Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Joe's BBQ Supply began operations in 2016 and adopted weighted-average pricing for its inventory. At the beginning of 2017, Joe's decided to switch to

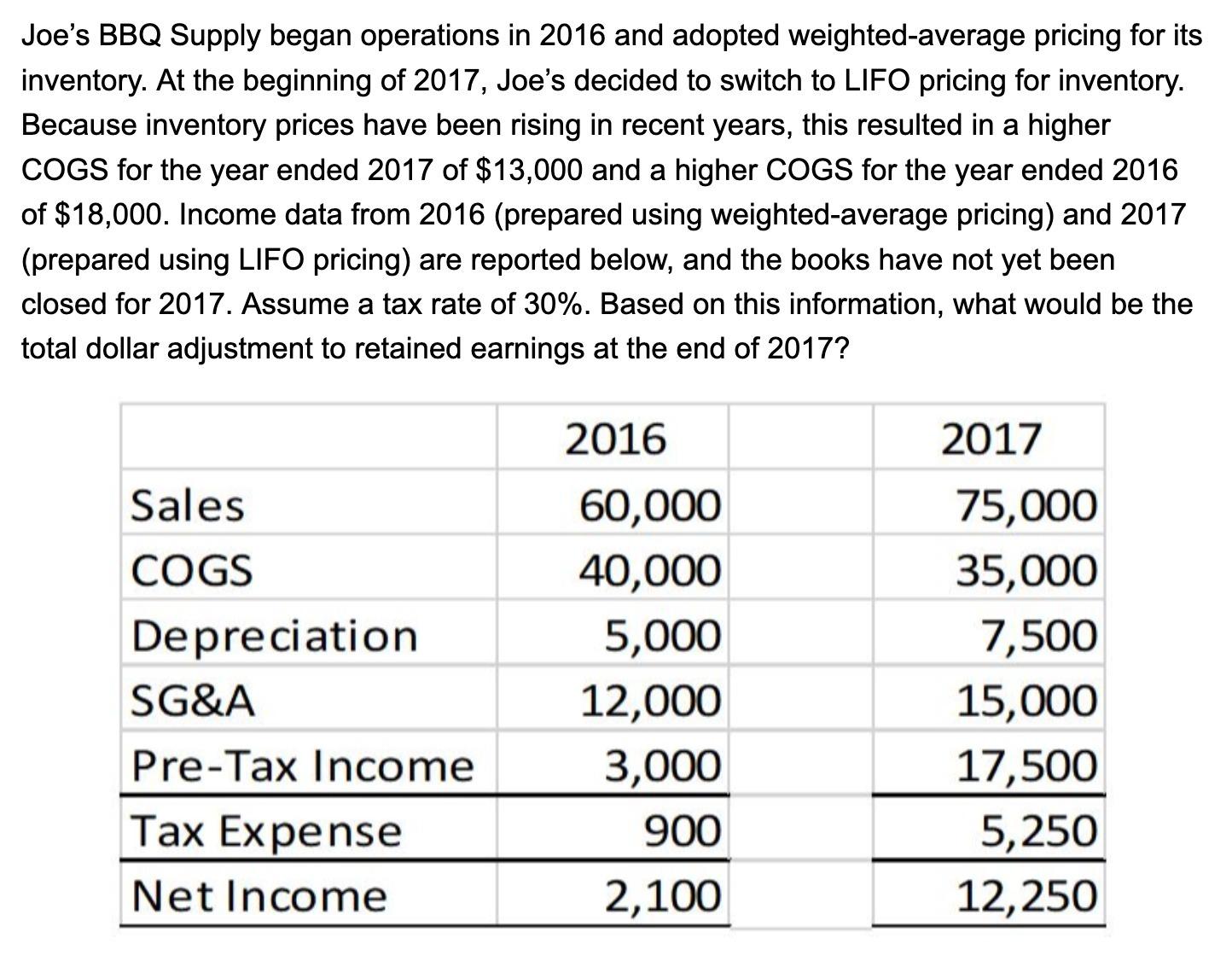

Joe's BBQ Supply began operations in 2016 and adopted weighted-average pricing for its inventory. At the beginning of 2017, Joe's decided to switch to LIFO pricing for inventory. Because inventory prices have been rising in recent years, this resulted in a higher COGS for the year ended 2017 of $13,000 and a higher COGS for the year ended 2016 of $18,000. Income data from 2016 (prepared using weighted-average pricing) and 2017 (prepared using LIFO pricing) are reported below, and the books have not yet been closed for 2017. Assume a tax rate of 30%. Based on this information, what would be the total dollar adjustment to retained earnings at the end of 2017? 2016 2017 Sales 60,000 75,000 COGS 40,000 35,000 Depreciation 5,000 7,500 SG&A 12,000 15,000 Pre-Tax Income 3,000 17,500 5,250 x Expense 900 Net Income 2,100 12,250

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer Therefore the total adjustment to the retained earnings in 2017 15750 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started