Question

Johann Van Aert has decided to use the following information to explain portfolio composition options that are available to his high net-worth client. 3 suitable

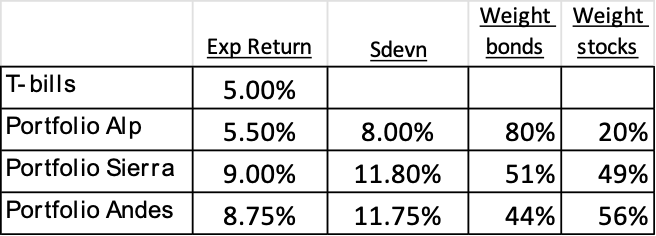

Johann Van Aert has decided to use the following information to explain portfolio composition options that are available to his high net-worth client. 3 suitable portfolios are shown in the table below.

Help Johann determine the minimum-variance and optimal portfolios

Help Johann explain the advantage of the optimal portfolio to his client using the Sharpe ratio of each portfolio

Johann’s client has noted that she is not interested in investing all her monies in the optimal portfolio; she prefers a mix of 45% in a risk-free asset and the remainder in the optimal portfolio. Compute the allocation to each of the three asset classes in her preferred complete portfolio. All values must be shown.

T-bills Portfolio Alp Portfolio Sierra Portfolio Andes Exp Return 5.00% 5.50% 8.00% 9.00% 11.80% 8.75% 11.75% Sdevn Weight Weight bonds stocks 80% 20% 51% 49% 44% 56%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To help Johann determine the minimumvariance and optimal portfolios and explain the advantages of the optimal portfolio using the Sharpe ratio we can ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started