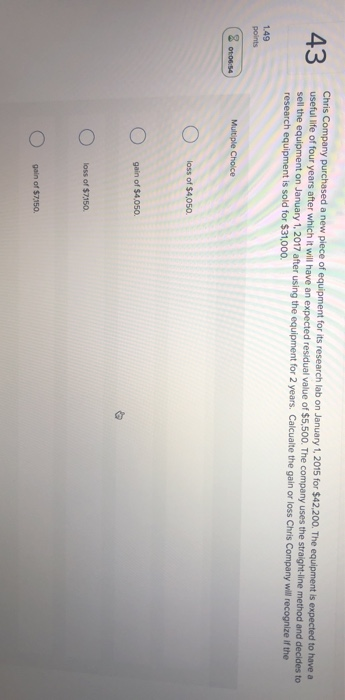

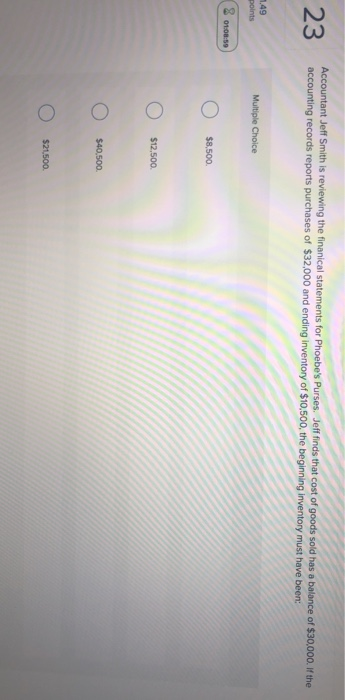

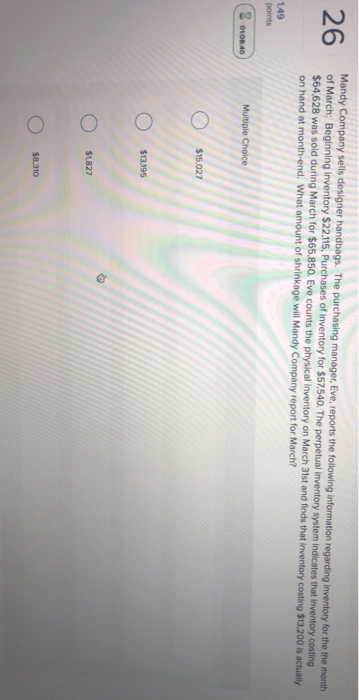

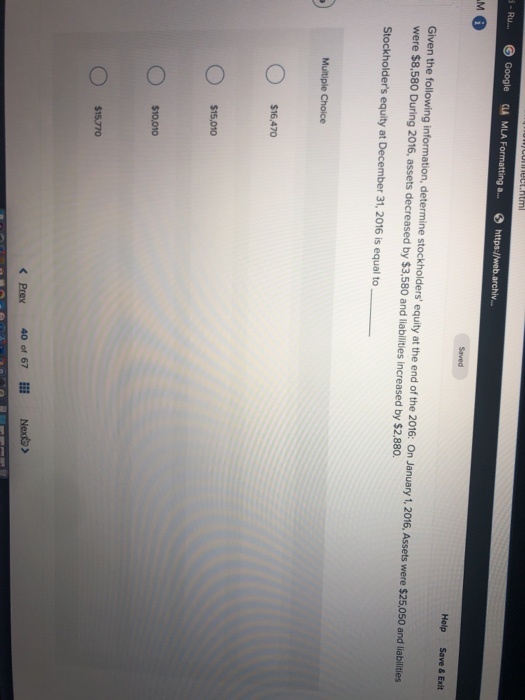

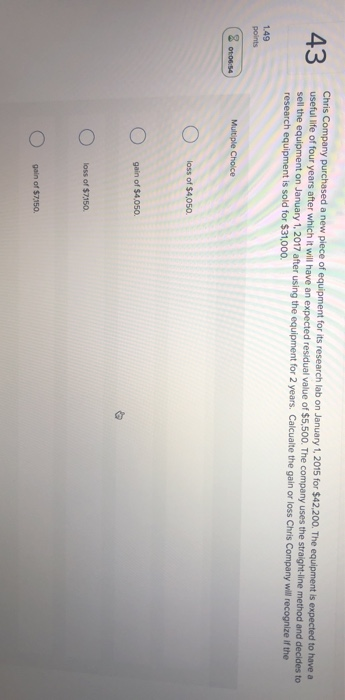

Joe Jones is preparing the statement of cash flows for Apricot Inc. He has determined that the net cash flow provided by operating activities for Apricot is an inflow of $50,042, the net cash flow used in investing activities for Apricot is $23,331, and the net cash flow used in financing activities for Apricot is $28.997. Joe has also determined that Apricot's beginning cash account balance is $12.583. The ending cash account balance for Apricot Inc is Multiple Choice o o $44,376 o $10,297 o $56,959 23 Accountant Jeff Smith is reviewing the finanical statements for Phoebe's Purses. Jeff finds that cost of goods sold has a balance of $30,000. If the accounting records reports purchases of $32,000 and ending Inventory of $10,500, the beginning inventory must have been: 49 points Multiple Choice 3 oto o $8,500. o $12,500. o 540,500. o $1,500. 26 Mandy Company sells designer handbags. The purchasing manager, Eve, reports the following information regarding Inventory for the the month of March: Beginning inventory $22,115, Purchases of inventory for $57,540. The perpetual Inventory system indicates that inventory costing $64,628 was sold during March for $65,850. Eve counts the physical inventory on March 31st and finds that inventory costing $13.200 is actually on hand at month-end. What amount of shrinkage will Mandy Company report for March? 149 points 18:40 Multiple Choice oo $13,195 O $1827 o 0 $8,310 - RJ Google WCMt.html CLA MLA Formatting a... https://web.archiv... M 6 Saved Help Save & Exit Given the following information, determine stockholders' equity at the end of the 2016: On January 1, 2016, Assets were $25,050 and liabilities were $8,580 During 2016, assets decreased by $3,580 and liabilities increased by $2,880. Stockholder's equity at December 31, 2016 is equal to Multiple Choice O O O 43 Chris Company purchased a new piece of equipment for its research lab on January 1, 2015 for $42.200. The equipment is expected to have a useful life of four years after which it will have an expected residual value of $5,500. The company uses the straight-line method and decides to sell the equipment on January 1, 2017 after using the equipment for 2 years. Calcualte the gain or loss Chris Company will recognize if the research equipment is sold for $31,000. 1.49 points % 0106:54 Multiple Choice o loss of $4,050 0 O gain of $4,050 0 loss of $7150 0 0 gain of $7150