Joe and Jessie are married and have one dependent child, Lizzie. Lizzie is currently in college at State University. Joe works as a design engineer for a manufacturing firm while Jessie runs a craft business from their home. Jessies craft business consists of making craft items for sale at craft shows that are held periodically at various locations. Jessie spends considerable time and effort on her craft business, and it has been consistently profitable over the years. Joe and Jessie pay interest on a personal loan to pay for Lizzies college expenses (balance of $35,000).

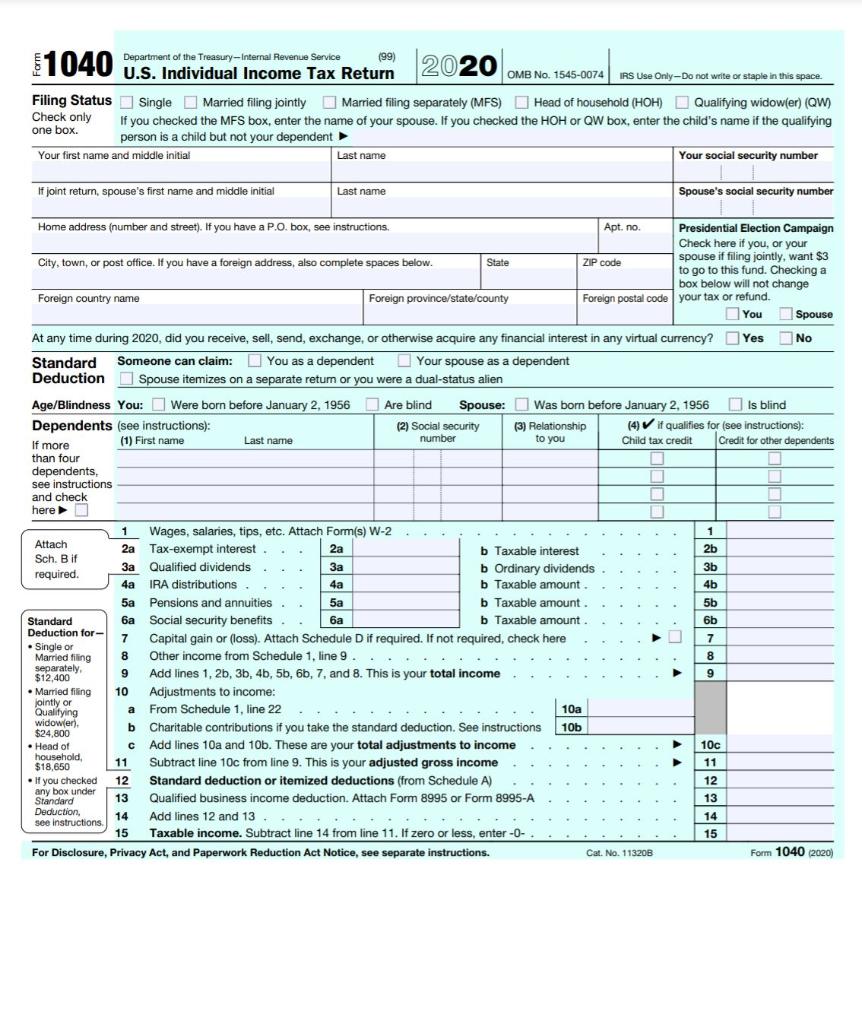

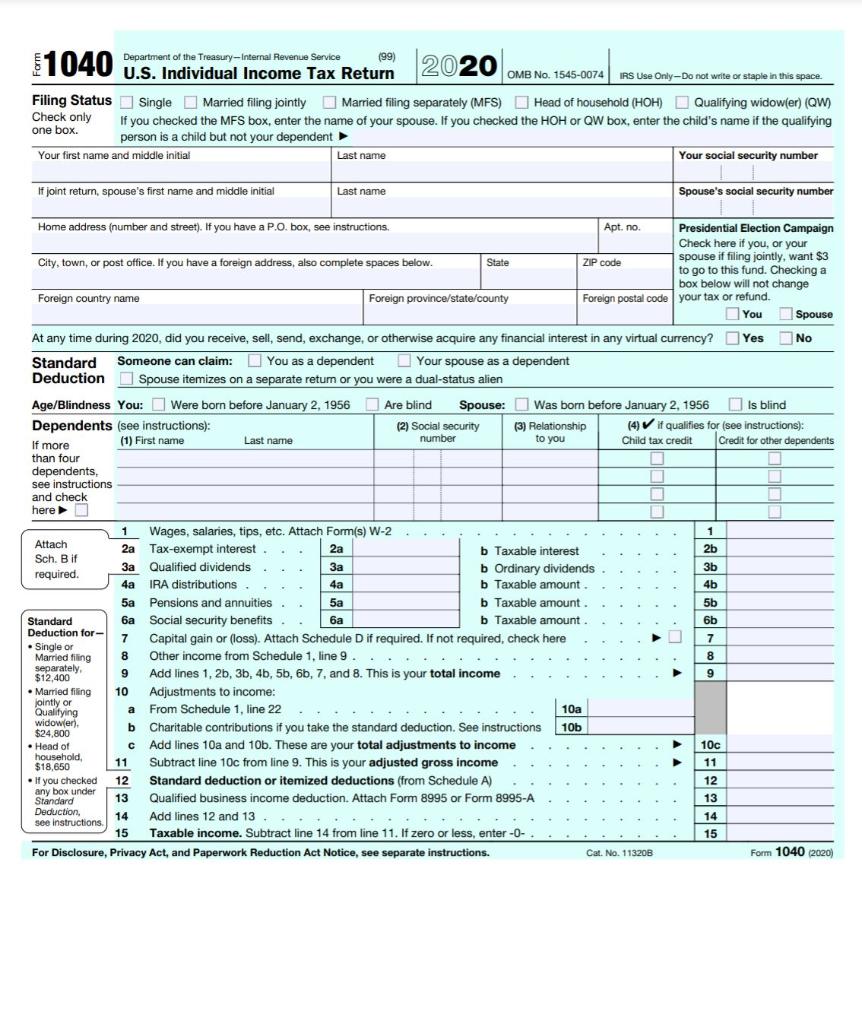

Based on their estimates, complete page 1 of the IRS Form 1040 (through line 11) and schedule 1. Assume that the employer portion of the self-employment tax on Jessies income is $831. Joe and Jessie have summarized the income and expenses they expect to report this year as follows:

Income:

Joes salary $129,100

Jessies craft sales 18,400

Interest from certificate of deposit 1,650

Interest from Treasury bond funds 716

Interest from municipal bond funds 920

Income from renting out their personal 800

residence for 10 days

Expenditures:

Social security tax withheld from Joes wages 7,482

Cost of Jessies craft supplies 4,260

Postage for mailing crafts 145

Travel and lodging for craft shows 2,230

Self-employment tax on Jessies craft income 1,662

College tuition paid for Lizzie 5,780

Interest on loans to pay Lizzies tuition 3,200

Lizzies room and board at college 12,620

Cleaning fees and advertising expense associated

with renting their residence 600

1040 ... C.Ss. Individual Income Tax Return 2020 OMB No. 1545-0078 Ms Um Day-Do not want his space Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying widow(er) (QW) Check only If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child's name if the qualifying one box. person is a child but not your dependent Your first name and middle initial Last name Your social security number If joint return, spouse's first name and middle initial Last name Spouse's social security number Home address (number and street). If you have a P.O. box, see instructions. . . Apt.no Presidential Election