Question

John purchased an equipment for BHD 25,000 on 1 January 2013, it had an estimated useful life of 5 years, and it was depreciated using

John purchased an equipment for BHD 25,000 on 1 January 2013, it had an estimated useful life of 5 years, and it was depreciated using reducing balance method at a rate of 20% and residual value of BHD 1,000. On 1 January 2015 it was justifiably decided to change the depreciation method from reducing balance to straight line method.

Required:

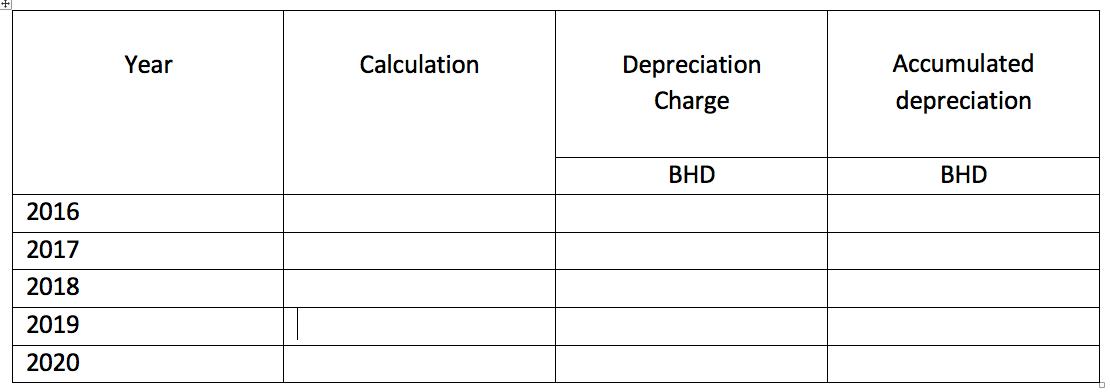

(A) Calculate the depreciation charge and accumulated depreciation for the equipment over its useful life in the table below

(B) Describe the conditions that give rise to excess depreciation and the related accounting treatment.

(C) Calculate the profit/(loss) if the business decides to sell the equipment after 2 years of purchase for BHD 20,000.

\begin{tabular}{|c|c|c|c|} \hline \multicolumn{1}{|c|}{ Year } & Calculation & Depreciation Charge & Accumulated depreciation \\ \hline 2016 & & BHD & BHD \\ \hline 2017 & & & \\ \hline 2018 & & & \\ \hline 2019 & & & \\ \hline 2020 & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{1}{|c|}{ Year } & Calculation & Depreciation Charge & Accumulated depreciation \\ \hline 2016 & & BHD & BHD \\ \hline 2017 & & & \\ \hline 2018 & & & \\ \hline 2019 & & & \\ \hline 2020 & & & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started