Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. Semi-strong form of market efficiency requires that the price does not drift prior to the announcement. B. Strong form of market efficiency implies that

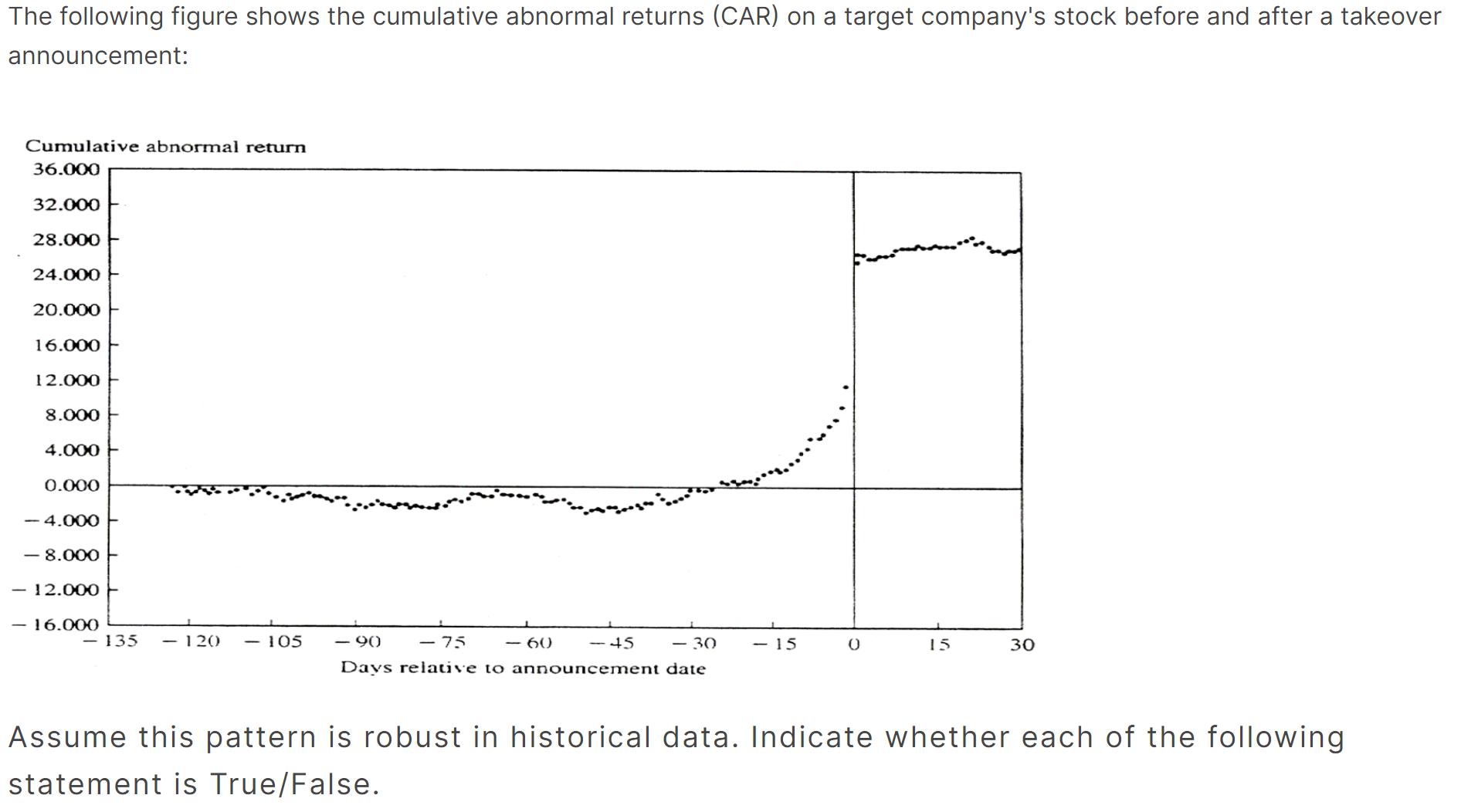

A. Semi-strong form of market efficiency requires that the price does not drift prior to the announcement.

A. Semi-strong form of market efficiency requires that the price does not drift prior to the announcement.

B. Strong form of market efficiency implies that one cannot forecast where the price will end up after the announcement.

C. Under semi-strong form of market efficiency, it is possible that taking a position in the target stock before the announcement generates abnormal risk-adjusted returns.

D. This violates the weak form of market efficiency, because the stock reaction to the announcement is positive on average.

The following figure shows the cumulative abnormal returns (CAR) on a target company's stock before and after a takeover announcement: Cumulative abnormal return 36.000 32.000 28.000 24.000 20.000 16.000 12.000 8.000 4.000 0.000

Step by Step Solution

★★★★★

3.54 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below B False The strong form of market effic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started