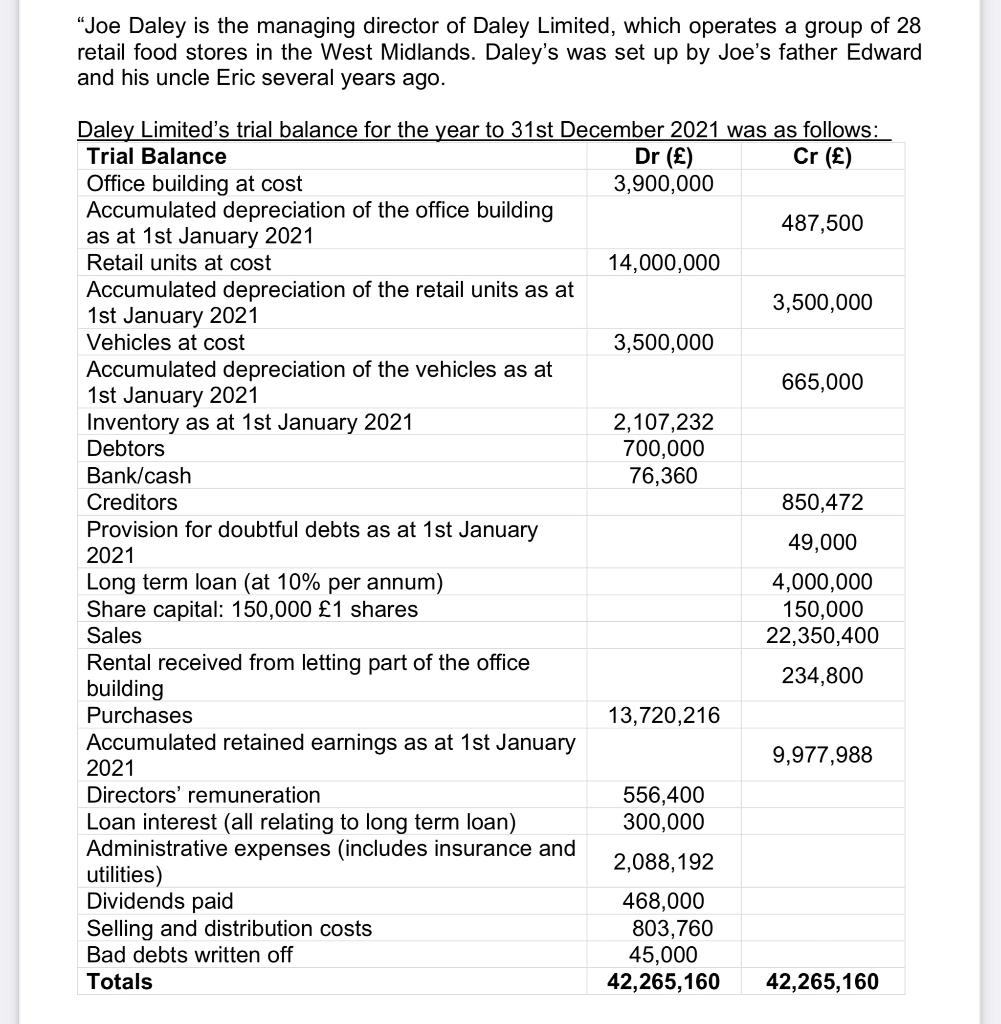

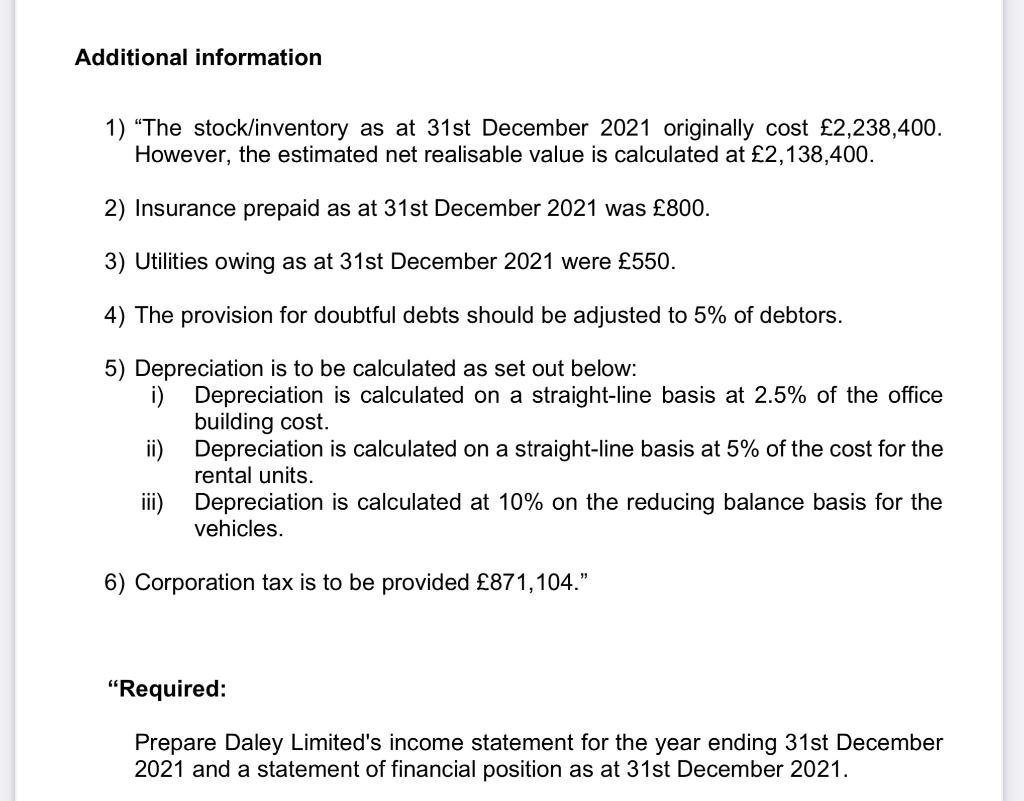

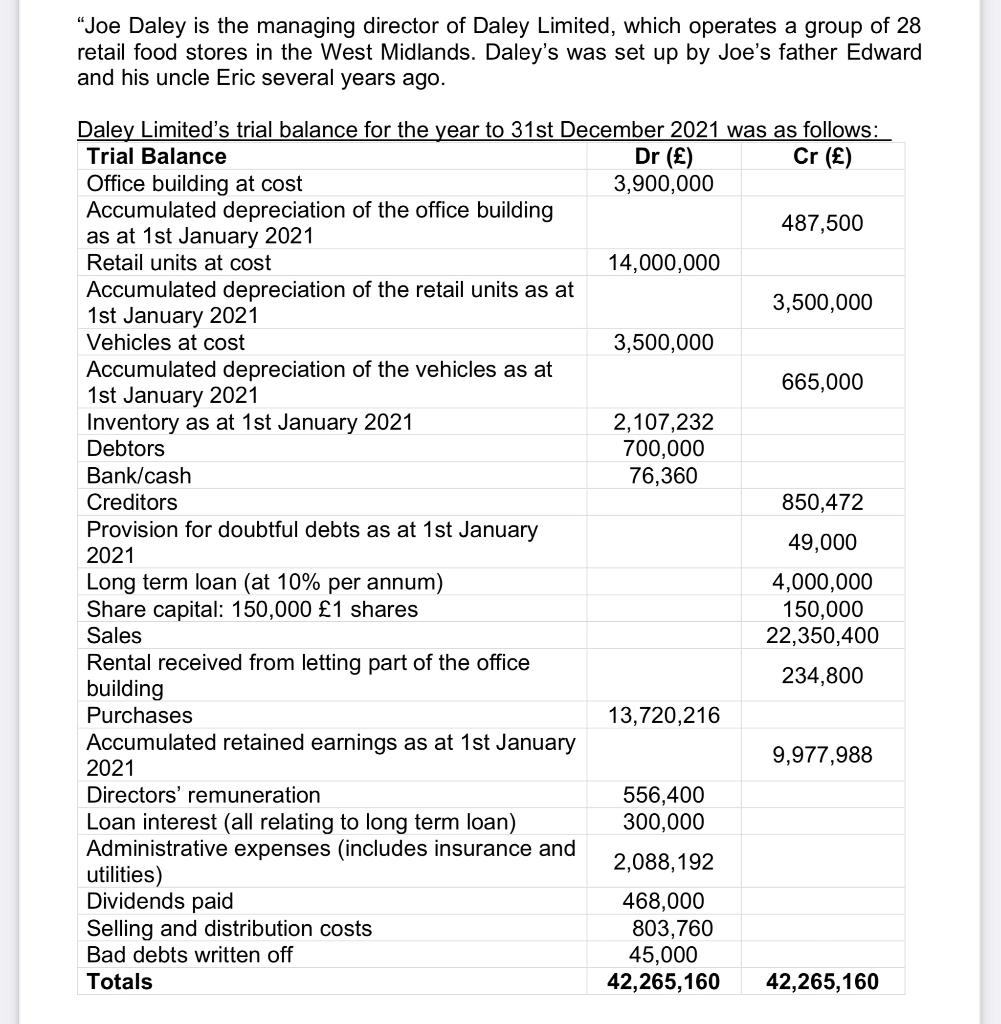

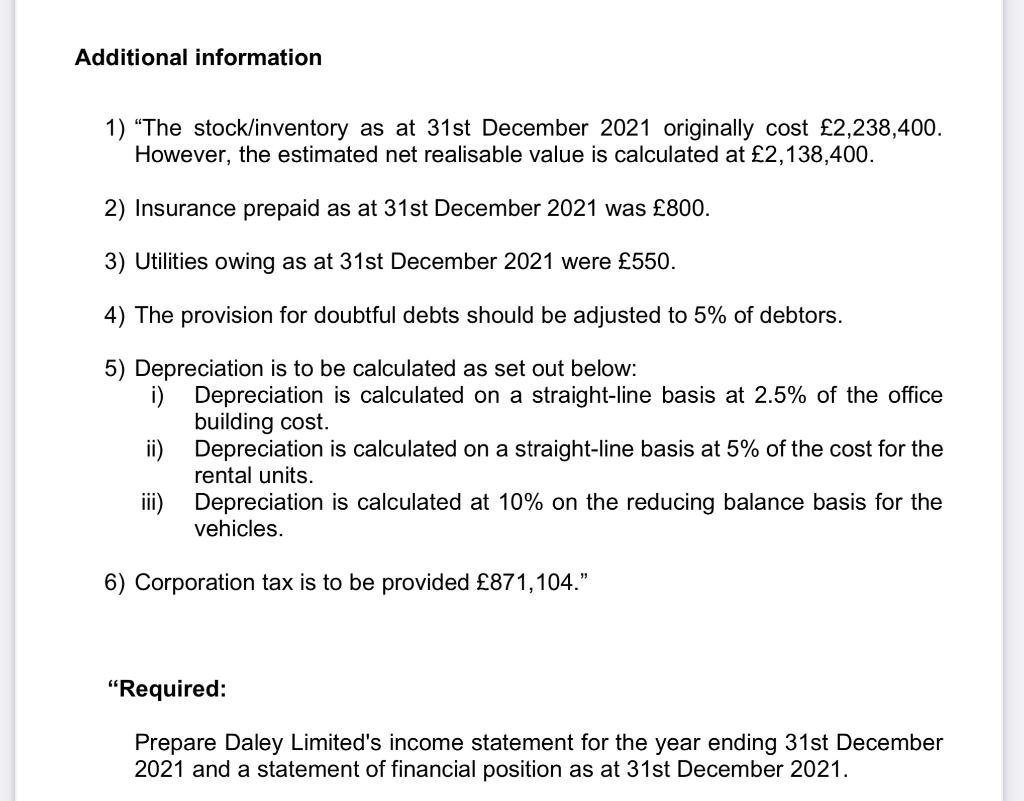

"Joe Daley is the managing director of Daley Limited, which operates a group of 28 retail food stores in the West Midlands. Daley's was set up by Joe's father Edward and his uncle Eric several years ago. Daley Limited's trial balance for the year to 31st December 2021 was as follows: Trial Balance Dr () Cr () Office building at cost 3,900,000 Accumulated depreciation of the office building as at 1st January 2021 487,500 Retail units at cost 14,000,000 Accumulated depreciation of the retail units as at 1st January 2021 3,500,000 Vehicles at cost 3,500,000 Accumulated depreciation of the vehicles as at 1st January 