Answered step by step

Verified Expert Solution

Question

1 Approved Answer

John Roberts is 50 years old and has been asked to accept early retirement from his company. The company has offered John three alternative compensation

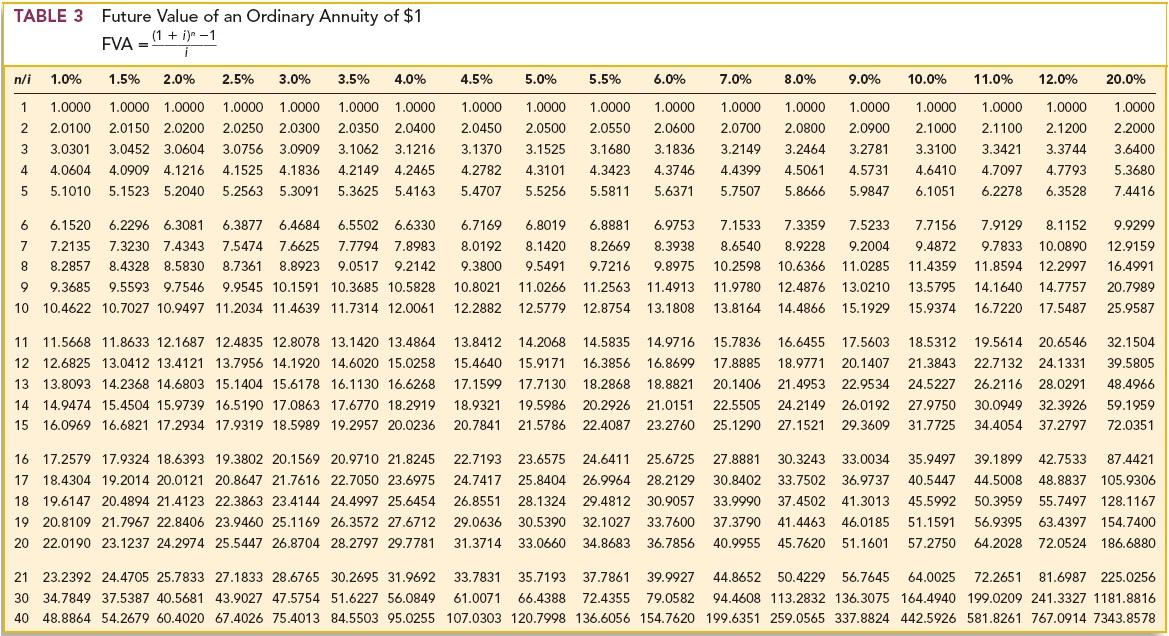

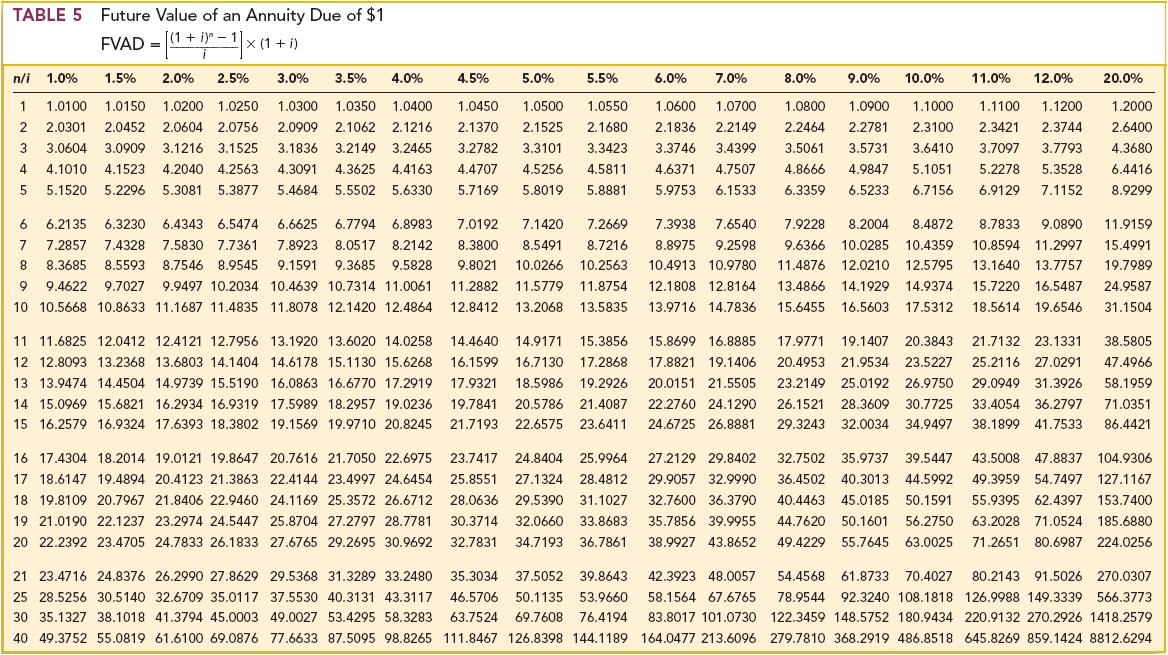

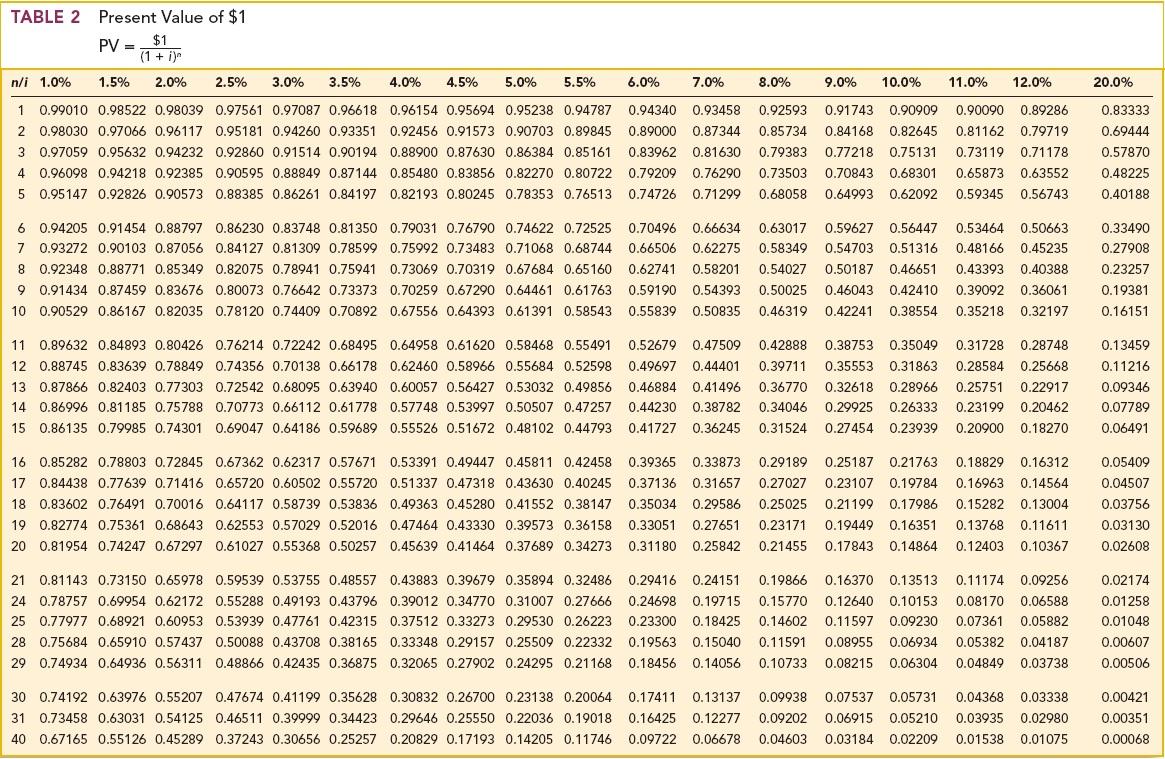

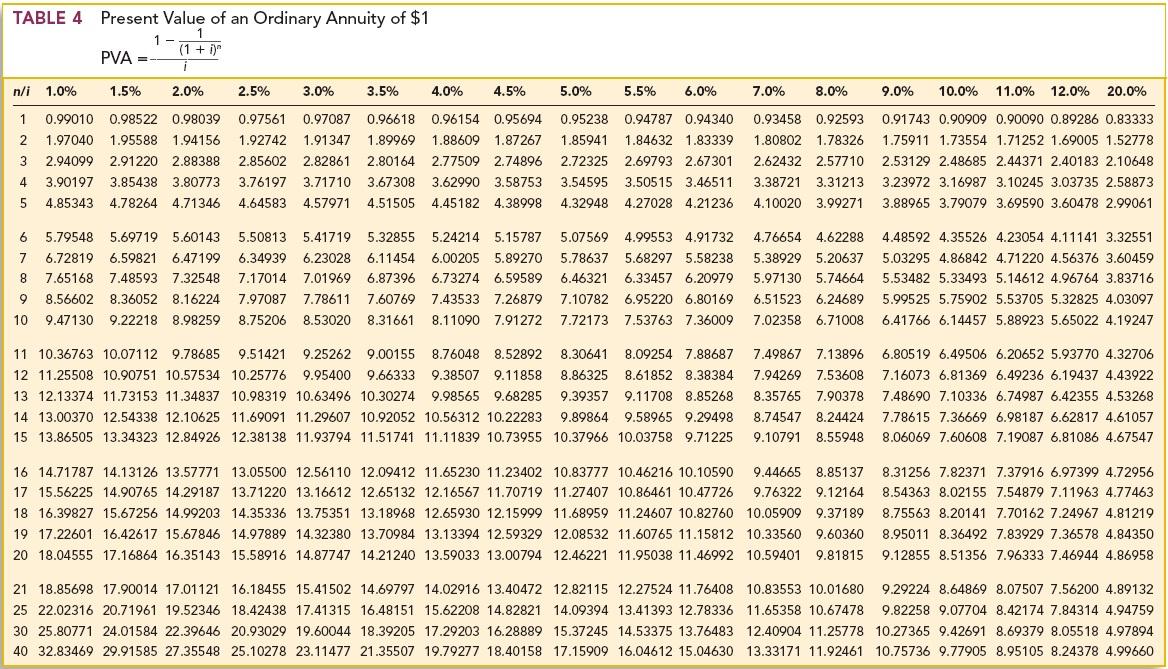

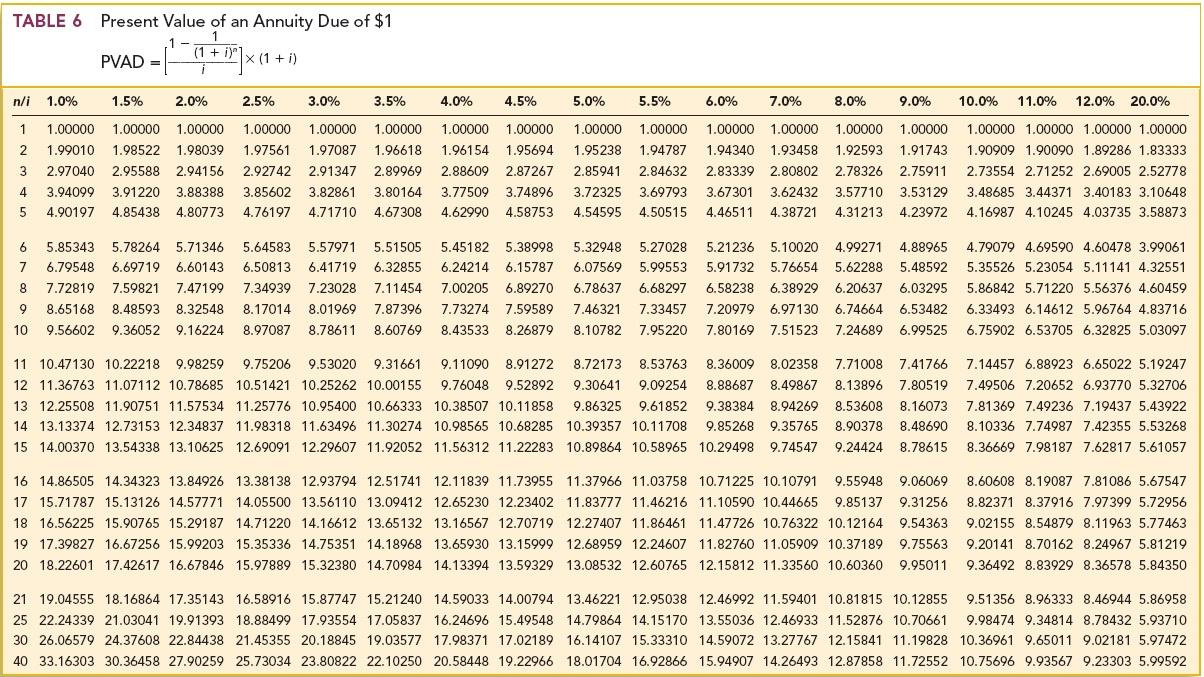

John Roberts is 50 years old and has been asked to accept early retirement from his company. The company has offered John three alternative compensation packages to induce John to retire (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.): |

