Question

John and Lucy Miegel (dates of birth: December 18, 1971 and September 14, 1971, respectively) are married with three children: Jason, MaryJane and Sally (dates

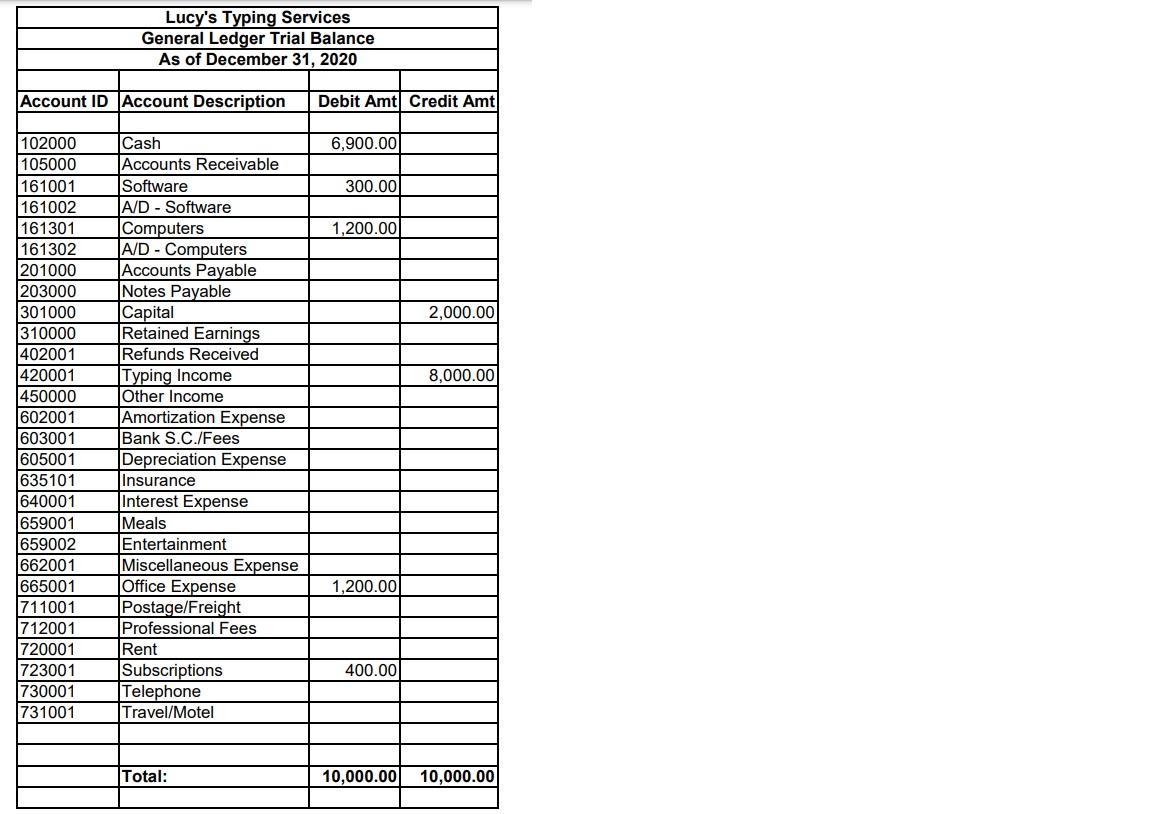

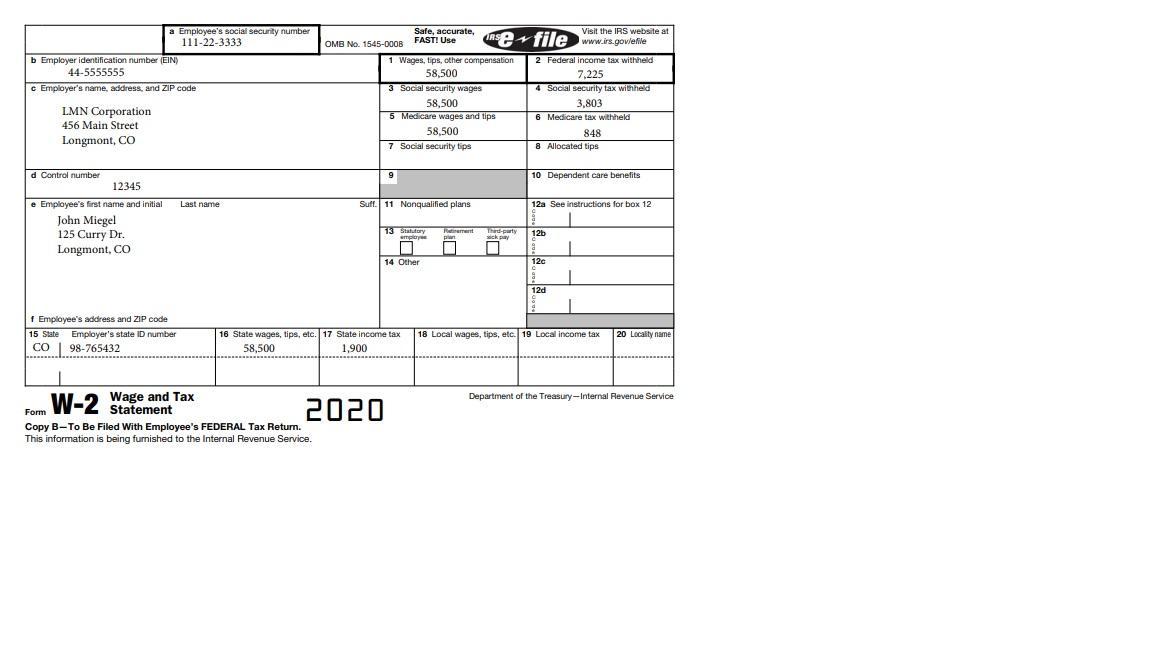

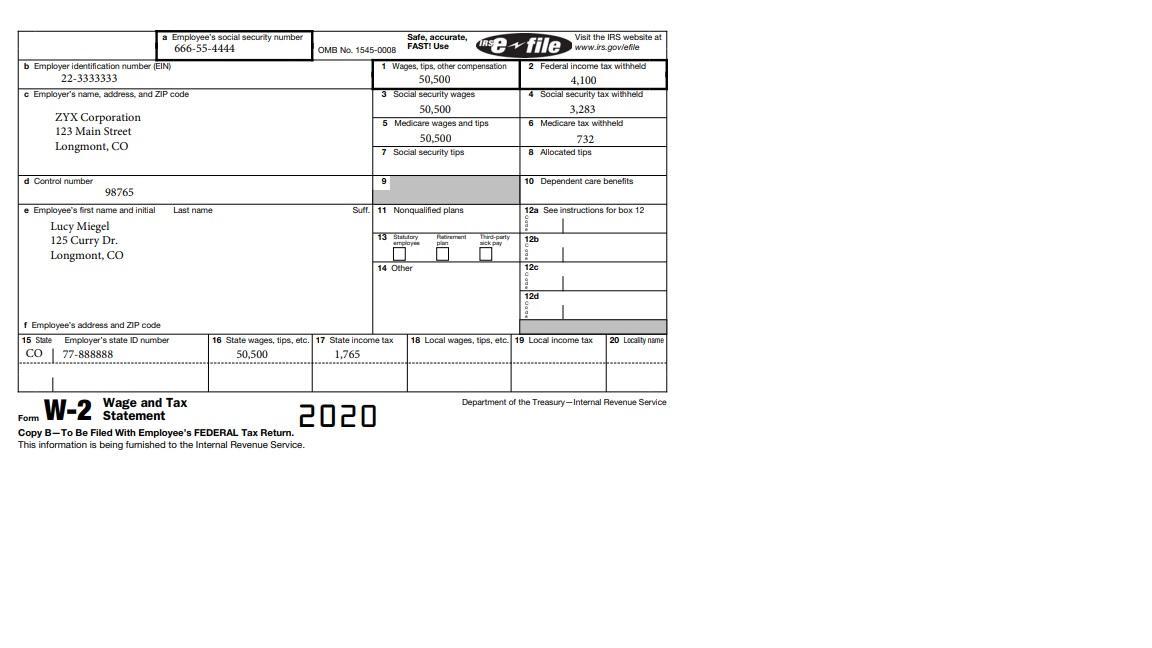

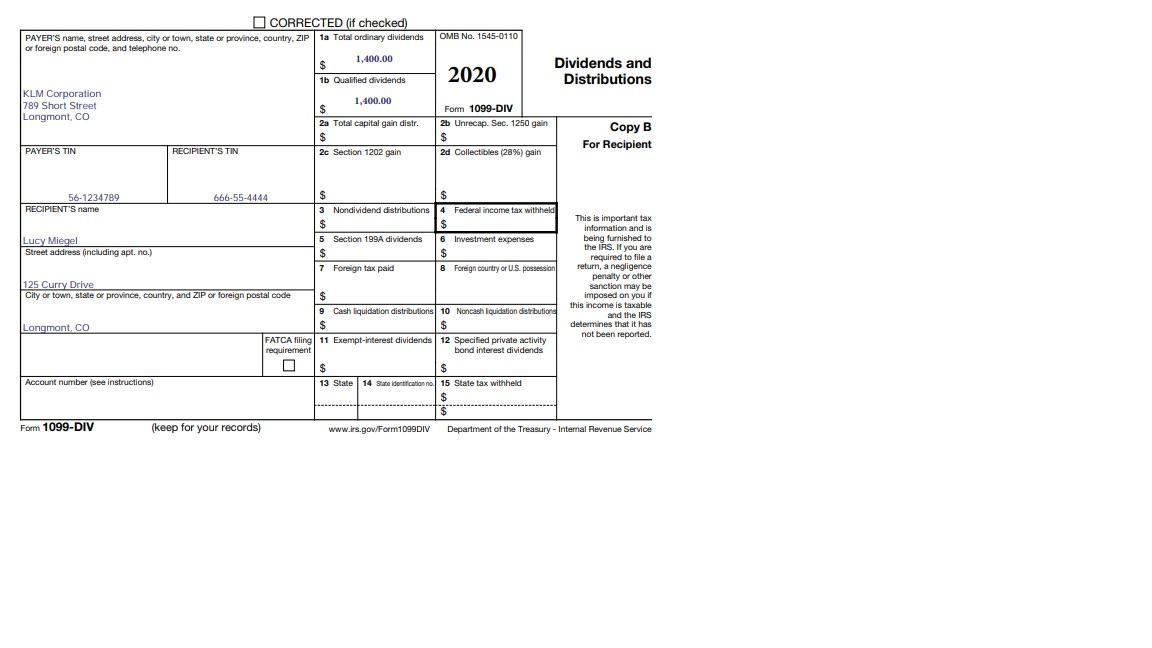