2021 665,000 Inventory as at 1st January 2021 2,107,232 Debtors 700,000 Bank/cash 76,360 Creditors 850,472 Provision for doubtful debts as at 1st January 2021 49,000 Long term loan (at 10% per annum) 4,000,000 150,000 Share capital: 150,000 1 shares Sales 22,350,400 Rental received from letting part of the office building 234,800 Purchases 13,720,216 Accumulated retained earnings as at 1st January 2021 9,977,988 Directors' remuneration 556,400 300,000 Loan interest (all relating to long term loan) Administrative expenses (includes insurance and utilities) 2,088,192 Dividends paid 468,000 Selling and distribution costs 803,760 Bad debts written off 45,000 Totals 42,265,160 42,265,160 Additional information 1) "The stock/inventory as at 31st December 2021 originally cost 2,238,400. However, the estimated net realisable value is calculated at 2,138,400. 2) Insurance prepaid as at 31st December 2021 was 800. 3) Utilities owing as at 31st December 2021 were 550. 4) The provision for doubtful debts should be adjusted to 5% of debtors. 5) Depreciation is to be calculated as set out below: i) Depreciation is calculated on a straight-line basis at 2.5% of the office building cost. ii) Depreciation is calculated on a straight-line basis at 5% of the cost for the rental units. iii) Depreciation is calculated at 10% on the reducing balance basis for the vehicles. 6) Corporation tax is to be provided 871,104." "Required: Prepare Daley Limited's income statement for the year ending 31st December 2021 and a statement of financial position as at 31st December 2021