Answered step by step

Verified Expert Solution

Question

1 Approved Answer

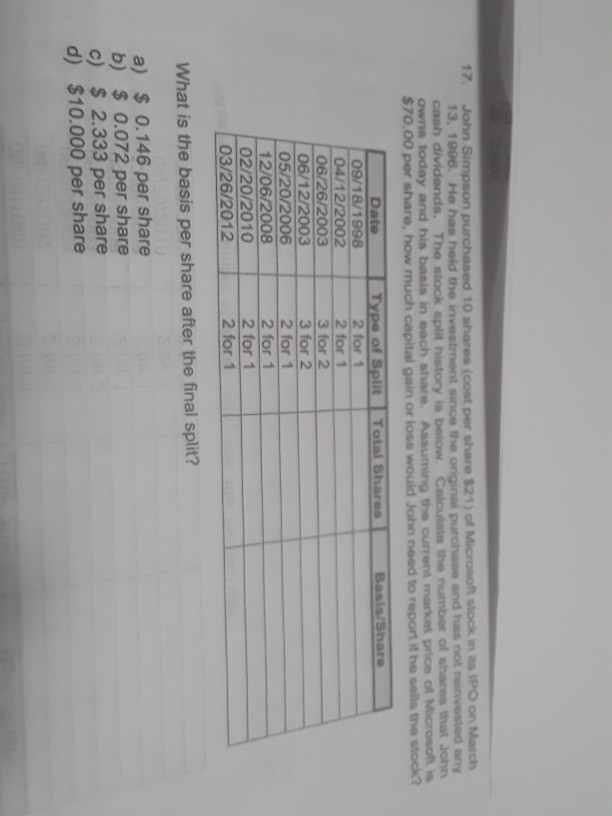

John Simpson purchased 10 shares (cost per share 521) of Microsoft stock in its IPO on March 13, 1996. He has held the investment since

John Simpson purchased 10 shares (cost per share 521) of Microsoft stock in its IPO on March 13, 1996. He has held the investment since the original purchase and has not invested any cash dividends. The stock split history is below. Calculate the number of shares that John owns today and his basis in each share. Assuming the current market price of Microso $70.00 per share, how much capital gain or loss would John need to report the sells the stock? Total Shares Basis Share Date 09/18/1998 04/12/2002 06/26/2003 06/12/2003 05/20/2006 12/06/2008 02/20/2010 03/26/2012 Type of Split 2 for 1 2 for 1 3 for 2 3 for 2 2 for 1 2 for 1 2 for 1 2 for 1 What is the basis per share after the final split? a) $ 0.146 per share b) $ 0.072 per share c) $ 2.333 per share d) $10.000 per share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started