Question

John Brady borrowed $24,000 from Morgan Stanley. He was forced to make 16 equal payments of principal. These were to be made annually with the

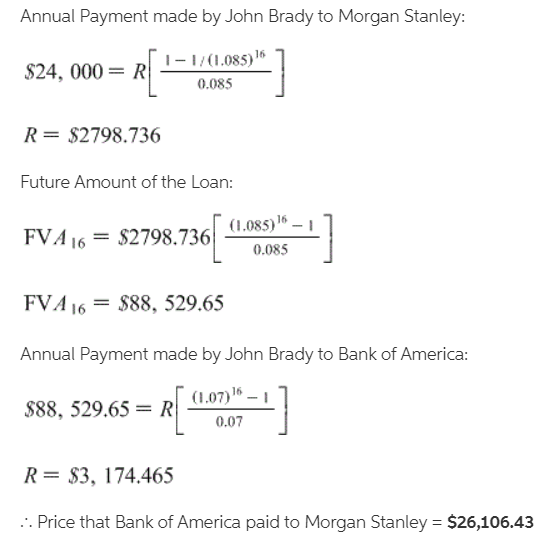

John Brady borrowed $24,000 from Morgan Stanley. He was forced to make 16 equal payments of principal. These were to be made annually with the first payment due exactly one year after he received the $24,000. Mr. Brady also had to make annual payments of interest to the loan holder at an annual effective rate of 8.5%. Immediately after the loan is made, Bank of America purchases the right to receive all of Mr. Brady's Payments from Morgan Stanley. The price paid by Bank of America resulted in them having a 7% annual yield on their 16 year investment. Find the price that Bank of America paid Morgan Stanley.

The question is how to get the answer 26106.43?

Annual Payment made by John Brady to Morgan Stanley: 1 [I-1/(1.085) $24, 000 = R- 0.085 R= $2798.736 Future Amount of the Loan: FVA 16 = $21 FVA 16 = $2798.736 . (1.085) 6 - 1 0.085 FVA16 = $88, 529.65 Annual Payment made by John Brady to Bank of America: 588, 529.65 = r { cura ] R= $3, 174.465 :: Price that Bank of America paid to Morgan Stanley = $26,106.43Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started