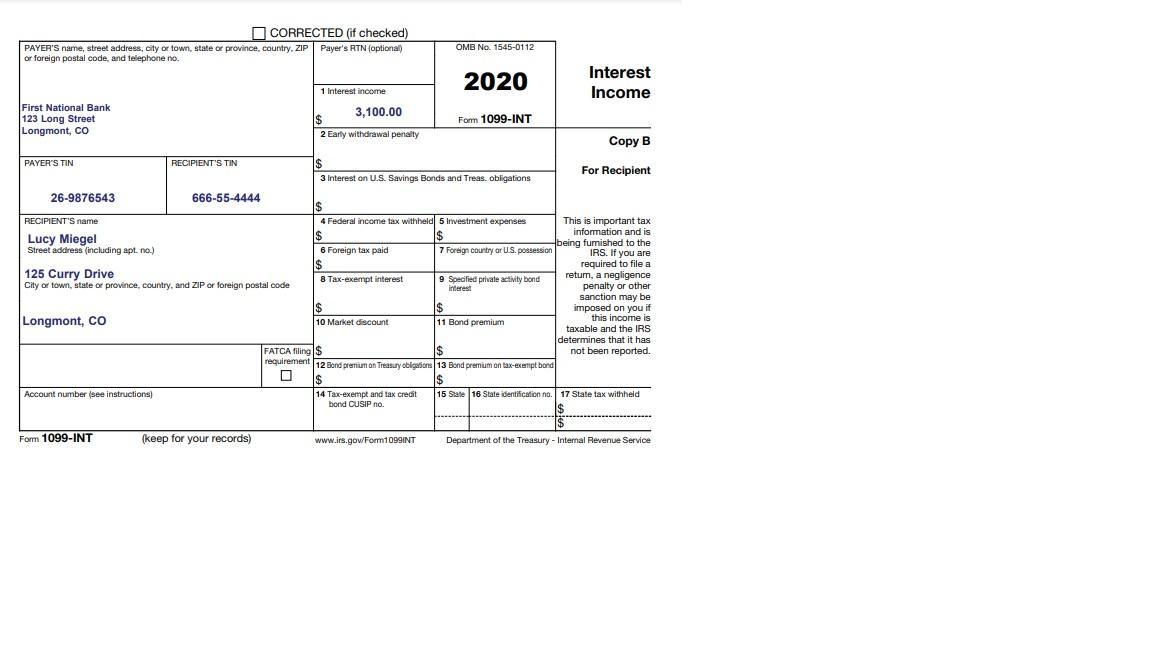

John and Lucy Miegel (dates of birth: December 18, 1971 and September 14, 1971, respectively) are married with three children: Jason, MaryJane and Sally (dates of birth: July 22, 2000, June 6, 2002 and February 14, 2007, respectively). John works as a Salesman for LMN Corporation and Lucy is an Administrative