Answered step by step

Verified Expert Solution

Question

1 Approved Answer

John and Patricia are auditors for a regional CPA firm and travel regularly to client locations. The firm invoices their time to clients at a

John and Patricia are auditors for a regional CPA firm and travel regularly to client locations. The firm invoices their time to clients at a rate of $ hour as spon as jobs are completed. The firm recognizes the cost of their labor at $ hour, including payroll taxes and benefits.

a If John and Patricia spend a combined hours at one client and complete the audit while there, how much labor cost will the firm recognize for this job?

Labor cost

$

Ruth was attempting to estimate a model for her small business's overhead costs. She is sure that overhead costs are driven primarily by production, but she also knows that this cost isn't entirely variable. So she grabbed the last months of production and overhead cost data, listed it out, and plotted it as follows.

tableMonth# of Units Produced,Overhead Cost$

Viewing

Accounting

Questio

Accounting

Questio

Accounting

Questio

Multiple Ch

Questio

Multiple Ch

Questio

Multiple C

Knowledge Check

Adjustments are itemized on

Form W

Schedule

Form

Form W

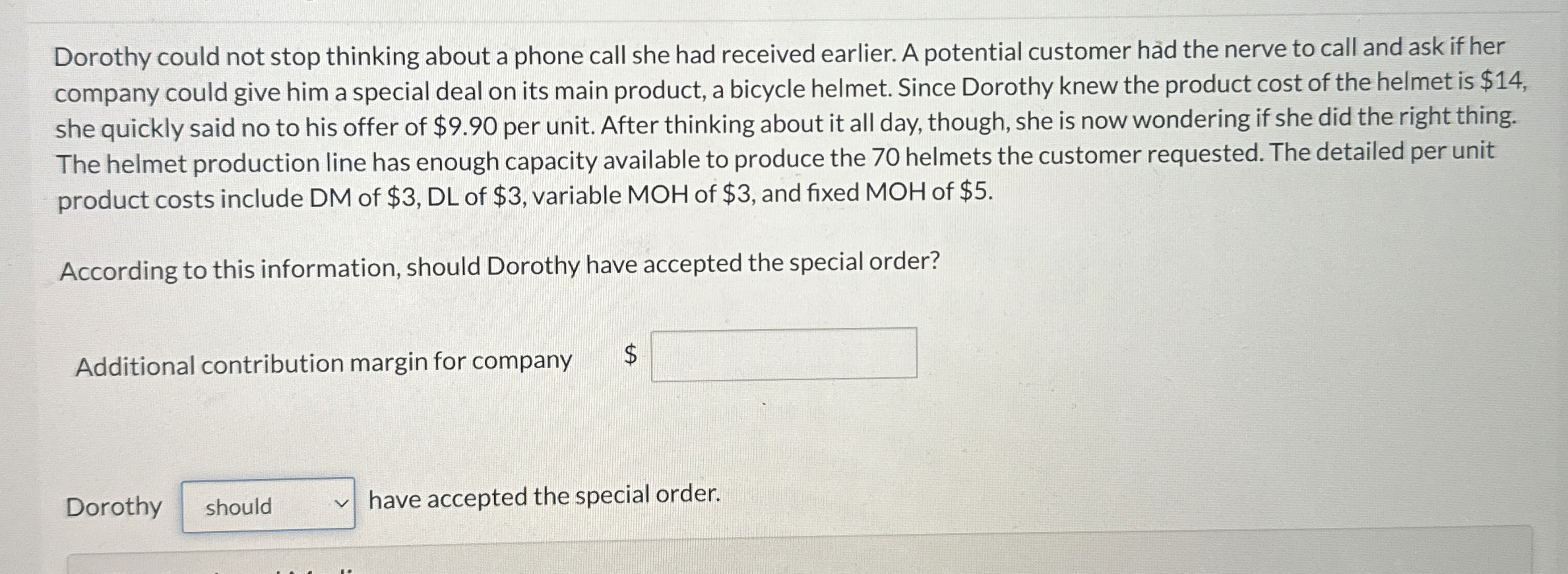

Dorothy could not stop thinking about a phone call she had received earlier. A potential customer hd the nerve to call and ask if her

company could give him a special deal on its main product, a bicycle helmet. Since Dorothy knew the product cost of the helmet is $

she quickly said no to his offer of $ per unit. After thinking about it all day, though, she is now wondering if she did the right thing.

The helmet production line has enough capacity available to produce the helmets the customer requested. The detailed per unit

product costs include DM of $ DL of $ variable MOH of $ and fixed MOH of $

According to this information, should Dorothy have accepted the special order?

Additional contribution margin for company $

Dorothy

have accepted the special order.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started