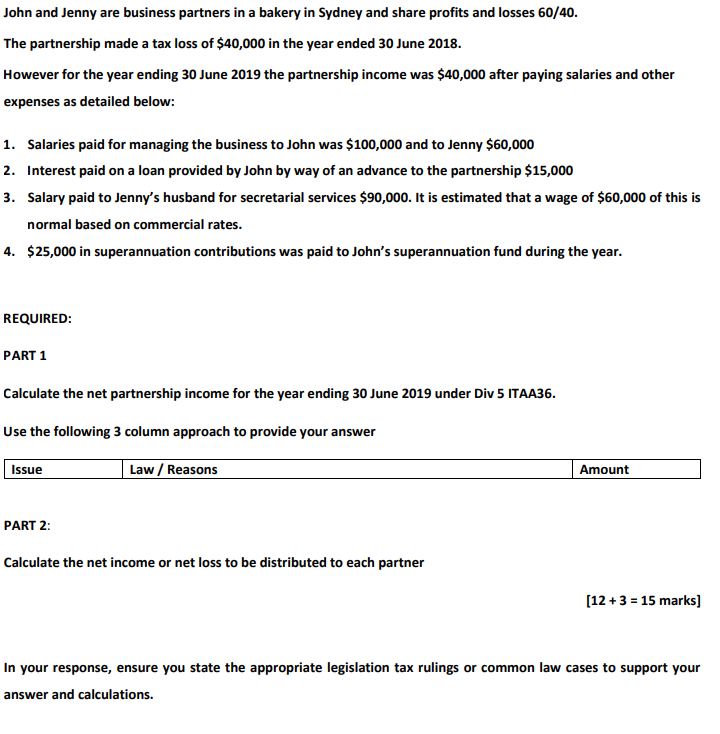

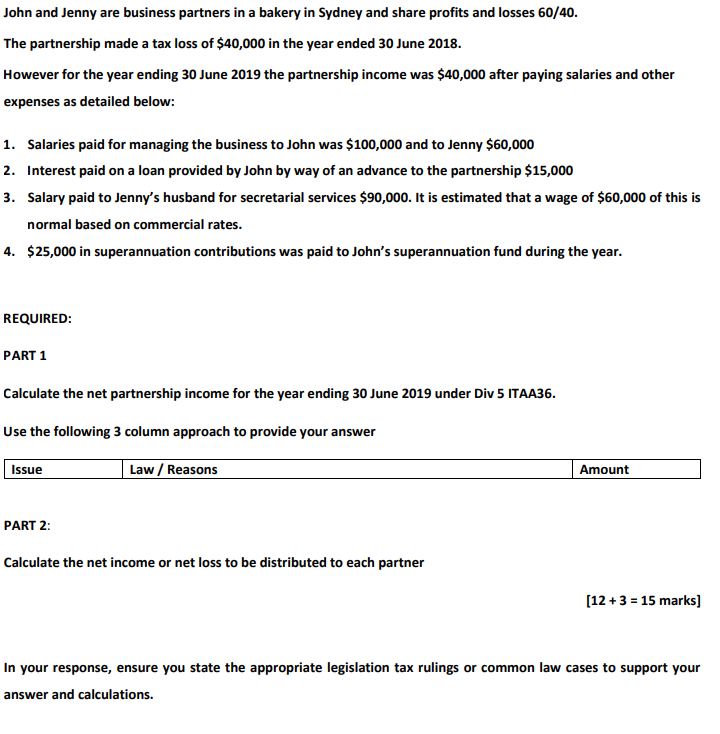

John and Jenny are business partners in a bakery in Sydney and share profits and losses 60/40. The partnership made a tax loss of $40,000 in the year ended 30 June 2018. However for the year ending 30 June 2019 the partnership income was $40,000 after paying salaries and other expenses as detailed below: 1. Salaries paid for managing the business to John was $100,000 and to Jenny $60,000 2. Interest paid on a loan provided by John by way of an advance to the partnership $15,000 3. Salary paid to Jenny's husband for secretarial services $90,000. It is estimated that a wage of $60,000 of this is normal based on commercial rates. 4. $25,000 in superannuation contributions was paid to John's superannuation fund during the year. REQUIRED: PART 1 Calculate the net partnership income for the year ending 30 June 2019 under Div 5 ITAA36. Use the following 3 column approach to provide your answer Issue Law / Reasons Amount PART 2: Calculate the net income or net loss to be distributed to each partner [12 + 3 = 15 marks] In your response, ensure you state the appropriate legislation tax rulings or common law cases to support your answer and calculations. John and Jenny are business partners in a bakery in Sydney and share profits and losses 60/40. The partnership made a tax loss of $40,000 in the year ended 30 June 2018. However for the year ending 30 June 2019 the partnership income was $40,000 after paying salaries and other expenses as detailed below: 1. Salaries paid for managing the business to John was $100,000 and to Jenny $60,000 2. Interest paid on a loan provided by John by way of an advance to the partnership $15,000 3. Salary paid to Jenny's husband for secretarial services $90,000. It is estimated that a wage of $60,000 of this is normal based on commercial rates. 4. $25,000 in superannuation contributions was paid to John's superannuation fund during the year. REQUIRED: PART 1 Calculate the net partnership income for the year ending 30 June 2019 under Div 5 ITAA36. Use the following 3 column approach to provide your answer Issue Law / Reasons Amount PART 2: Calculate the net income or net loss to be distributed to each partner [12 + 3 = 15 marks] In your response, ensure you state the appropriate legislation tax rulings or common law cases to support your answer and calculations