Answered step by step

Verified Expert Solution

Question

1 Approved Answer

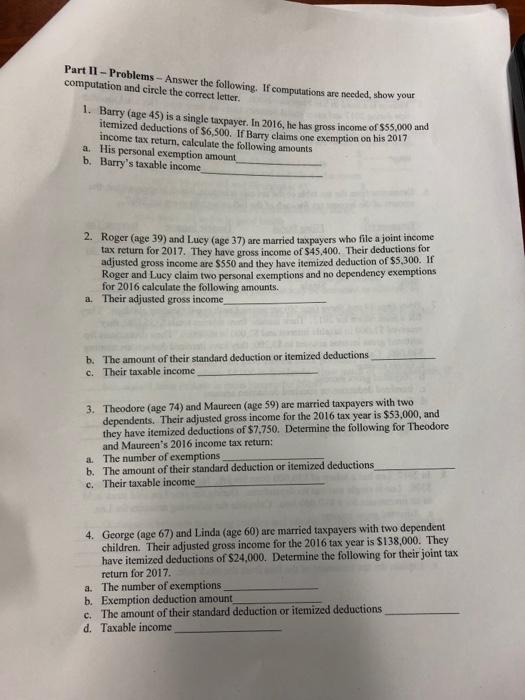

Part II - Problems - Answer the following. If computations are needed, show your computation and circle the correct letter. 1. Barry (age 45)

Part II - Problems - Answer the following. If computations are needed, show your computation and circle the correct letter. 1. Barry (age 45) is a single taxpayer. In 2016, he has gross income of $55,000 and itemized deductions of $6,500. If Barry claims one exemption on his 2017 income tax return, calculate the following amounts a. His personal exemption amount, b. Barry's taxable income 2. Roger (age 39) and Lucy (age 37) are married taxpayers who file a joint income tax return for 2017. They have gross income of $45,400. Their deductions for adjusted gross income are $550 and they have itemized deduction of $5,300. If Roger and Lucy claim two personal exemptions and no dependency exemptions for 2016 calculate the following amounts. a. Their adjusted gross income b. The amount of their standard deduction or itemized deductions. c. Their taxable income 3. Theodore (age 74) and Maureen (age 59) are married taxpayers with two dependents. Their adjusted gross income for the 2016 tax year is $53,000, and they have itemized deductions of $7,750. Determine the following for Theodore and Maureen's 2016 income tax return: a. The number of exemptions b. The amount of their standard deduction or itemized deductions c. Their taxable income 4. George (age 67) and Linda (age 60) are married taxpayers with two dependent children. Their adjusted gross income for the 2016 tax year is $138,000. They have itemized deductions of $24,000. Determine the following for their joint tax return for 2017. a. The number of exemptions b. Exemption deduction amount_ c. The amount of their standard deduction or itemized deductions d. Taxable income

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 a 4050 b 48950 2 a 50950 b 12700 c 38250 3 a 6 b 12700 c 40300 4 a 6 b 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d85064a5dc_176380.pdf

180 KBs PDF File

635d85064a5dc_176380.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started