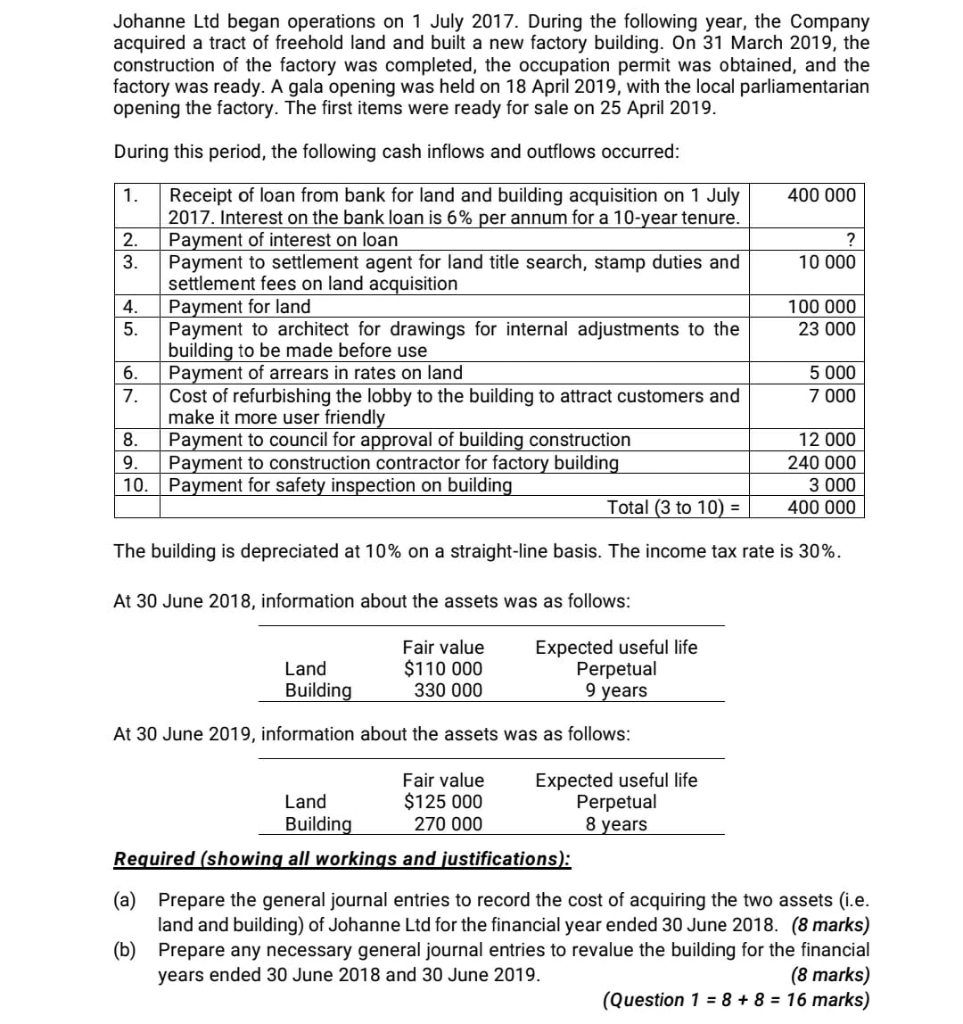

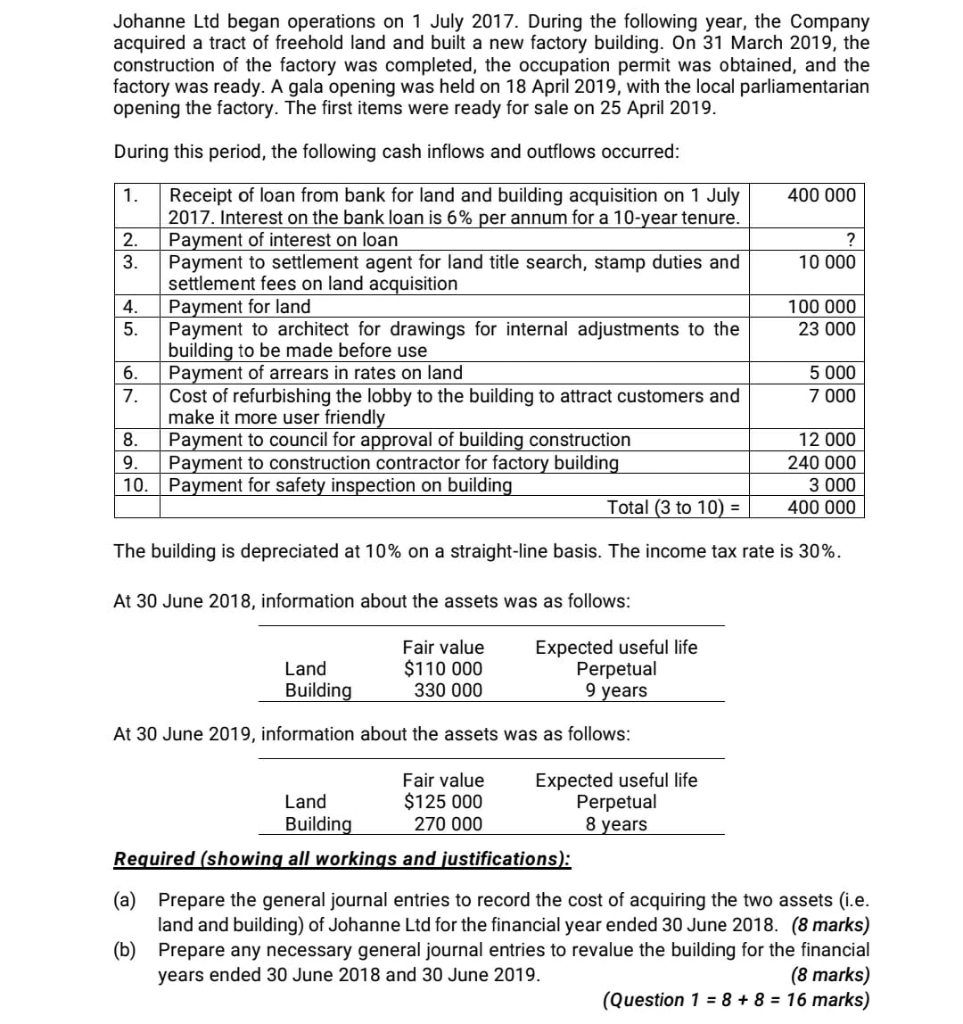

Johanne Ltd began operations on 1 July 2017. During the following year, the Company acquired a tract of freehold land and built a new factory building. On 31 March 2019, the construction of the factory was completed, the occupation permit was obtained, and the factory was ready. A gala opening was held on 18 April 2019, with the local parliamentarian opening the factory. The first items were ready for sale on 25 April 2019. During this period, the following cash inflows and outflows occurred: 1. 400 000 2. 3. ? 10 000 4. 5. 100 000 23 000 Receipt of loan from bank for land and building acquisition on 1 July 2017. Interest on the bank loan is 6% per annum for a 10-year tenure. Payment of interest on loan Payment to settlement agent for land title search, stamp duties and settlement fees on land acquisition Payment for land Payment to architect for drawings for internal adjustments to the building to be made before use Payment of arrears in rates on land Cost of refurbishing the lobby to the building to attract customers and make it more user friendly Payment to council for approval of building construction Payment to construction contractor for factory building Payment for safety inspection on building Total (3 to 10) = 6. 7. 5 000 7 000 8. 9. 10. 12 000 240 000 3 000 400 000 The building is depreciated at 10% on a straight-line basis. The income tax rate is 30%. At 30 June 2018, information about the assets was as follows: Land Building Fair value $110 000 330 000 Expected useful life Perpetual 9 years At 30 June 2019, information about the assets was as follows: Land Building Fair value $125 000 270 000 Expected useful life Perpetual 8 years Required (showing all workings and justifications): (a) Prepare the general journal entries to record the cost of acquiring the two assets (i.e. land and building) of Johanne Ltd for the financial year ended 30 June 2018. (8 marks) (b) Prepare any necessary general journal entries to revalue the building for the financial years ended 30 June 2018 and 30 June 2019. (8 marks) (Question 1 = 8 + 8 = 16 marks)