| 1. | $186,000 cash payment to be paid immediately. |

| 2. | A 12-year annuity of $23,000 beginning immediately. |

| 3. | A 10-year annuity of $59,000 beginning at age 60. |

| Required: |

Determine the present value, assuming that he is able to invest funds at a 7% rate. |

|

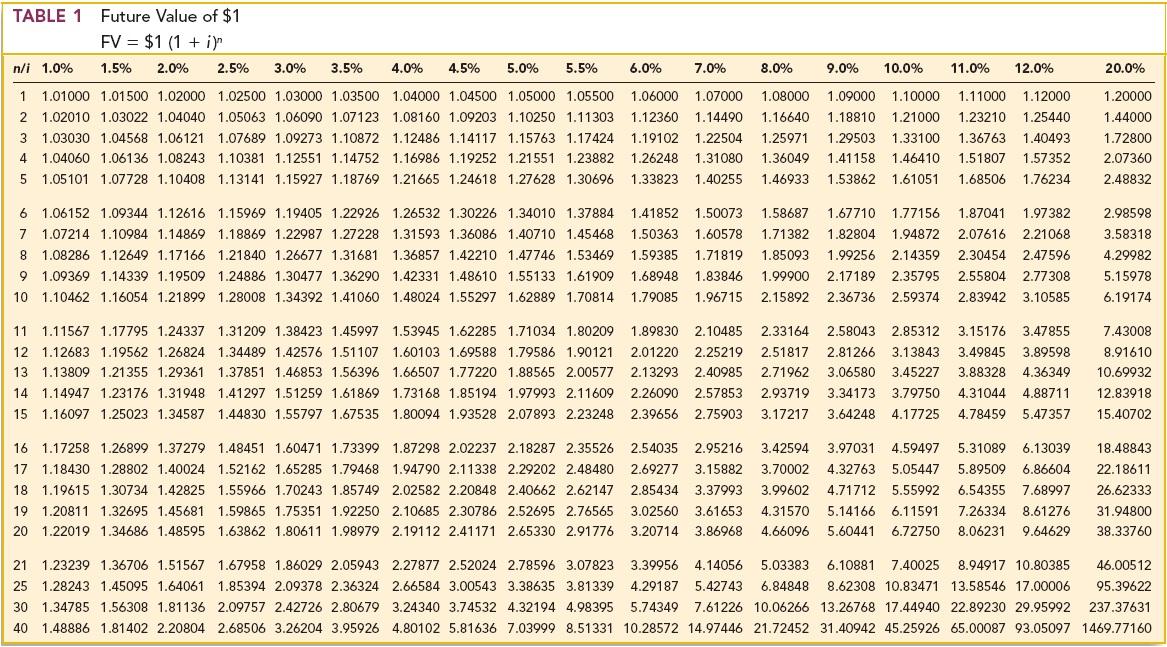

TABLE 1 Future Value of $1 FV = $1 (1 + i)" 6.0% 9.0% 10.0% 11.0% 12.0% 8.0% 1.08000 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 7.0% 1.04000 1.04500 1.05000 1.05500 1.06000 1.07000 1.09000 1.10000 1.11000 1.12000 1.08160 1.09203 1.10250 1.11303 1.12360 1.14490 1.16640 1.18810 1.21000 1.23210 1.25440 1.12486 1.14117 1.15763 1.17424 1.19102 1.22504 1.25971 1.29503 1.33100 1.36763 1.40493 1.16986 1.19252 1.21551 1.23882 1.26248 1.31080 1.36049 1.41158 1.46410 1.51807 1.57352 1.21665 1.24618 1.27628 1.30696 1.33823 1.40255 1.46933 1.53862 1.61051 1.68506 1.76234 n/i 1.0% 1 1.01000 1.01500 1.02000 1.02500 1.03000 1.03500 2 1.02010 1.03022 1.04040 1.05063 1.06090 1.07123 3 1.03030 1.04568 1.06121 1.07689 1.09273 1.10872 4 1.04060 1.06136 1.08243 1.10381 1.12551 1.14752 5 1.05101 1.07728 1.10408 1.13141 1.15927 1.18769 6 1.06152 1.09344 1.12616 1.15969 1.19405 1.22926 7 1.07214 1.10984 1.14869 1.18869 1.22987 1.27228 8 1.08286 1.12649 1.17166 1.21840 1.26677 1.31681 9 1.09369 1.14339 1.19509 1.24886 1.30477 1.36290 10 1.10462 1.16054 1.21899 1.28008 1.34392 1.41060 16 1.17258 1.26899 1.37279 17 1.18430 1.28802 1.40024 18 1.19615 1.30734 1.42825 19 1.20811 1.32695 1.45681 20 1.22019 1.34686 1.48595 11 1.11567 1.17795 1.24337 1.31209 1.38423 1.45997 1.53945 1.62285 1.71034 1.80209 1.89830 2.10485 2.33164 2.58043 2.85312 3.15176 3.47855 12 1.12683 1.19562 1.26824 1.34489 1.42576 1.51107 1.60103 1.69588 1.79586 1.90121. 2.01220 2.25219 2.51817 2.81266 3.13843 3.49845 3.89598 13 1.13809 1.21355 1.29361 1.37851 1.46853 1.56396 1.66507 1.77220 1.88565 2.00577 2.13293 2.40985 2.71962 3.06580 3.45227 3.88328 4.36349 14 1.14947 1.23176 1.31948 1.41297 1.51259 1.61869 1.73168 1.85194 1.97993 2.11609 2.26090 2.57853 2.93719 3.34173 3.79750 4.31044 4.88711 15 1.16097 1.25023 