Question

John and Jane have been saving to pay for their daughter Macy's college education. Macy just turned 10 at (t = 0), and she

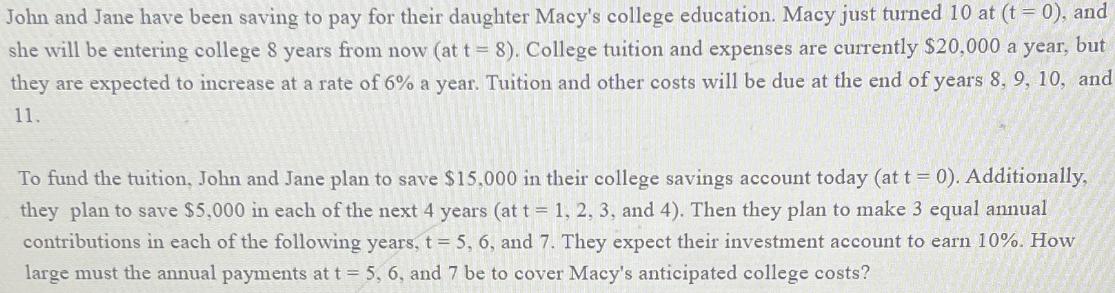

John and Jane have been saving to pay for their daughter Macy's college education. Macy just turned 10 at (t = 0), and she will be entering college 8 years from now (at t = 8). College tuition and expenses are currently $20,000 a year, but they are expected to increase at a rate of 6% a year. Tuition and other costs will be due at the end of years 8, 9, 10, and 11. To fund the tuition, John and Jane plan to save $15,000 in their college savings account today (at t = 0). Additionally, they plan to save $5,000 in each of the next 4 years (at t = 1, 2, 3, and 4). Then they plan to make 3 equal annual contributions in each of the following years, t = 5, 6, and 7. They expect their investment account to earn 10%. How large must the annual payments at t = 5, 6, and 7 be to cover Macy's anticipated college costs?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Spreadsheet Modeling And Decision Analysis A Practical Introduction To Management Science

Authors: Cliff T. Ragsdale

5th Edition

324656645, 324656637, 9780324656640, 978-0324656633

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App