Answered step by step

Verified Expert Solution

Question

1 Approved Answer

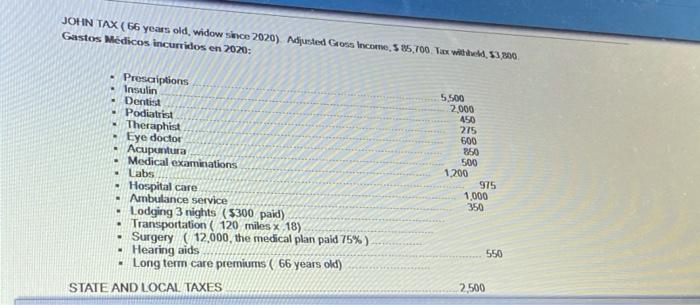

JOHN TAX(66 years old, widow since 2020) Adjusted Gross Income, $ 85,700. Tax withheld, 53,800. Gastos Mdicos incumidos en 2020: Prescriptions Insulin Dentist Podiatrist 5,500

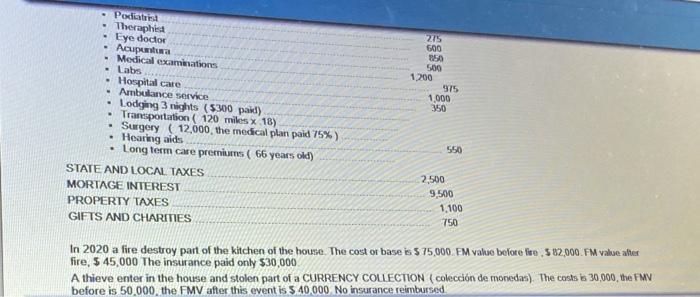

JOHN TAX(66 years old, widow since 2020) Adjusted Gross Income, $ 85,700. Tax withheld, 53,800. Gastos Mdicos incumidos en 2020: Prescriptions Insulin Dentist Podiatrist 5,500 2,000 450 275 600 850 500 Theraphist Eye doctor - Acupuntura - Medical examinations Labs - Hospital care Ambulance service 1,200 975 1,000 350 Lodging 3 nights ($300 paid) Transportation ( 120 miles x 18) Surgery (12,000, the medical plan paid 75% ) Hearing aids Long term care premiums ( 66 years old) 550 2,500 STATE AND LOCAL TAXES

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started