Campaign Check here if you, or your City, town, or post office. If you have a foreign address, also complete spaces below. , spouse if filing jointly, want $3 State ZIP code to go to this fund. Checking a box below will not change Foreign country name Foreign province/state/county Foreign postal code your tax or refund. You Spouse At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? Yes No Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction Spouse itemizes on a separate retum or you were a dual-status alien Age/Blindness You: Were born before January 2, 1956 Are blind Spouse: Was born before January 2, 1956 is blind Dependents (see instructions): (2) Social security ) (3) Relationship (3 (4) i qualifies for (see instructions): If more (1) First name Last name number to you Child tax credit Credit for other dependents than four dependents, see instructions and check here 1 Wages, salaries, tips, etc. Attach Form(s) W-2 1 Attach 2a Tax-exempt interest b Taxable interest 2b Sch. Bif 3a Qualified dividends 3a required. 3b b Ordinary dividends 4a IRA distributions. 4a b Taxable amount 4b 5a Pensions and annuities 5a b Taxable amount 5b Standard 6a Social security benefits b Taxable amount 6b Deduction for 7 Capital gain or loss). Attach Schedule D if required. If not required, check here 7 Single or Married filing 8 Other income from Schedule 1, line 9... 8 separately 9 $12,400 Add lines 1, 2b, 3, 4, 5, 6, 7, and 8. This is your total income 9 Married filing 10 Adjustments to income: jointly or Qualifying a a From Schedule 1, line 22 ... 10a widow(er) 10b $24.800 b Charitable contributions if you take the standard deduction. See instructions Head of c Add lines 10a and 10b. These are your total adjustments to income 10c household, $18,650 11 11 Subtract line 10c from line 9. This is your adjusted gross income Hyou checked 12 Standard deduction or itemized deductions (from Schedule A) 12 any box under Standard 13 Qualified business income deduction. Attach Form 8995 or Form 8995-A 13 Deduction, see instructions 14 Add lines 12 and 13 14 15 Taxable income. Subtract line 14 from line 11. If zero or less, enter-O- 15 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B Form 1040 (2020) 2a