Answered step by step

Verified Expert Solution

Question

1 Approved Answer

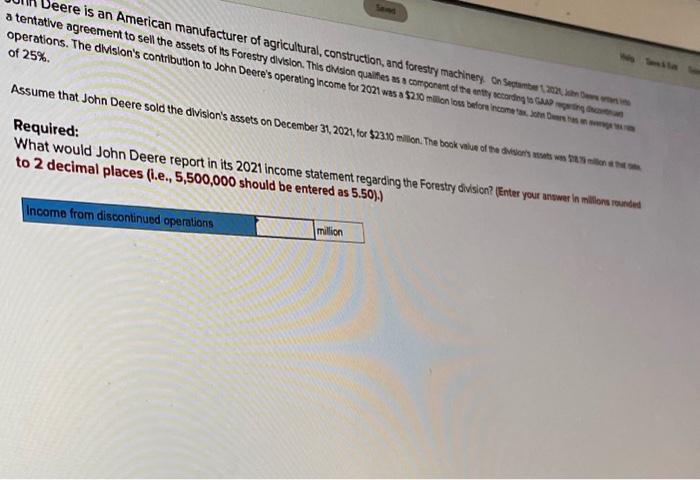

John Deere is an American manufacturer of agricultural, construction, and forestry machinery. On September 12021 a tentative agreement to sell the assets of Forestry division.

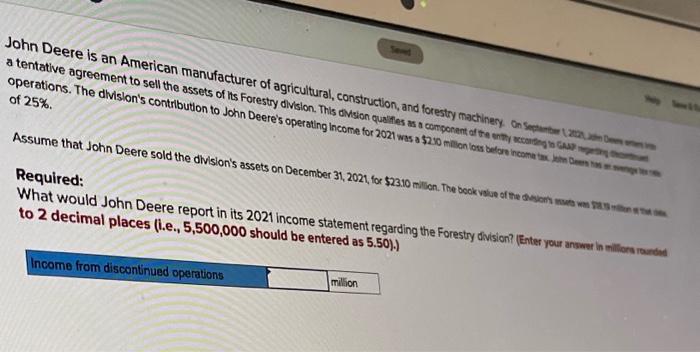

John Deere is an American manufacturer of agricultural, construction, and forestry machinery. On September 12021 a tentative agreement to sell the assets of Forestry division. This division qualifies as a component of the entity according to GAAP operations . The division's contribution to John Deere's operating income for 2021 was a $2.10 million loss before income tax Deere has average of 25 %. Assume that John Deere sold the division's assets on December 31 , 2021 , for $23.10 million . The book value of the division's assets was 18.19 that Required : What would John Deere report in its 2021 income statement regarding the Forestry division ? ( Enter your answer in millions rounded to 2 decimal places ( i.e. , 5,500,000 should be entered as 5.50 ) ) million Income from discontinued operations

of 25% What would John Deere report in its 2021 income statement regarding the Forestry division? (Enter your unwwer in milloms ranum to 2 decimal places (i.e., 5,500,000 should ho a.c. . .). of 25% Assume thot What would John Deere report in its 2021 income statement regarding the Forestyy division? (Enter your answe in millome ionsed to 2 decimal places (i.e., 5,500,000 should be enterad ae EEm.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started