Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Joe and June Green are planning for their son's college education. Joe would like his son to attend his alma mater where tuition is currently

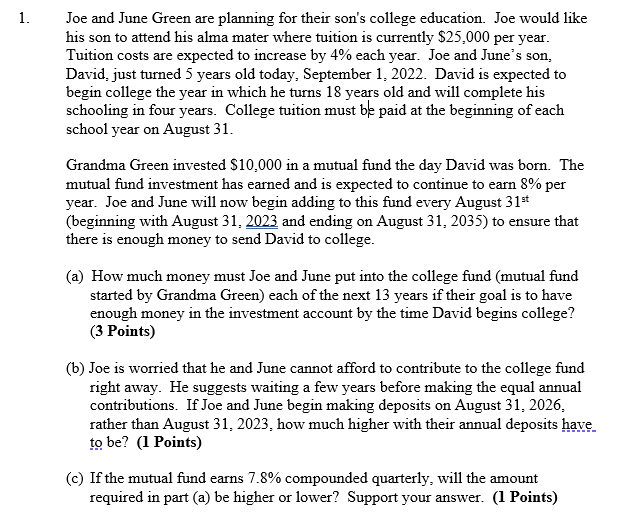

Joe and June Green are planning for their son's college education. Joe would like

his son to attend his alma mater where tuition is currently $ per year.

Tuition costs are expected to increase by each year. Joe and June's son,

David, just turned years old today, September David is expected to

begin college the year in which he turns years old and will complete his

schooling in four years. College tuition must be paid at the beginning of each

school year on August

Grandma Green invested $ in a mutual fund the day David was born. The

mutual fund investment has earned and is expected to continue to earn per

year. Joe and June will now begin adding to this fund every August

beginning with August and ending on August to ensure that

there is enough money to send David to college.

a How much money must Joe and June put into the college fund mutual fund

started by Grandma Green each of the next years if their goal is to have

enough money in the investment account by the time David begins college?

Points

b Joe is worried that he and June cannot afford to contribute to the college fund

right away. He suggests waiting a few years before making the equal annual

contributions. If Joe and June begin making deposits on August

rather than August how much higher with their annual deposits have.

to be Points

c If the mutual fund earns compounded quarterly, will the amount

required in part a be higher or lower? Support your answer. PointsPLEASE SHOW ALL WORK SO I CAN UNDERSTAND

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started