Assistant for ZYX Corporation. See the client's tax return documents for more information. Lucy began a Typing Service during 2020. See the Trial Balance for income and expenses. Both the computers and software were purchased on 07/15/2020. Lucy would like to take the maximum depreciation available on these assets. Assume the Schedule C net profit does not qualify as a qualified business income under Section 199A. The Miegel’s received qualified dividends from LMN Corporation and interest from First National Bank.

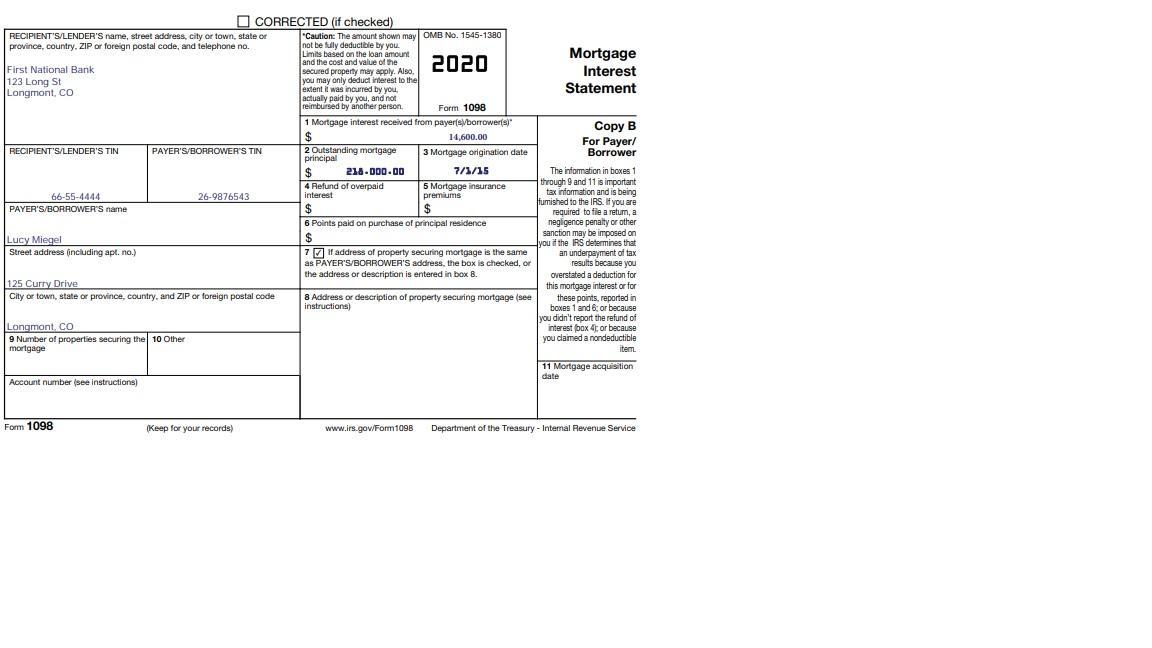

See the client's tax return documents for more information. The Miegel’s reported the following payments during the year:

