Answered step by step

Verified Expert Solution

Question

1 Approved Answer

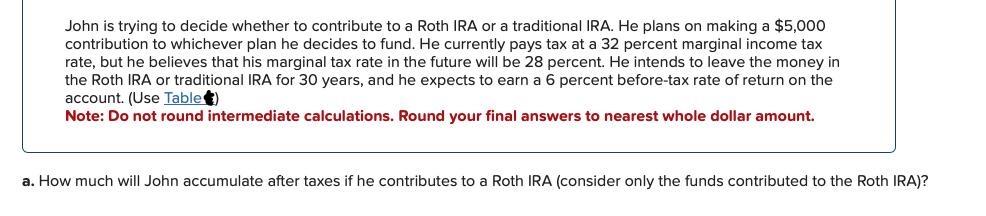

John is trying to decide whether to contribute to a Roth IRA or a traditional IRA. He plans on making a $5,000 contribution to

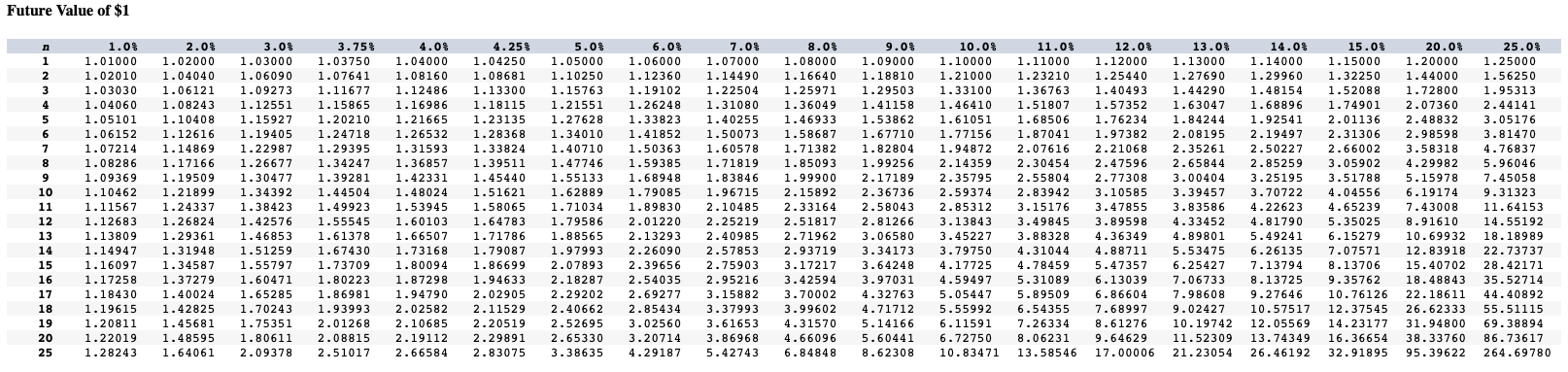

John is trying to decide whether to contribute to a Roth IRA or a traditional IRA. He plans on making a $5,000 contribution to whichever plan he decides to fund. He currently pays tax at a 32 percent marginal income tax rate, but he believes that his marginal tax rate in the future will be 28 percent. He intends to leave the money in the Roth IRA or traditional IRA for 30 years, and he expects to earn a 6 percent before-tax rate of return on the account. (Use Table) Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar amount. a. How much will John accumulate after taxes if he contributes to a Roth IRA (consider only the funds contributed to the Roth IRA)? Future Value of $1 n 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 25 1.0% 7.0% 1.07000 8.0% 1.08000 1.01000 2.0% 1.02000 1.04040 1.06121 1.04060 1.08243 10.0% 1.10000 1.21000 1.02010 1.03030 4.0% 1.04000 1.08160 1.12486 1.16986 1.21665 3.0% 3.75% 1.03000 1.03750 1.06090 1.07641 1.09273 1.11677 1.12551 1.15865 1.15927 1.20210 1.06152 1.12616 1.19405 1.24718 1.07214 1.14869 1.22987 1.29395 1.08286 1.17166 1.26677 1.34247 1.09369 1.19509 1.30477 1.39281 1.10462 1.21899 1.34392 1.44504 1.11567 1.24337 1.38423 1.49923 11.0% 12.0% 13.0% 14.0% 15.0% 20.0% 25.0% 1.11000 1.12000 1.13000 1.14000 1.15000 1.20000 1.25000 1.23210 1.25440 1.27690 1.29960 1.32250 1.44000 1.56250 1.36763 1.40493 1.44290 1.48154 1.52088 1.72800 1.95313 1.51807 1.57352 1.63047 1.68896 1.74901 2.07360 2.44141 1.68506 1.76234 1.84244 1.92541 2.01136 2.48832 3.05176 1.87041 1.97382 2.08195 2.19497 2.31306 2.98598 2.07616 2.21068 2.35261 2.50227 2.66002 3.58318 1.05101 1.10408 4.25% 5.0% 6.0% 9.0% 1.04250 1.05000 1.06000 1.09000 1.08681 1.10250 1.12360 1.14490 1.16640 1.18810 1.13300 1.15763 1.19102 1.22504 1.25971 1.29503 1.33100 1.18115 1.21551 1.26248 1.31080 1.36049 1.41158 1.46410 1.23135 1.27628 1.33823 1.40255 1.46933 1.53862 1.61051 1.26532 1.28368 1.34010 1.41852 1.50073 1.58687 1.67710 1.77156 1.31593 