Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Joe made taxable gifts as follows: $1,200,000 in 1975,$1.7 million in 1999 , and $400,000 in 2022 . View the unified transfer tax rates for

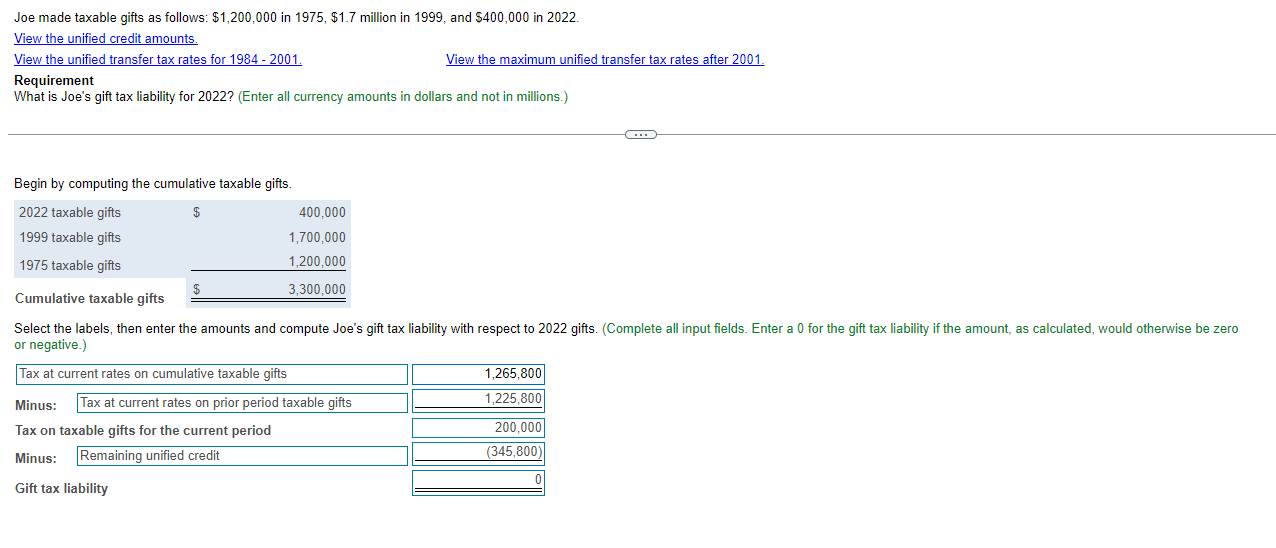

Joe made taxable gifts as follows: $1,200,000 in 1975,$1.7 million in 1999 , and $400,000 in 2022 . View the unified transfer tax rates for 1984 - 2001. Requirement What is Joe's gift tax liability for 2022 ? (Enter all currency amounts in dollars and not in millions.) View the maximum unified transfer tax rates after 2001. View the maximum unified transfer tax rates after 2001. Begin by computing the cumulative taxable gifts

Joe made taxable gifts as follows: $1,200,000 in 1975,$1.7 million in 1999 , and $400,000 in 2022 . View the unified transfer tax rates for 1984 - 2001. Requirement What is Joe's gift tax liability for 2022 ? (Enter all currency amounts in dollars and not in millions.) View the maximum unified transfer tax rates after 2001. View the maximum unified transfer tax rates after 2001. Begin by computing the cumulative taxable gifts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started