Answered step by step

Verified Expert Solution

Question

1 Approved Answer

John Parsons ( 1 2 3 - 4 5 - 6 7 8 1 ) and George Smith ( 1 2 3 - 4 5

John Parsons and George Smith are and owners, respectively, of Premium, Inc. a candy company located at th Street, Cut and Shoot, TX Premium's S election was made on January its date of incorporation. The following information was taken from the company's income statement. Statement

Form S Schedule M Column A Line

Other Reductions

Contributions

$

Penalties

$

Total

$

Statement

Form A Line

Other Costs

Direct other costs

Total

Interest income $

Gross sales receipts

Beginning inventory

Direct labor

Direct materials purchased

Direct other costs

Ending inventory

Salaries and wages

Officers' salaries $ each to Parsons and Smith

Repairs

Depreciation expense, tax and book

Interest expense

Rent expense operating

Taxes

Charitable contributions cash

Advertising expenses

Payroll penalties

Other deductions

Book income

A comparative balance sheet appears below.

January December

Cash $ $

Accounts receivable

Inventories

Prepaid expenses

Building and equipment

Accumulated depreciation

Land

Total assets $ $

Accounts payable $ $

Notes payable less than year

Notes payable more than year

Capital stock

Retained earnings $

Total liabilities and capital $ $

Premium's accounting firm provides the following additional information.

Distributions to shareholders not reported on Form DIV and

made based on percentage of ownership:

$

Beginning balance, Accumulated adjustments account:

Ordinary business income for QBI:

W wages

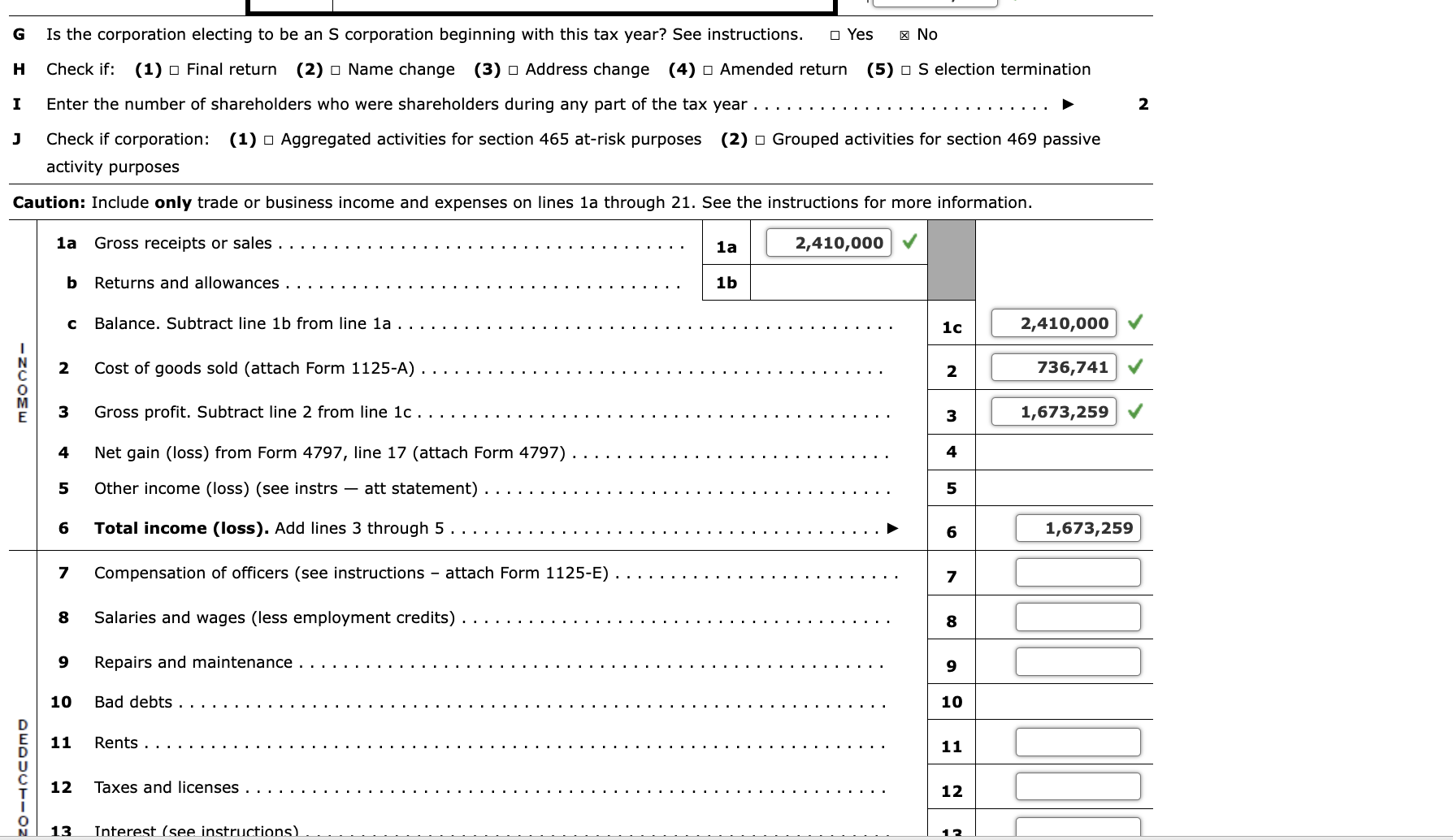

G Is the corporation electing to be an S corporation beginning with this tax year? See instructions.

Yes

No

H Check if: Final return Name change Address change Amended return S election termination

I Enter the number of shareholders who were shareholders during any part of the tax year

J Check if corporation: Aggregated activities for section atrisk purposes Grouped activities for section passive

activity purposes

Caution: Include only trade or business income and expenses on lines a through See the instructions for more information.Prepare the Schedule K for John Parsons.

If required, round amounts to the nearest dollar. for QBI:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started