1.34587 1.44830 1.55797 1.67535 1.80094 1.93528 2.07893 2.23248 2.39656 2.75903 3.17217 3.64248 4.17725 4.78459 5.47357 21 1.23239 1.36706 1.51567 25 1.28243 1.45095 1.64061 30 1.34785 1.56308 1.81136 40 1.48886 1.81402 2.20804 1.26532 1.30226 1.34010 1.37884 1.31593 1.36086 1.40710 1.45468 1.36857 1.42210 1.47746 1.53469 1.42331 1.48610 1.55133 1.61909 1.48024 1.55297 1.62889 1.70814 1.48451 1.60471 1.73399 1.52162 1.65285 1.79468 1.55966 1.70243 1.85749 1.59865 1.75351 1.92250 1.63862 1.80611 1.98979 1.41852 1.50073 1.58687 1.67710 1.77156 1.87041 1.97382 1.50363 1.60578 1.71382 1.82804 1.94872 2.07616 2.21068 1.59385 1.71819 1.85093 1.99256 2.14359 2.30454 2.47596 1.68948 1.83846 1.99900 2.17189 2.35795 2.55804 2.77308 1.79085 1.96715 2.15892 2.36736 2.59374 2.83942 3.10585 20.0% 1.20000 1.44000 1.72800 2.07360 2.48832 2.98598 3.58318 4.29982 5.15978 6.19174 7.43008 8.91610 10.69932 12.83918 15.40702 1.87298 2.02237 2.18287 2.35526 2.54035 2.95216 3.42594 3.97031 4.59497 5.31089 6.13039 18.48843 1.94790 2.11338 2.29202 2.48480 2.69277 3.15882 3.70002 4.32763 5.05447 5.89509 6.86604 22.18611 2.02582 2.20848 2.40662 2.62147 2.85434 3.37993 3.99602 4.71712 5.55992 6.54355 7.68997 26.62333 2.10685 2.30786 2.52695 2.76565 3.02560 3.61653 4.31570 5.14166 6.11591 7.26334 8.61276 31.94800 2.19112 2.41171 2.65330 2.91776 3.20714 3.86968 4.66096 5.60441 6.72750 8.06231 9.64629 38.33760 46.00512 95.39622 1.67958 1.86029 2.05943 2.27877 2.52024 2.78596 3.07823 3.39956 4.14056 5.03383 6.10881 7.40025 8.94917 10.80385 1.85394 2.09378 2.36324 2.66584 3.00543 3.38635 3.81339 4.29187 5.42743 6.84848 8.62308 10.83471 13.58546 17.00006 2.09757 2.42726 2.80679 3.24340 3.74532 4.32194 4.98395 5.74349 7.61226 10.06266 13.26768 17.44940 22.89230 29.95992 237.37631 2.68506 3.26204 3.95926 4.80102 5.81636 7.03999 8.51331 10.28572 14.97446 21.72452 31.40942 45.25926 65.00087 93.05097 1469.77160

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Alternative 1 Note that we want to compute the present value of all the alternatives Since the 18600...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started