1.33824 1.40710 1.50363 1.60578 1.71382 1.82804 1.94872 1.36857 1.39511 1.47746 1.59385 1.71819 1.85093 1.99256 2.14359 2.30454 2.47596 2.65844 2.85259 3.05902 4.29982 1.42331 1.45440 1.55133 1.68948 1.83846 1.99900 2.17189 2.35795 2.55804 2.77308 3.00404 3.25195 3.51788 5.15978 7.45058 1.48024 1.51621 1.62889 1.79085 1.96715 2.15892 2.36736 2.59374 2.83942 3.10585 3.39457 3.70722 4.04556 6.19174 9.31323 1.53945 1.58065 1.71034 1.89830 2.10485 2.33164 2.58043 2.85312 3.15176 3.47855 3.83586 4.22623 4.65239 7.43008 11.64153 1.60103 1.64783 1.79586 2.01220 2.25219 2.51817 2.81266 3.13843 3.49845 3.89598 4.33452 4.81790 5.35025 8.91610 14.55192 1.61378 1.66507 1.71786 1.88565 2.71962 3.06580 3.45227 3.88328 4.36349 4.89801 5.49241 6.15279 10.69932 18.18989 1.67430 1.73168 1.79087 1.97993 2.26090 2.57853 2.93719 3.34173 3.79750 4.31044 4.88711 5.53475 6.26135 7.07571 12.83918 22.73737 1.73709 1.80094 1.86699 2.07893 2.39656 2.75903 3.17217 3.64248 4.17725 4.78459 5.47357 6.25427 7.13794 8.13706 15.40702 28.42171 1.80223 1.87298 1.94633 2.18287 2.54035 2.95216 3.42594 3.97031 4.59497 5.31089 6.13039 7.06733 8.13725 9.35762 18.48843 35.52714 1.18430 1.40024 1.65285 1.86981 1.94790 2.02905 2.29202 2.69277 3.15882 3.70002 4.32763 5.05447 5.89509 6.86604 7.98608 9.27646 10.76126 22.18611 44.40892 1.19615 1.42825 1.70243 1.93993 2.02582 2.11529 2.40662 2.85434 3.37993 3.99602 4.71712 5.55992 6.54355 7.68997 9.02427 10.57517 12.37545 26.62333 55.51115 1.20811 1.45681 1.75351 2.01268 2.10685 2.20519 2.52695 3.02560 3.61653 4.31570 5.14166 6.11591 7.26334 8.61276 10.19742 12.05569 14.23177 31.94800 69.38894 1.22019 1.48595 1.80611 2.08815 2.19112 2.29891 2.65330 3.20714 3.86968 4.66096 5.60441 6.72750 8.06231 9.64629 11.52309 13.74349 16.36654 38.33760 86.73617 1.28243 1.64061 2.09378 2.51017 2.66584 2.83075 3.38635 4.29187 5.42743 6.84848 8.62308 10.83471 13.58546 17.00006 21.23054 26.46192 32.91895 95.39622 264.69780 3.81470 4.76837 5.96046 1.12683 1.26824 1.42576 1.55545 1.13809 2.13293 2.40985 1.29361 1.46853 1.14947 1.31948 1.51259 1.16097 1.34587 1.55797 1.17258 1.37279 1.60471

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer i Before tax accumulation 5000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started