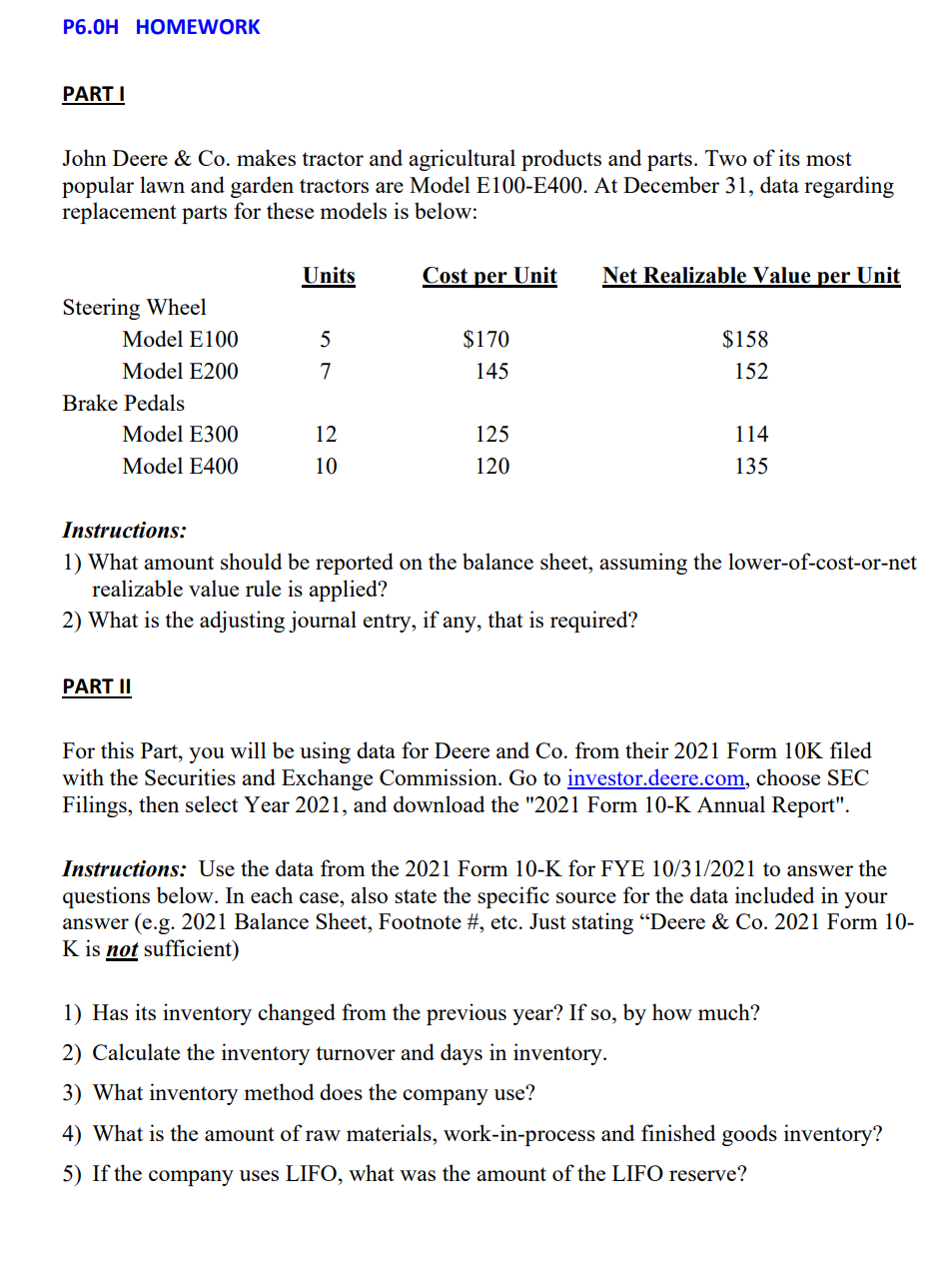

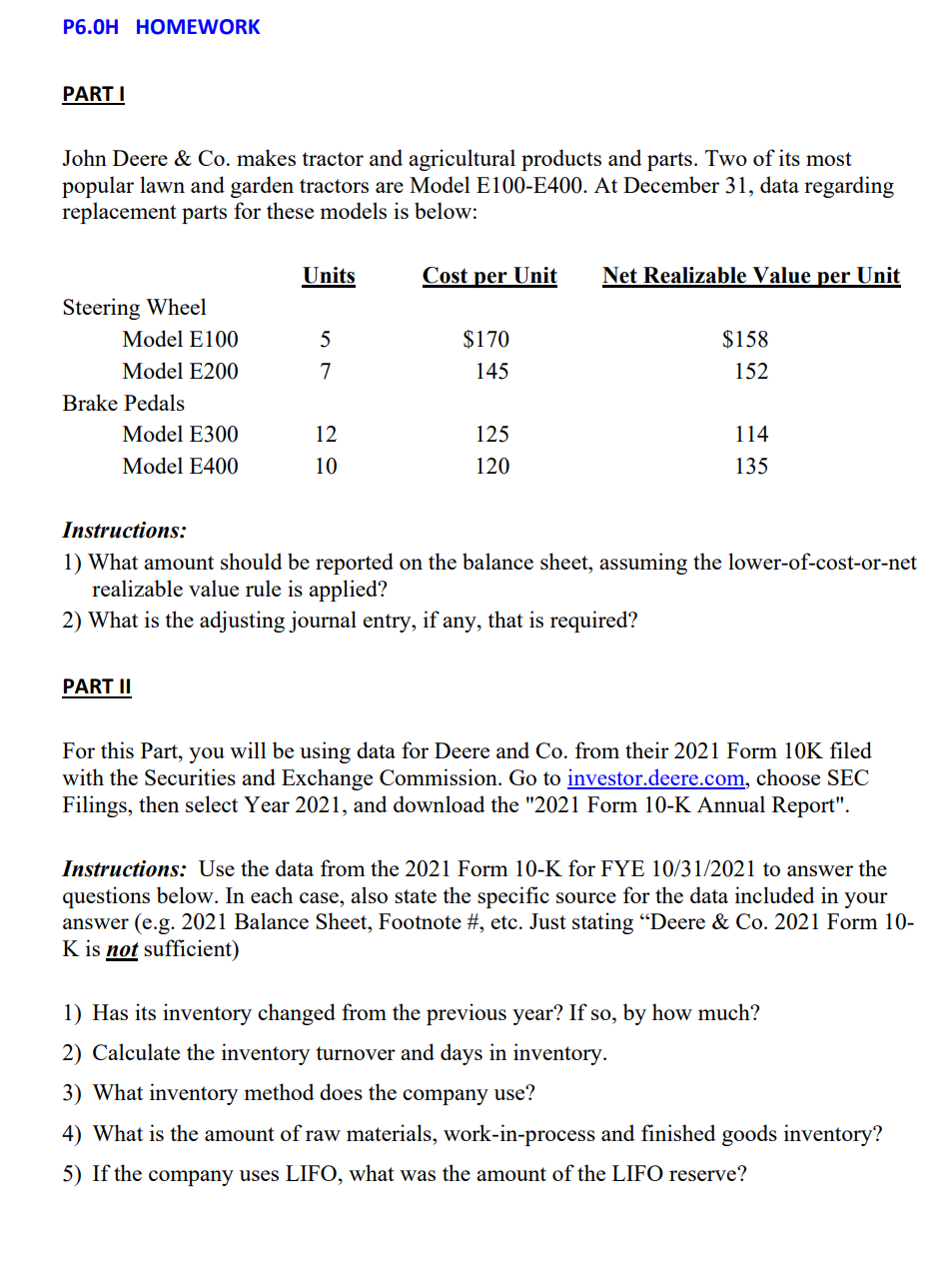

John Deere \& Co. makes tractor and agricultural products and parts. Two of its most popular lawn and garden tractors are Model E100-E400. At December 31, data regarding replacement parts for these models is below: Instructions: 1) What amount should be reported on the balance sheet, assuming the lower-of-cost-or-net realizable value rule is applied? 2) What is the adjusting journal entry, if any, that is required? PART II For this Part, you will be using data for Deere and Co. from their 2021 Form 10K filed with the Securities and Exchange Commission. Go to choose SEC Filings, then select Year 2021, and download the "2021 Form 10-K Annual Report". Instructions: Use the data from the 2021 Form 10-K for FYE 10/31/2021 to answer the questions below. In each case, also state the specific source for the data included in your answer (e.g. 2021 Balance Sheet, Footnote #, etc. Just stating "Deere \& Co. 2021 Form 10K is not sufficient) 1) Has its inventory changed from the previous year? If so, by how much? 2) Calculate the inventory turnover and days in inventory. 3) What inventory method does the company use? 4) What is the amount of raw materials, work-in-process and finished goods inventory? 5) If the company uses LIFO, what was the amount of the LIFO reserve? John Deere \& Co. makes tractor and agricultural products and parts. Two of its most popular lawn and garden tractors are Model E100-E400. At December 31, data regarding replacement parts for these models is below: Instructions: 1) What amount should be reported on the balance sheet, assuming the lower-of-cost-or-net realizable value rule is applied? 2) What is the adjusting journal entry, if any, that is required? PART II For this Part, you will be using data for Deere and Co. from their 2021 Form 10K filed with the Securities and Exchange Commission. Go to choose SEC Filings, then select Year 2021, and download the "2021 Form 10-K Annual Report". Instructions: Use the data from the 2021 Form 10-K for FYE 10/31/2021 to answer the questions below. In each case, also state the specific source for the data included in your answer (e.g. 2021 Balance Sheet, Footnote #, etc. Just stating "Deere \& Co. 2021 Form 10K is not sufficient) 1) Has its inventory changed from the previous year? If so, by how much? 2) Calculate the inventory turnover and days in inventory. 3) What inventory method does the company use? 4) What is the amount of raw materials, work-in-process and finished goods inventory? 5) If the company uses LIFO, what was the amount of the LIFO reserve