Answered step by step

Verified Expert Solution

Question

1 Approved Answer

John is filing his Income Tax Return with the Government. He can choose either to truthfully report his income, $100,000, or to report a

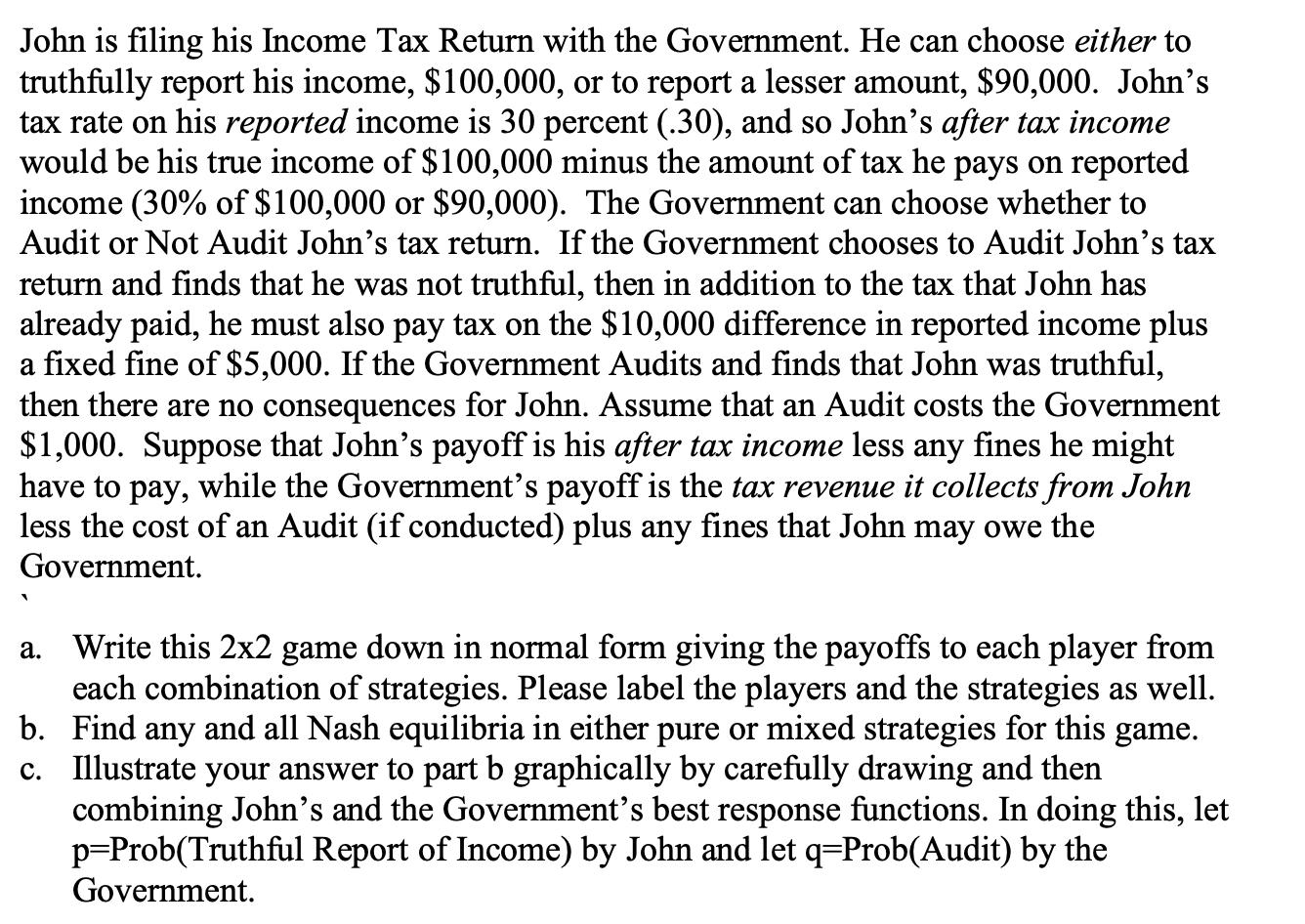

John is filing his Income Tax Return with the Government. He can choose either to truthfully report his income, $100,000, or to report a lesser amount, $90,000. John's tax rate on his reported income is 30 percent (.30), and so John's after tax income would be his true income of $100,000 minus the amount of tax he pays on reported income (30% of $100,000 or $90,000). The Government can choose whether to Audit or Not Audit John's tax return. If the Government chooses to Audit John's tax return and finds that he was not truthful, then in addition to the tax that John has already paid, he must also pay tax on the $10,000 difference in reported income plus a fixed fine of $5,000. If the Government Audits and finds that John was truthful, then there are no consequences for John. Assume that an Audit costs the Government $1,000. Suppose that John's payoff is his after tax income less any fines he might have to pay, while the Government's payoff is the tax revenue it collects from John less the cost of an Audit (if conducted) plus any fines that John may owe the Government. Write this 2x2 game down in normal form giving the payoffs to each player from each combination of strategies. Please label the players and the strategies as well. Find any and all Nash equilibria in either pure or mixed strategies for this game. c. Illustrate your answer to part b graphically by carefully drawing and then b. combining John's and the Government's best response functions. In doing this, let p=Prob(Truthful Report of Income) by John and let q=Prob(Audit) by the Government. a.

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Johns Strategies Truthful Reporting Misreporting Governments Strategies Audit Do Not Audit Payoffs to John If John truthfully reports his income and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started