Question

John Bear 1% 25, Net 45 Nov. 21 ??198 $3,390 Molly Maid 1% 25, Net 45 Nov. 26 ?? 199 3,955 Lovely Homes 1% 25,

John Bear 1% 25, Net 45 Nov. 21 ??198 $3,390

Molly Maid 1% 25, Net 45 Nov. 26 ??199 3,955

Lovely Homes 1% 25, Net 45 Nov. 29 ??200 3,616

Total $10,961

Bridgestone Tire Net 40 Nov. 16 ??BT-329 $1,356

Snowmaster Tire 2% 15, Net 45 Nov. 27 ??ST-924 3,164

Michelin Tire 1% 25, Net 60 Nov. 28 ??MT-736 2,260

Total $6,780

Create journal entries, , as if they are all done in the general journal.

Dec 1: Complete Tire repurchased and cancelled 15,000 of its common shares @ $1.25 per share. All 100,000 common shares outstanding prior to this transaction were issued on Jan. 1, 2018, when the company commenced operations. There have been no other common share transactions since Jan. 1, 2018 (cheque 300). There is no HST paid on this transaction. Payment is made to Complete Tires broker, TD bank. Use Misc. Payment do not set up a vendor.

Dec 1: Received cheque #724 from Lovely Homes in full payment of invoice ??200, net of the available discount.

Dec 2: Paid Michelin Tire invoice ??MT-736 (cheque 301), net of the available discount.

Dec 6: Sold 4 winter tires to Your Name (you are the customer enter your first and last name),

invoice ??201, $700 plus HST. You paid by personal cheque #37. Enter this transaction as a

Misc. Receipt do not set up a new customer. Note: there are no sales discounts on cash sales.

Dec 7: Sold 12 winter tires for $200 each to Lorie Lynn on account (1% 25 Net 45), invoice ??202, $2,400 plus HST.

Dec 8: Purchased 4 winter tires for $600 plus HST from Dundas Automotive, invoice ??DA1018. Purchase terms are 3% 20, Net 60.

Dec 8: Received cheque #384 from Molly Maid in full payment of invoice ??199, net of the available discount.

