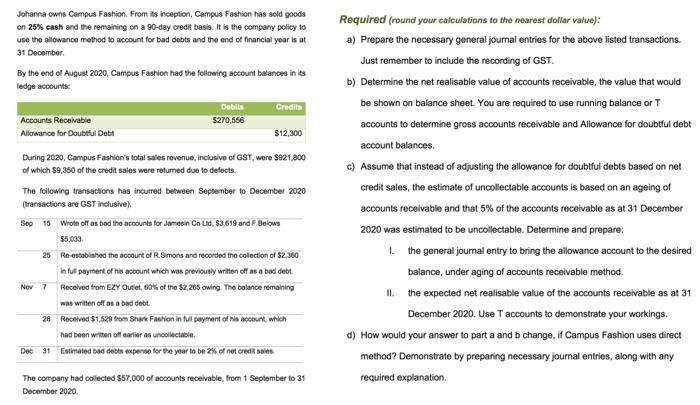

Johanna owns Campus Fashion. From its inception, Campus Fashion has sold goods on 25% cash and the remaining on a 90-day credit basis. It is the company policy to use the allowance method to account for bad debts and the end of financial year is at 31 December By the end of August 2020, Campus Fashion had the following account balances in its ledge accounts: Debit Credits Accounts Receivable $270,556 Allowance for Doubtful Debt $12,300 During 2020, Campus Fashion's total sales revenue, inclusive of GST, were $921,800 of which $9,350 of the credit sales were returned due to defects. The following transactions has incurred between September to December 2020 (transactions are GST inclusive) Sep 15 Wrote off as bad the accounts for Jamesin Co Ltd, $3,619 and F.Belows $5,033 25 Re-established the account of R. Smons and recorded the colection of $2.360 in full payment of his account which was previously written off as a bad debt. Nov 7 Received from EZY Outlet, eos of the $2.285 owing. The balance remaining was written off as a bad debt 28 Received $1,529 from Shark Fashion in til payment of his account, which had been written off earlier as uncollectable, Dec 31 Estimated bad debts expense for the year to be 2% of net credit sales Required (round your calculations to the nearest dollar value): a) Prepare the necessary general journal entries for the above listed transactions. Just remember to include the recording of GST. b) Determine the net realisable value of accounts receivable, the value that would be shown on balance sheet. You are required to use running balance or T accounts to determine gross accounts receivable and Allowance for doubtful debt account balances c) Assume that instead of adjusting the allowance for doubtful debts based on net credit sales, the estimate of uncollectable accounts is based on an ageing of accounts receivable and that 5% of the accounts receivable as at 31 December 2020 was estimated to be uncollectable. Determine and prepare: the general journal entry to bring the allowance account to the desired balance, under aging of accounts receivable method. II. the expected net realisable value of the accounts receivable as at 31 December 2020. Use Taccounts to demonstrate your workings, d) How would your answer to part a and b change. If Campus Fashion uses direct method? Demonstrate by preparing necessary journal entries, along with any required explanation L. The company had collected $57,000 of accounts receivable, from 1 September to 31 December 2020 Johanna owns Campus Fashion. From its inception, Campus Fashion has sold goods on 25% cash and the remaining on a 90-day credit basis. It is the company policy to use the allowance method to account for bad debts and the end of financial year is at 31 December By the end of August 2020, Campus Fashion had the following account balances in its ledge accounts: Debit Credits Accounts Receivable $270,556 Allowance for Doubtful Debt $12,300 During 2020, Campus Fashion's total sales revenue, inclusive of GST, were $921,800 of which $9,350 of the credit sales were returned due to defects. The following transactions has incurred between September to December 2020 (transactions are GST inclusive) Sep 15 Wrote off as bad the accounts for Jamesin Co Ltd, $3,619 and F.Belows $5,033 25 Re-established the account of R. Smons and recorded the colection of $2.360 in full payment of his account which was previously written off as a bad debt. Nov 7 Received from EZY Outlet, eos of the $2.285 owing. The balance remaining was written off as a bad debt 28 Received $1,529 from Shark Fashion in til payment of his account, which had been written off earlier as uncollectable, Dec 31 Estimated bad debts expense for the year to be 2% of net credit sales Required (round your calculations to the nearest dollar value): a) Prepare the necessary general journal entries for the above listed transactions. Just remember to include the recording of GST. b) Determine the net realisable value of accounts receivable, the value that would be shown on balance sheet. You are required to use running balance or T accounts to determine gross accounts receivable and Allowance for doubtful debt account balances c) Assume that instead of adjusting the allowance for doubtful debts based on net credit sales, the estimate of uncollectable accounts is based on an ageing of accounts receivable and that 5% of the accounts receivable as at 31 December 2020 was estimated to be uncollectable. Determine and prepare: the general journal entry to bring the allowance account to the desired balance, under aging of accounts receivable method. II. the expected net realisable value of the accounts receivable as at 31 December 2020. Use Taccounts to demonstrate your workings, d) How would your answer to part a and b change. If Campus Fashion uses direct method? Demonstrate by preparing necessary journal entries, along with any required explanation L. The company had collected $57,000 of accounts receivable, from 1 September to 31 December 2020