lizzie's room and board at college Cash contributions to the Red Cross Joe's addiress is 19010 N.W. 135th Street, Miami, FL 33054. Social security numbers: Joe: 111-11-1111 Jessie: 123-45-6789 Form 1040 for a Head of household with one dependent. Fling status Chock orty one ber Married thing a child but not vour dociondant. equired information Your spouse as a dependent Spowken Acrices on a separate return or you were a dual-status alien It more than It dopenderits. 6 urituctinns wi check heint 1 Wages, sidanes, tips, ofc Altach Focm(s) W.2 2 a Tax-nxempt unterest 3is Criolfinod divitonds Sa IPA distributions 5a Ponsions and annutios 6a Social securty benofits b Taxabio interest 7Crotidoamor(loss)AtastischeduleDifrequeredifnotregined,chec b Ordinary dvidands b Taxiabie imouns b Taxabile amount b Taxabila amount. 1) Required information