Question

John has just resigned from his $8,000-a-month job to start up his own accounting service firm. He has paid a non-refundable 3-month advanced rental payment

John has just resigned from his $8,000-a-month job to start up his own accounting service firm. He has paid a non-refundable 3-month advanced rental payment of $9,000 for an office space. To ensure his continued tenancy, the owner has agreed that after the first three months, the rental will be reduced to $2,500 per month.

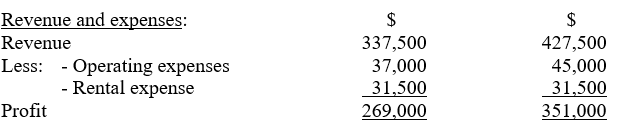

John estimated that his yearly revenue and expenses would vary with the number of hours he intends to work per year. He has the following estimates for his first year of operation:

Number of hours worked1,500 hours1,900 hours

Number of hours worked1,500 hours1,900 hours

Revenue and expenses: Revenue Less: Operating expenses -Rental expense Profit $ $ 337,500 427,500 37,000 45,000 31,500 31,500 269,000 351,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The given information provides details about Johns decision to start his own accounting service ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started