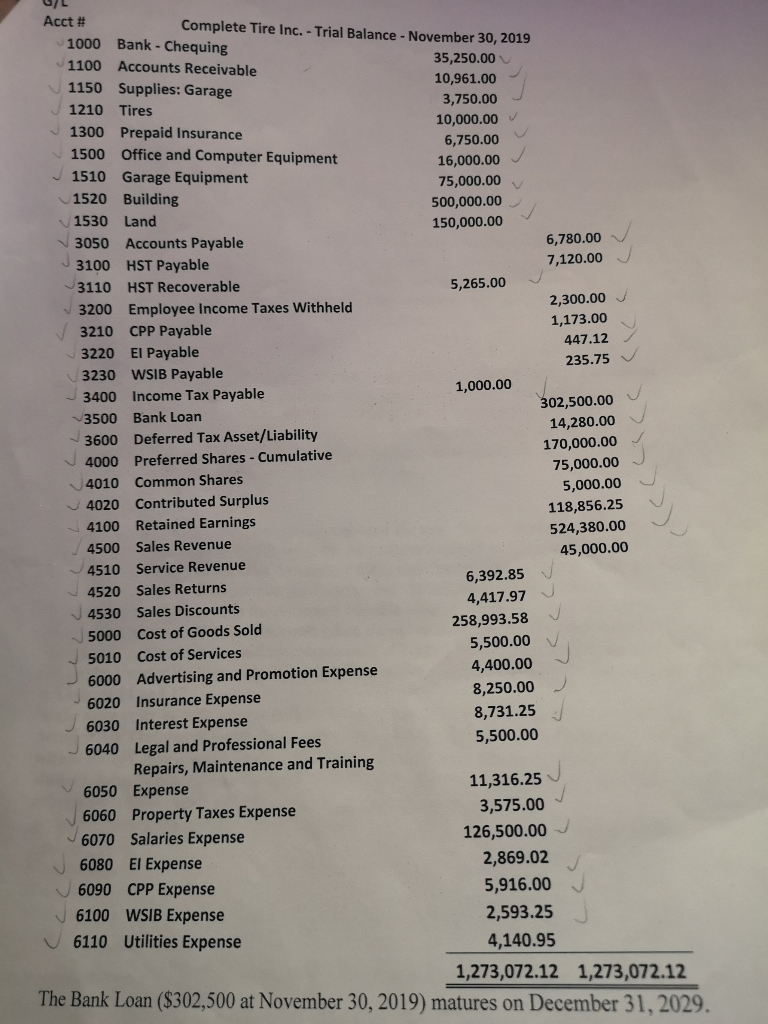

447.12 G/L Acct # Complete Tire Inc. - Trial Balance - November 30, 2019 1000 Bank - Chequing 1100 Accounts Receivable 35,250.00 1150 Supplies: Garage 10,961.00 1210 3,750.00 Tires 1300 Prepaid Insurance 10,000.00 6,750.00 1500 Office and Computer Equipment 16,000.00 1510 Garage Equipment 75,000.00 1520 Building 500,000.00 1530 Land 150,000.00 3050 Accounts Payable 6,780.00 3100 HST Payable 7,120.00 3110 HST Recoverable 5,265.00 3200 Employee Income Taxes Withheld 2,300.00 3210 CPP Payable 1,173.00 3220 El Payable 235.75 3230 WSIB Payable 3400 Income Tax Payable 1,000.00 302,500.00 3500 Bank Loan 14,280.00 3600 Deferred Tax Asset/Liability 170,000.00 4000 Preferred Shares - Cumulative 75,000.00 4010 Common Shares 5,000.00 4020 Contributed Surplus 118,856.25 4100 Retained Earnings 524,380.00 4500 Sales Revenue 45,000.00 4510 Service Revenue 6,392.85 V 4520 Sales Returns 4,417.97 4530 Sales Discounts 258,993.58 5000 Cost of Goods Sold 5,500.00 5010 Cost of Services 6000 Advertising and Promotion Expense 4,400.00 6020 Insurance Expense 8,250.00 6030 Interest Expense 8,731.25 6040 Legal and Professional Fees 5,500.00 Repairs, Maintenance and Training 6050 Expense 6060 Property Taxes Expense 3,575.00 6070 Salaries Expense 126,500.00 6080 El Expense 2,869.02 6090 CPP Expense 5,916.00 6100 WSIB Expense 2,593.25 6110 Utilities Expense 4,140.95 1,273,072.12 1,273,072.12 The Bank Loan ($302,500 at November 30, 2019) matures on December 31, 2029. 11,316.25 447.12 G/L Acct # Complete Tire Inc. - Trial Balance - November 30, 2019 1000 Bank - Chequing 1100 Accounts Receivable 35,250.00 1150 Supplies: Garage 10,961.00 1210 3,750.00 Tires 1300 Prepaid Insurance 10,000.00 6,750.00 1500 Office and Computer Equipment 16,000.00 1510 Garage Equipment 75,000.00 1520 Building 500,000.00 1530 Land 150,000.00 3050 Accounts Payable 6,780.00 3100 HST Payable 7,120.00 3110 HST Recoverable 5,265.00 3200 Employee Income Taxes Withheld 2,300.00 3210 CPP Payable 1,173.00 3220 El Payable 235.75 3230 WSIB Payable 3400 Income Tax Payable 1,000.00 302,500.00 3500 Bank Loan 14,280.00 3600 Deferred Tax Asset/Liability 170,000.00 4000 Preferred Shares - Cumulative 75,000.00 4010 Common Shares 5,000.00 4020 Contributed Surplus 118,856.25 4100 Retained Earnings 524,380.00 4500 Sales Revenue 45,000.00 4510 Service Revenue 6,392.85 V 4520 Sales Returns 4,417.97 4530 Sales Discounts 258,993.58 5000 Cost of Goods Sold 5,500.00 5010 Cost of Services 6000 Advertising and Promotion Expense 4,400.00 6020 Insurance Expense 8,250.00 6030 Interest Expense 8,731.25 6040 Legal and Professional Fees 5,500.00 Repairs, Maintenance and Training 6050 Expense 6060 Property Taxes Expense 3,575.00 6070 Salaries Expense 126,500.00 6080 El Expense 2,869.02 6090 CPP Expense 5,916.00 6100 WSIB Expense 2,593.25 6110 Utilities Expense 4,140.95 1,273,072.12 1,273,072.12 The Bank Loan ($302,500 at November 30, 2019) matures on December 31, 2029. 11,316.25Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started