Question

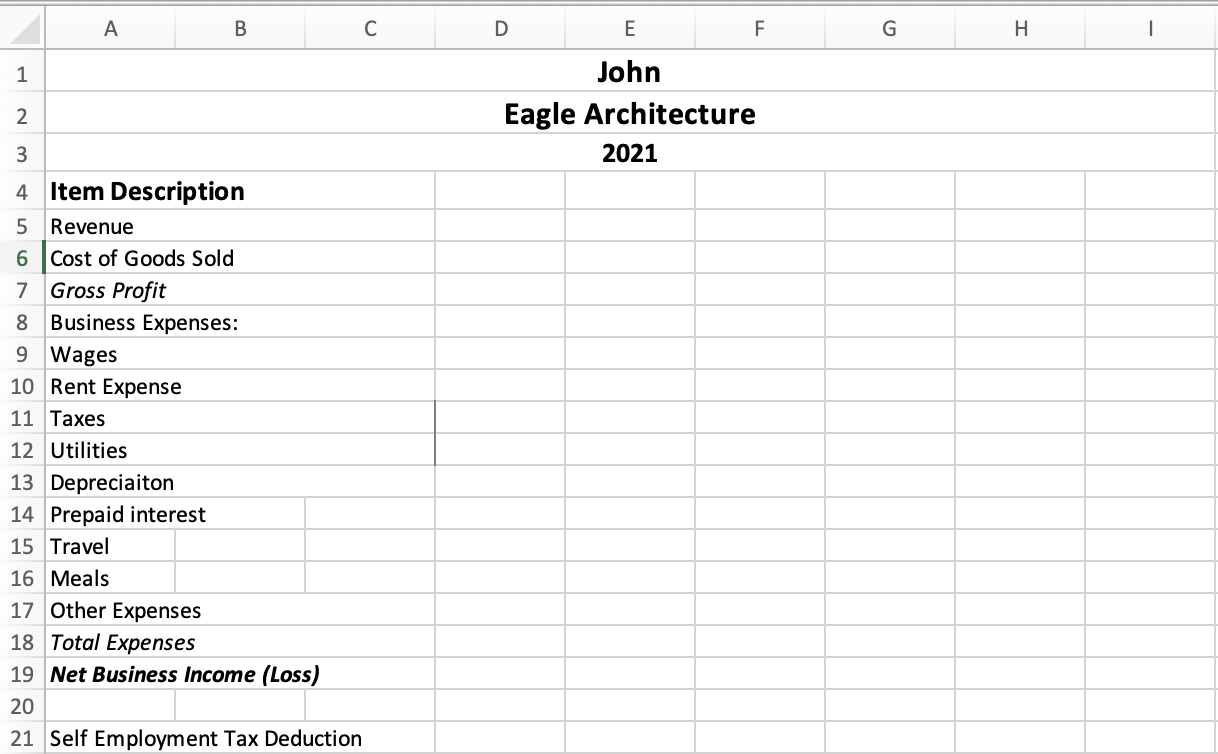

John is an architect and he manages an architectural firm, Eagle Architecture (EA), as a sole proprietorship since 2012. A) 2021 was a successful year

John is an architect and he manages an architectural firm, Eagle Architecture (EA), as a sole proprietorship since 2012.

A) 2021 was a successful year for EA earning and receiving $550,000 in gross receipts from client fees charged.

B) EA rents an office in the design district where they meet with clients and conducts business. The rent includes all utilities. EA paid $26,000 in rent expense in 2021. In December 2021 the landlord offered to maintain the same yearly rent cost and John could receive an additional month's rent for free if he prepaid his 2022 year rent in advance. John agreed and paid an additional $26,000 on December 1, 2021 to cover January 2022 through January 2023 rent.

C) EA obtained a business loan from Wells Fargo Bank and paid $4,500 in prepaid interest for April 1, 2021 through March 30, 2022.

D) EA has a few employees, including a full-time architect, a part-time architect and an administrative assistant. The combined wages for these employees is $160,000. Payroll taxes including for these employees is $12,000.

E) John took different business clients to see several home Miami Heat games followed by dinners at nearby restaurants where business was discussed. The meals were not considered lavish. The total cost for the Heat tickets and accompanying meals were $1,400 and $760, respectively.

F) In August 2021, John traveled to Mexico City to meet with a client regarding proposals. The trip last ten days, six were business related and four were personal as John remained to visit with his cousin. John paid $650 in airfare, $1,500 for hotel and $500 for a rental car. All deductible food was paid for during the trip.

G) The depreciation for the year on the fixed assets owned by VA are estimated to total $4,600.

H) All of EAs business transactions are properly documented and supported by receipts/invoices. In addition to deductible portion of the items listed above the business will have an additional $5,200 of deductible other expenses.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started