Answered step by step

Verified Expert Solution

Question

1 Approved Answer

John Doe owns a proprietorship JDC, with a taxation year ending on December 31. For simplicity, John has used tax procedures to calculate JDC's

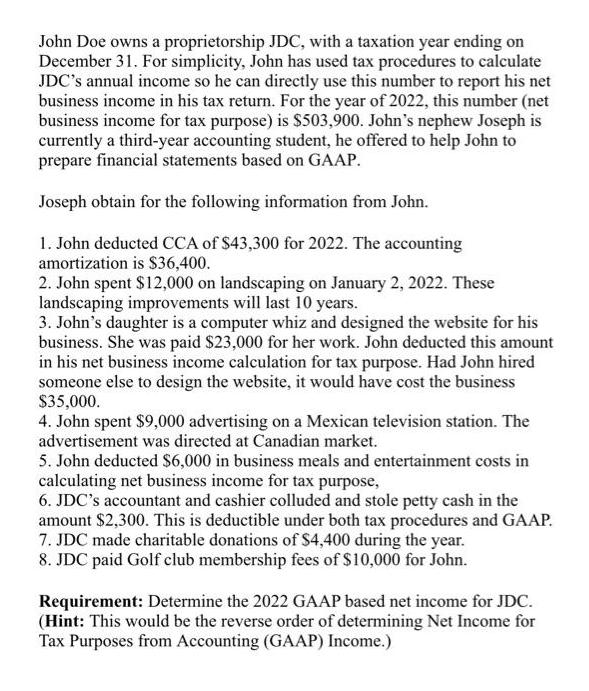

John Doe owns a proprietorship JDC, with a taxation year ending on December 31. For simplicity, John has used tax procedures to calculate JDC's annual income so he can directly use this number to report his net business income in his tax return. For the year of 2022, this number (net business income for tax purpose) is $503,900. John's nephew Joseph is currently a third-year accounting student, he offered to help John to prepare financial statements based on GAAP. Joseph obtain for the following information from John. 1. John deducted CCA of $43,300 for 2022. The accounting amortization is $36,400. 2. John spent $12,000 on landscaping on January 2, 2022. These landscaping improvements will last 10 years. 3. John's daughter is a computer whiz and designed the website for his business. She was paid $23,000 for her work. John deducted this amount in his net business income calculation for tax purpose. Had John hired someone else to design the website, it would have cost the business $35,000. 4. John spent $9,000 advertising on a Mexican television station. The advertisement was directed at Canadian market. 5. John deducted $6,000 in business meals and entertainment costs in calculating net business income for tax purpose, 6. JDC's accountant and cashier colluded and stole petty cash in the amount $2,300. This is deductible under both tax procedures and GAAP. 7. JDC made charitable donations of $4,400 during the year. 8. JDC paid Golf club membership fees of $10,000 for John. Requirement: Determine the 2022 GAAP based net income for JDC. (Hint: This would be the reverse order of determining Net Income for Tax Purposes from Accounting (GAAP) Income.) John Doe owns a proprietorship JDC, with a taxation year ending on December 31. For simplicity, John has used tax procedures to calculate JDC's annual income so he can directly use this number to report his net business income in his tax return. For the year of 2022, this number (net business income for tax purpose) is $503,900. John's nephew Joseph is currently a third-year accounting student, he offered to help John to prepare financial statements based on GAAP. Joseph obtain for the following information from John. 1. John deducted CCA of $43,300 for 2022. The accounting amortization is $36,400. 2. John spent $12,000 on landscaping on January 2, 2022. These landscaping improvements will last 10 years. 3. John's daughter is a computer whiz and designed the website for his business. She was paid $23,000 for her work. John deducted this amount in his net business income calculation for tax purpose. Had John hired someone else to design the website, it would have cost the business $35,000. 4. John spent $9,000 advertising on a Mexican television station. The advertisement was directed at Canadian market. 5. John deducted $6,000 in business meals and entertainment costs in calculating net business income for tax purpose, 6. JDC's accountant and cashier colluded and stole petty cash in the amount $2,300. This is deductible under both tax procedures and GAAP. 7. JDC made charitable donations of $4,400 during the year. 8. JDC paid Golf club membership fees of $10,000 for John. Requirement: Determine the 2022 GAAP based net income for JDC. (Hint: This would be the reverse order of determining Net Income for Tax Purposes from Accounting (GAAP) Income.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the 2022 GAAPbased net income for JDC John Does proprietorship youll need to start with ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started