• $2,000 of medical expenses (after insurance)

• $340 of prior year state income tax paid

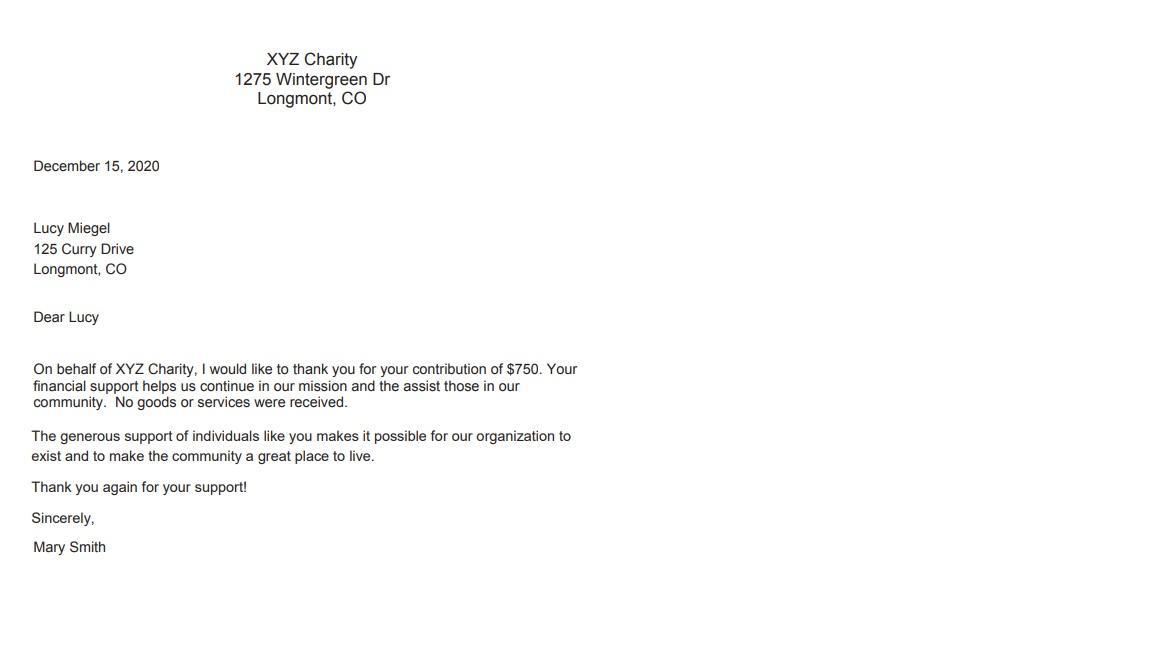

• $750 charitable contribution to a qualified charity

• $14,600 of mortgage interest

• $6,900 of real estate taxes

Required:

1. Prepare the Miegel’s 2020 federal tax return. Use Form 1040, Schedule 1, Schedule 2, Schedule A (even if using the standard deduction), Schedule B, Schedule C, Schedule SE, and Form 4562 (with Schedule C).

Documents (screenshots):

Account ID Account Description 102000 105000 161001 161002 161301 161302 201000 203000 301000 310000 402001 420001 450000 Lucy's Typing Services General Ledger Trial Balance As of December 31, 2020 602001 603001 605001 635101 640001 Cash Accounts Receivable Software A/D - Software Computers A/D - Computers Accounts Payable Notes Payable Capital Retained Earnings Refunds Received Typing Income Other Income Amortization Expense Bank S.C./Fees Depreciation Expense Insurance Interest Expense Meals 659001 659002 662001 665001 711001 712001 720001 723001 730001 Telephone 731001 Travel/Motel Entertainment Miscellaneous Expense Office Expense Postage/Freight Professional Fees Rent Subscriptions Total: Debit Amt Credit Amt 6,900.00 300.00 1,200.00 1,200.00 400.00 2,000.00 8,000.00 10,000.00 10,000.00

Step by Step Solution

3.54 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Form 1040 Filers John and Lucy Miegel Address 123 Main Street Anytown CA 91234 Filing status Married filing jointly Dependents Jason born 07222000 MaryJane born 06062002 and Sally born 02142007 Income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started