Answered step by step

Verified Expert Solution

Question

1 Approved Answer

John and Linda form the J&L Partnership. John contributes cash of $36,000 for a 40 percent interest in the partnership. Linda contributes equipment worth

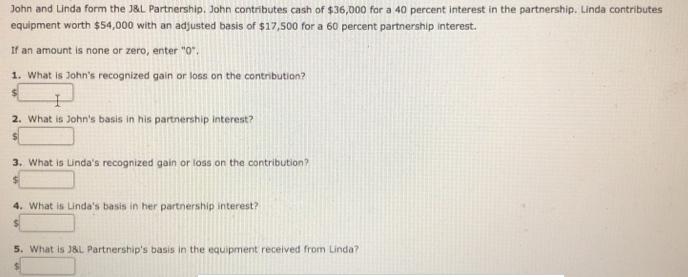

John and Linda form the J&L Partnership. John contributes cash of $36,000 for a 40 percent interest in the partnership. Linda contributes equipment worth $54,000 with an adjusted basis of $17,500 for a 60 percent partnership interest. If an amount is none or zero, enter "0". 1. What is John's recognized gain or loss on the contribution? 2. What is John's basis in his partnership interest? 3. What is Lunda's recognized gain or loss on the contribution? 4. What is Linda's basis in her partnership interest? 5. What is 18L Partnership's basis in the equipment received from Linda?

Step by Step Solution

★★★★★

3.47 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Required solution of all parts is given below What is Joh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635dca66e4170_178889.pdf

180 KBs PDF File

635dca66e4170_178889.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started