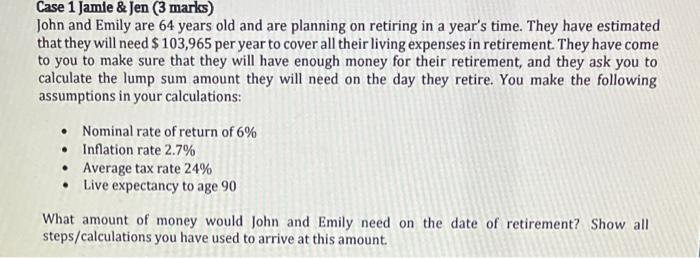

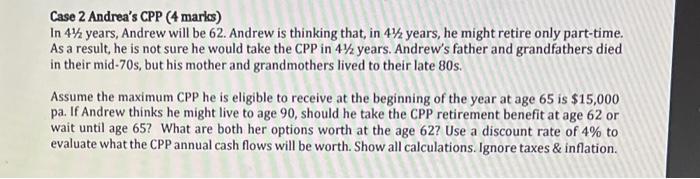

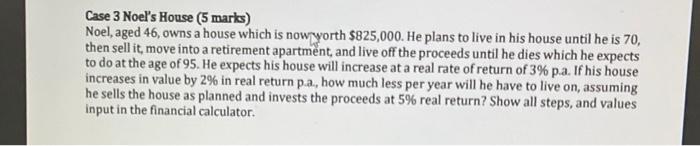

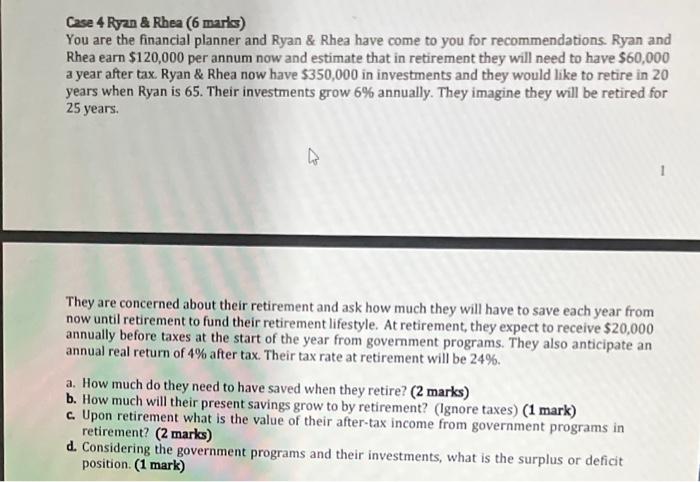

John and Emily are 64 years old and are planning on retiring in a year's time. They have estimated that they will need $103,965 per year to cover all their living expenses in retirement. They have come to you to make sure that they will have enough money for their retirement, and they ask you to calculate the lump sum amount they will need on the day they retire. You make the following assumptions in your calculations: - Nominal rate of return of 6% - Inflation rate 2.7% - Average tax rate 24% - Live expectancy to age 90 What amount of money would John and Emily need on the date of retirement? Show all steps/calculations you have used to arrive at this amount. Case 2 Andrea's CPP (4 marks) In 41/2 years, Andrew will be 62 . Andrew is thinking that, in 41/2 years, he might retire only part-time. As a result, he is not sure he would take the CPP in 4121 years. Andrew's father and grandfathers died in their mid-70s, but his mother and grandmothers lived to their late 80s. Assume the maximum CPP he is eligible to receive at the beginning of the year at age 65 is $15,000 pa. If Andrew thinks he might live to age 90 , should he take the CPP retirement benefit at age 62 or wait until age 65? What are both her options worth at the age 62 ? Use a discount rate of 4% to evaluate what the CPP annual cash flows will be worth. Show all calculations. Ignore taxes \& inflation. Case 3 Noel's House ( 5 marks) Noel, aged 46 , owns a house which is nowyorth $825,000. He plans to live in his house until he is 70 , then sell it, move into a retirement apartment, and live off the proceeds until he dies which he expects to do at the age of 95 . He expects his house will increase at a real rate of return of 3%p.a. If his house increases in value by 2% in real return p.a, how much less per year will he have to live on, assuming he sells the house as planned and invests the proceeds at 5% real return? Show all steps, and values input in the financial calculator. Case 4 Ryan \& Rhea ( 6 marrs) You are the financial planner and Ryan \& Rhea have come to you for recommendations. Ryan and Rhea earn $120,000 per annum now and estimate that in retirement they will need to have $60,000 a year after tax. Ryan \& Rhea now have $350,000 in investments and they would like to retire in 20 years when Ryan is 65 . Their investments grow 6% annually. They imagine they will be retired for 25 years. They are concerned about their retirement and ask how much they will have to save each year from now until retirement to fund their retirement lifestyle. At retirement, they expect to receive $20,000 annually before taxes at the start of the year from government programs. They also anticipate an annual real return of 4% after tax. Their tax rate at retirement will be 24%. a. How much do they need to have saved when they retire? ( 2 marks) b. How much will their present savings grow to by retirement? (Ignore taxes) (1 mark) c. Upon retirement what is the value of their after-tax income from government programs in retirement? (2 marks) d. Considering the government programs and their investments, what is the surplus or deficit position. (1 mark) Case 5: Asrita \& Sunil (12 marks) Asrita and Sunil, both aged 53, plan to retire in ten years. They have no company pension plans so they will save for retirement using only their RRSPs. They estimate they will need $85,000p. a aftertax for both. They expect to live to age 90 . Their combined RRSPs are valued at 245,000 and is earning a 6.5% real rate of return. Together, they expect to be able to contribute $12,000 every year. Asrita and Sunil have lived in Canada all their lives and will qualify for the maximum OAS of $700 per month at age 65 . They have also both been contributing to CPP since they started working. Both will qualify for the maximum CPP per month because of the level of their income and years of contribution into CPP. They anticipate they will each receive $1,400 at retirement. Assumptions: - Rate of Return in retirement 6% - Average Tax Rate (25\%) - Inflation 2% a. How much do they need p.a. before tax at retirement? ( 1 marks) b. What is the present value of their required retirement income before tax at retirement? (2 marks) c. What is the present value of their CPP and OAS. Assume CPP and OAS are received in the end of the month. (Hint: Remember CPP \& OAS are inflation adjusted) (4 marks) d. How much will they have in the RRSPs when they retire? (2 marks) e. What is the shortfall or surplus of their retirement income? ( 1 marks) f. Will they have the comfortable retirement they envision? Why or why not? If not, what can they do have this comfortable retirement? ( 2 marks)