Answered step by step

Verified Expert Solution

Question

1 Approved Answer

John Eros is a carpenter and his wife Janell works as a bank teller. John earns a rate of $23.22 before overtime and benefits and

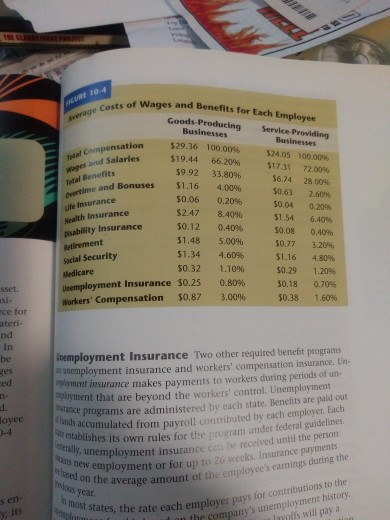

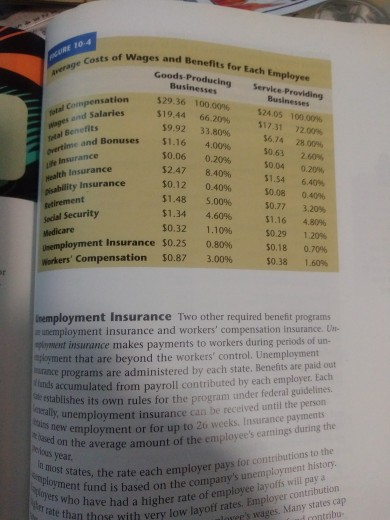

John Eros is a carpenter and his wife Janell works as a bank teller. John earns a rate of $23.22 before overtime and benefits and Janell earns a rate of $18.50 Using the percentages shown in figure 10-4, calculate the amount of compensation John and Janell would earn for each of the benefits listed in the figure. What is the total compensation for each person?

Average Costs al Compensation wage and Salaries Total Benefits Overtime and Bonuses ufe Insurance Health Insurance ability Insurance tirement Social Security of Wages and Benefits for Each Employee Goods Producing Businesses Service Providing Businesses $29.36 100.00% 524.05 100.00 $19.44 66,20% $17.31 72.00% 59.92 33.80% 56.74 28.00 51.16 4.00% 50.63 2.60% $0.06 0.20% 50.04 0209 $2.47 8.40% 51.54 6.40% 30.12 0.409% 50.08 0.40% $1.48 5.00% 50.77 3.20 $1.34 4.60% 51.16 4.80% $0.32 1.10% 50.29 1.209 $0.18 0.70% 50.38 1.60% sset Medicare Unemployment Insurance $0.25 Workers' Compensation $0.87 0.80% 3.00% rce for ateri- In be ges loyee 3-4 Inemployment Insurance Two other required benefit programs unemployment insurance and workers' compensation insurance. Um yment insurance makes payments to workers during periods of un- loyment that are beyond the workers' control. Unemployment programs are administered by each state. Benefits are paid out accumulated from payroll contributed by each employer. Each shes its own rules for the federal guidelines gram under leder lemployment insurance can be received until the person einployment or for up to 26 weeks. Insurance payments he average amount of the entployee's earnings during the e establishes its own rul endly, unemploym ins new employ Besed on the avera sen- most states slopes paysunemplois will do states, the rate each employer pays fach employer pays for contributions to the the company's unemployment history, layoffs will pay a average Costs - Compensation and Salaries al Benefits tine and Bonuses sts of Wages and Benefits for Each ents for each Employee Goods Producing Businesses Service Providing Businesses $29.36 100.0096 524.05 100.000 $19.44 66,20% $17.31 72.00 59.92 33.80% 56.74 28.00 51.16 4.00% 50.63 2.60 50.06 0.20% 50.04 0.2014 52.47 8.40% 51.54 64 $0.12 0.40% 50.08 0.40% 51.48 5.00% 50.77 3.20 $1.34 4.60% $1.16 4.80% 50.32 1.10% 50.29 1.20% $0.18 0.70% Insurance Health Insurance ability Insurance Retirement al Security Medicare employment Insurance $0.25 Workers' Compensation $0.87 0.80% 3.00% 50.38 1.60% Inemployment Insurance Two other required benefit programs unemployment insurance and workers' compensation insurance. Un met insurance makes payments to workers during periods of un- sployment that are beyond the workers' control. Unemployment nance programs are administered by each state. Benefits are paid out and accumulated from payroll contributed by each employer. Each Establishes its own rules for the program under federal guidelines unemployment insurance can be received until the person w employment or for up to 26 weeks. Insurance payments the average amount of the emplovee's earnings during the tally unemploym ins new employ Rased on the avera most states, the rate ployment fund is players who have petrate than the the rate each employer pays for contributions to the id is based on the company's unemployment history have had a higher rate of employee layoffs will paya ose with war la lavofl rates. Employer conto loyee's wages. Many states cap woontribu

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started