Question

John Post, age 45, is single and resides at 123 Main Street, West Haven, CT 06516. His social security number is 123-45-6788. John has two

John Post, age 45, is single and resides at 123 Main Street, West Haven, CT 06516. His social security number is 123-45-6788. John has two children, Alec (age 17) and Grace (age 8), and their social security #s are 049-52-5472 and 045-23-5432 respectively. Johns mother, Donna Post (age 70, social security #048-68-5874) lives at 50 Benton Street, West Haven, CT. Donna receives Social Security income of $11,000 per year and $9,000 in part-time wages. John pays ABC Afterschool Care (EIN: 01-123456) $100 per week to watch Grace after school (40 weeks). John does not want to designate $3 to the Presidential Election Campaign fund.

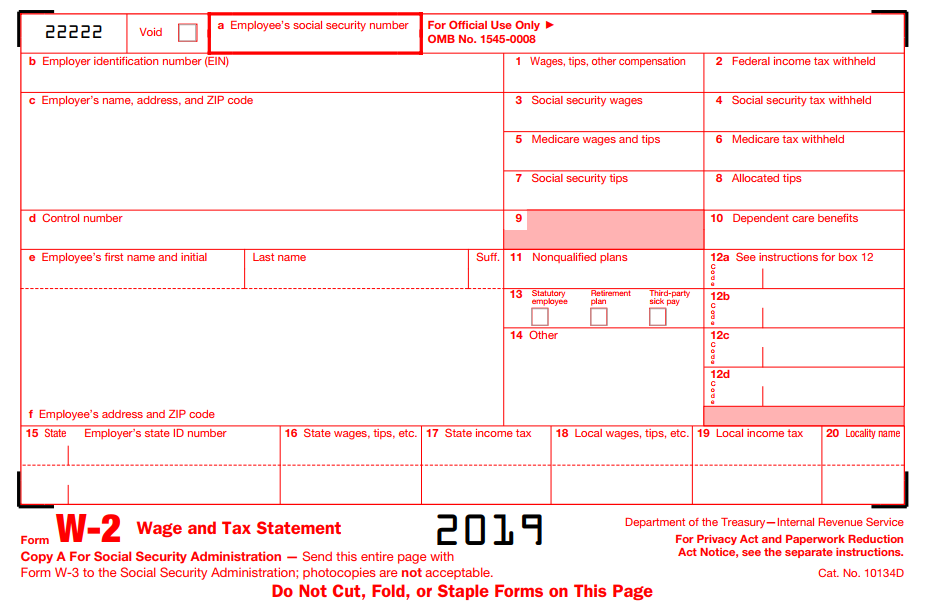

Due to the loss of his wife, John decided that he should work from home. In December of 2018, he retired from his job as a Waterbury police officer and started his own security company on January 1, 2019. He continued to work part-time for the Police Department in 2019. His W-2 from the Waterbury Police Department (EIN 06-1234567) reported the following: wages $18,000, federal income taxes withheld $4,500, and Connecticut income taxes withheld $2,000. WPD withheld the proper amounts of social security and medicare taxes from Johns pay during the year. John was not a participant in WPDs retirement plan.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started