Question

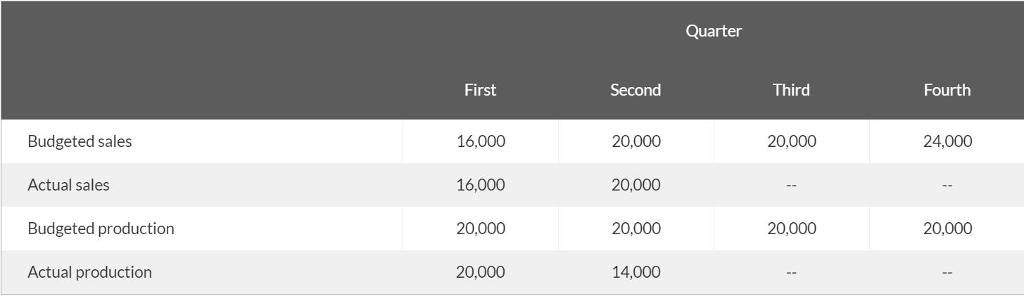

John Ovard, president of Mylar Inc., is looking forward to receiving the companys second-quarter income statement. He knows the sales budget of 20,000 units sold

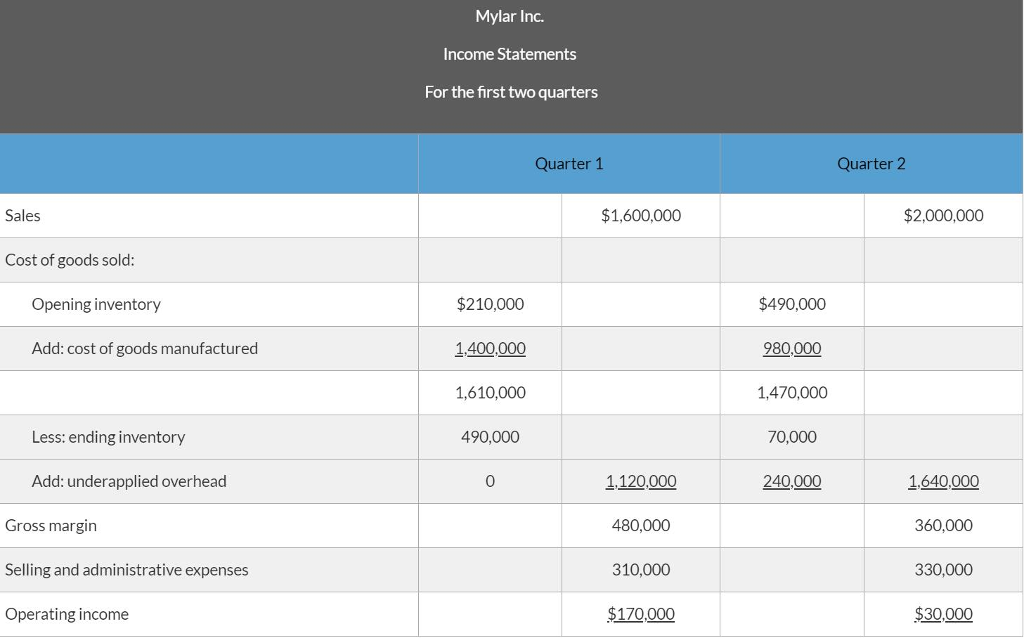

John Ovard, president of Mylar Inc., is looking forward to receiving the companys second-quarter income statement. He knows the sales budget of 20,000 units sold was met during the second quarter and that this represented a 25% increase in sales over the first quarter. He is especially happy about the increase in sales, since Mylar is about to approach its bank for additional loan money for expansion purposes. He anticipates that the strong second quarter results will be a real plus in persuading the bank to extend the additional credit. For this reason, Ovard is shocked when he receives the second-quarter income statement below, which shows a substantial drop in absorption costing operating income from the first quarter.

Ovard is certain there is an error somewhere and immediately calls the controller into his office to find the problem. The controller states, That operating income is correct John. Sales went up during the second quarter, but the problem is in production. You see, we budgeted to produce 20,000 units each quarter, but a strike in one of our suppliers plants forced us to cut production back to only 14,000 units in the second quarter. Thats what caused the drop in operating income. Ovard is angered by the controllers explanation: I call you in here to find out why income dropped when sales went up, and talk about production! So, what if production was off? What does that have to do with the sales that we made? If sales go up, then income ought to go up. If your statements cant show a simple thing like that, then were due for some changes in your area! Budgeted production and sales for the year, along with actual production and sales for the first two quarters, are given below.

The companys plant is heavily automated, so fixed manufacturing overhead costs total $800,000 per quarter. Variable manufacturing costs are $30 per unit. The fixed manufacturing overhead cost is applied to units of product at the rate of $40 per unit (based on the budgeted production shown above). Any underapplied or overapplied overhead is closed directly to cost of goods sold for the quarter. The company had 3,000 units in inventory to start the first quarter and uses the FIFO inventory flow assumption. Variable selling and administrative expenses are $5 per unit sold.

Take on the role of the controller of Mylar Inc. Write a memo to Ovard to explain the following:

What characteristic of absorption costing caused the drop in operating income for the second quarter?

Prepare a contribution format income statement for each quarter using variable costing, and reconcile the resulting operating income figure to that of the absorption costing operating income for each quarter.

Identify and discuss the advantages and disadvantages of using the variable costing method for internal reporting purposes.

Provide Ovard with an example: Assume the company had introduced lean production methods at the beginning of the second quarter, resulting in zero ending inventory. (Sales and production during the first quarter were as shown above.)

How many units would have been produced during the second quarter under lean production?

Starting with the third quarter, would you expect and difference between the operating income reported under absorption costing and under variable costing? Explain why there would or would not be a difference.

Mylar Inc. Income Statements For the first two quarters Quarter 1 Quarter 2 Sales $1,600,000 $2,000,000 Cost of goods sold $210,000 1,400,000 1,610,000 490,000 $490,000 980,000 1,470,000 70,000 240,000 Opening inventory Add: cost of goods manufactured Less: ending inventory Add: underapplied overhead Gross margin Selling and administrative expenses Operating income 0 1120,000 1,640,000 360,000 330,000 $30,000 480,000 310,000 $170,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started